Amidst a rally in U.S. stocks driven by growth and tax optimism following the recent election, global markets are experiencing notable shifts with major benchmarks reaching record highs. As investors navigate these dynamic conditions, identifying undervalued stocks becomes crucial; such stocks may offer potential value by being priced below their intrinsic worth, especially in an environment where economic policies and market expectations are rapidly evolving.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro-Star International (TWSE:2377) | NT$184.50 | NT$368.99 | 50% |

| Anhui Huaheng Biotechnology (SHSE:688639) | CN¥36.00 | CN¥71.65 | 49.8% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.81 | 50% |

| Dynavox Group (OM:DYVOX) | SEK66.50 | SEK132.84 | 49.9% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| Proficient Auto Logistics (NasdaqGS:PAL) | US$10.00 | US$19.92 | 49.8% |

| Royal Plus (SET:PLUS) | THB5.45 | THB10.88 | 49.9% |

| Dometic Group (OM:DOM) | SEK61.15 | SEK121.72 | 49.8% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.14 | €16.25 | 49.9% |

| St. James's Place (LSE:STJ) | £8.275 | £16.46 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

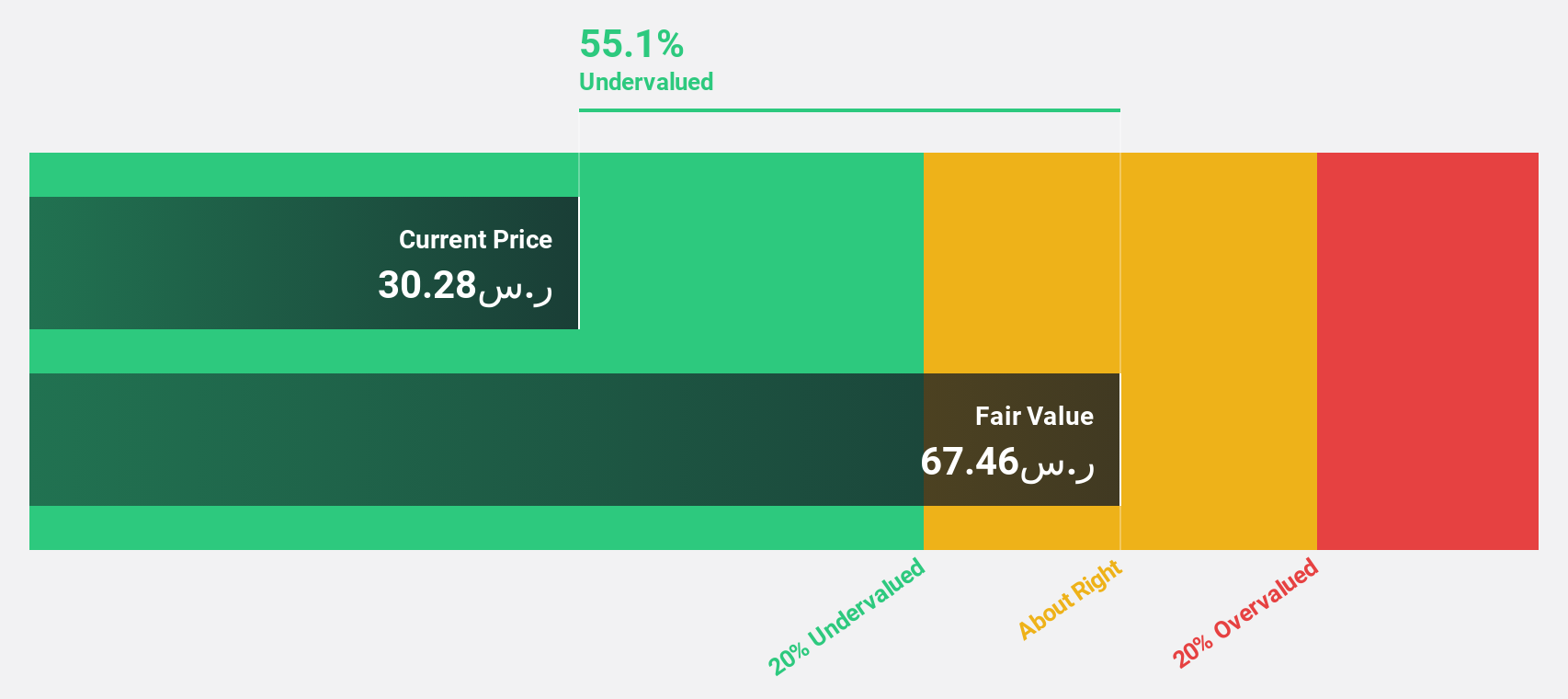

Yanbu National Petrochemical (SASE:2290)

Overview: Yanbu National Petrochemical Company manufactures and sells petrochemical products across Saudi Arabia, the Americas, Africa, the Middle East, Europe, and Asia with a market cap of SAR22.56 billion.

Operations: The company's revenue primarily comes from its petrochemical segment, totaling SAR6.12 billion.

Estimated Discount To Fair Value: 26%

Yanbu National Petrochemical's recent earnings report shows a turnaround with net income of SAR 130.58 million for Q3, compared to a loss last year. The stock is trading 26% below its estimated fair value of SAR 54.22, suggesting it may be undervalued based on discounted cash flows. Despite the dividend not being well-covered by earnings, revenue and profit growth are expected to outpace the market significantly in the coming years.

- Our earnings growth report unveils the potential for significant increases in Yanbu National Petrochemical's future results.

- Delve into the full analysis health report here for a deeper understanding of Yanbu National Petrochemical.

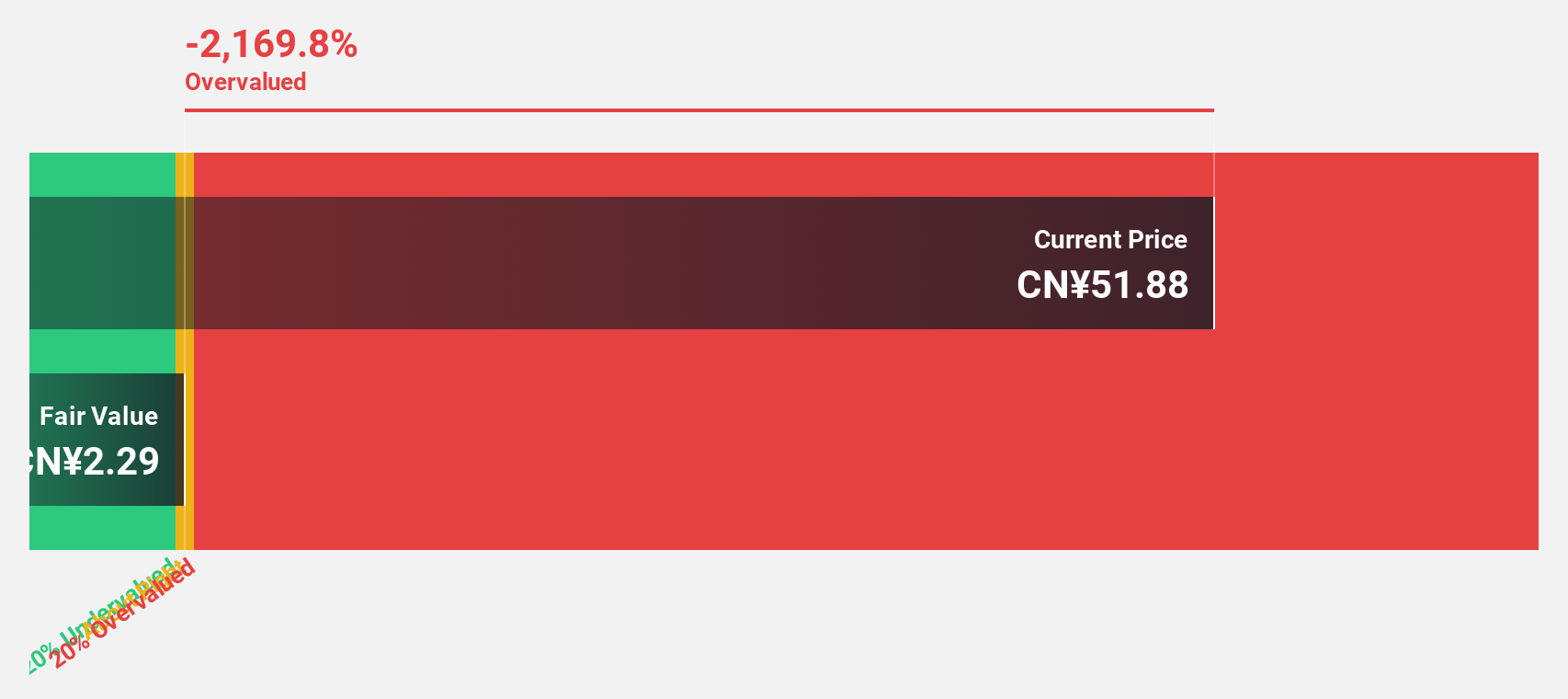

BrightGene Bio-Medical Technology (SHSE:688166)

Overview: BrightGene Bio-Medical Technology Co., Ltd. is a pharmaceutical company involved in the research, development, manufacture, and commercialization of pharmaceutical products in China with a market cap of approximately CN¥12.91 billion.

Operations: BrightGene Bio-Medical Technology Co., Ltd. generates revenue through its activities in the research, development, manufacturing, and commercialization of pharmaceutical products within China.

Estimated Discount To Fair Value: 47%

BrightGene Bio-Medical Technology's recent earnings reveal a mixed financial picture, with net income for the nine months at CNY 177.41 million, slightly down from last year. Despite this, the stock trades significantly below its estimated fair value of CNY 57.75, indicating potential undervaluation based on cash flows. Earnings and revenue are expected to grow substantially faster than the market average, although high volatility and debt coverage issues present concerns for investors.

- Our comprehensive growth report raises the possibility that BrightGene Bio-Medical Technology is poised for substantial financial growth.

- Navigate through the intricacies of BrightGene Bio-Medical Technology with our comprehensive financial health report here.

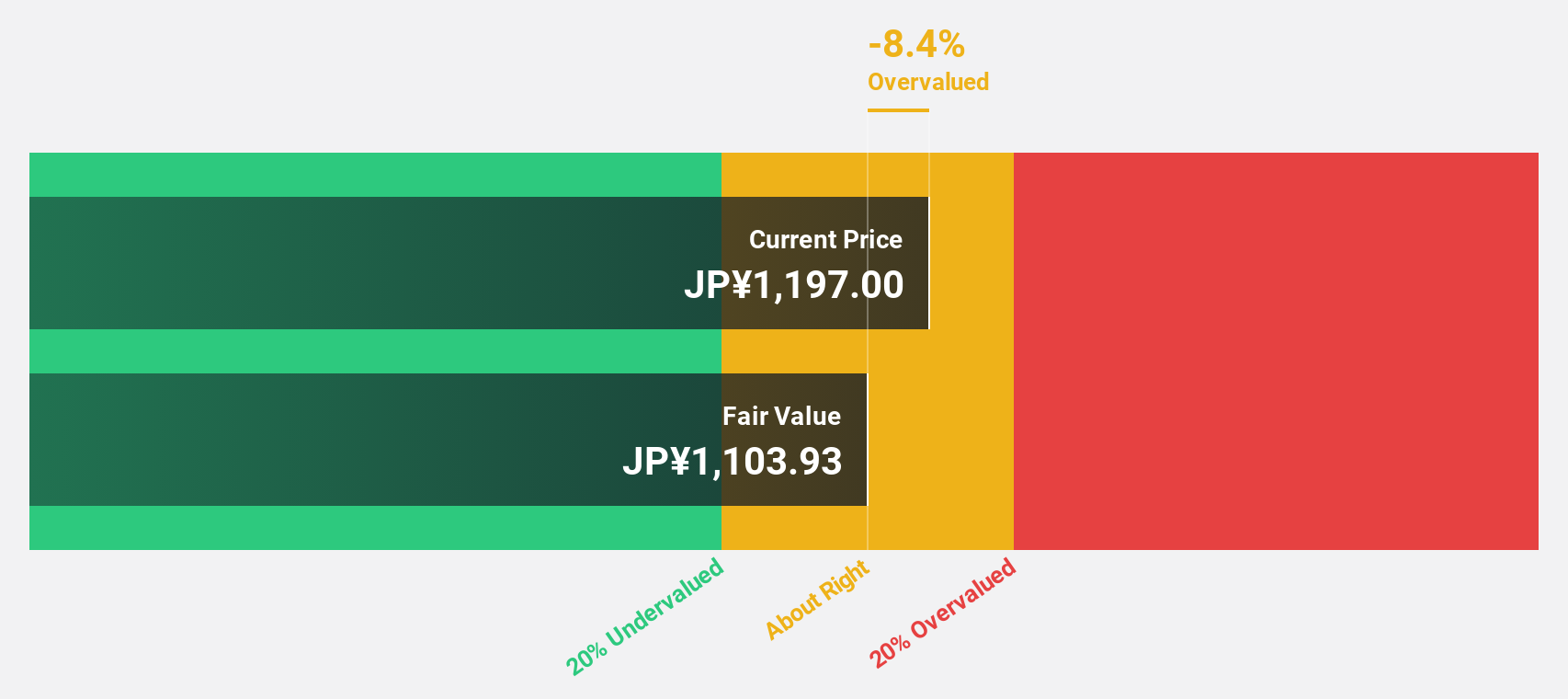

Sumco (TSE:3436)

Overview: Sumco Corporation manufactures and sells silicon wafers for the semiconductor industry across Japan, the United States, China, Taiwan, Korea, and internationally with a market cap of approximately ¥518.09 billion.

Operations: The company generates revenue primarily from its Crystalline Silicon segment, amounting to ¥401.75 billion.

Estimated Discount To Fair Value: 13.8%

Sumco's current trading price of ¥1481.5 is below its estimated fair value of ¥1719.15, showing potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 29.6% annually, outpacing the Japanese market average of 9.2%. However, profit margins have decreased from last year, and the forecasted return on equity remains low at 9.6%. Recent board discussions may impact future dividend forecasts for fiscal year 2024.

- The analysis detailed in our Sumco growth report hints at robust future financial performance.

- Dive into the specifics of Sumco here with our thorough financial health report.

Key Takeaways

- Unlock our comprehensive list of 899 Undervalued Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightGene Bio-Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688166

BrightGene Bio-Medical Technology

A pharmaceutical company, engages in the research and development, manufacture, and commercialization of pharmaceutical products in China.

High growth potential and slightly overvalued.