Undiscovered Gems Featuring Inner Mongolia North Hauler and Two Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate the complexities of policy changes and economic indicators, small-cap stocks have been experiencing notable fluctuations, with indices like the S&P 600 reflecting these shifts. Amidst this backdrop, identifying promising investment opportunities requires a keen eye for companies with strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.20% | 7.84% | 27.00% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Inner Mongolia North Hauler (SHSE:600262)

Simply Wall St Value Rating: ★★★★★☆

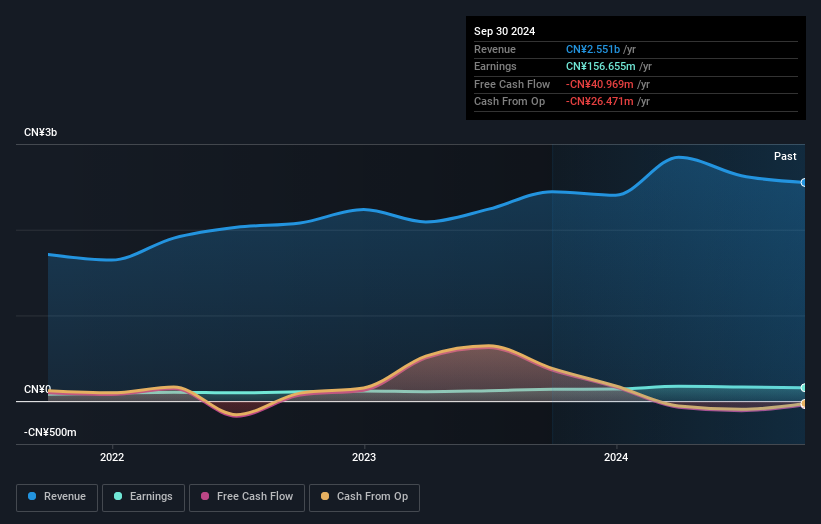

Overview: Inner Mongolia North Hauler Joint Stock Co., Ltd. is a company engaged in the manufacturing of machinery, with a market capitalization of CN¥3.52 billion.

Operations: Inner Mongolia North Hauler's primary revenue stream is from machinery manufacturing, generating CN¥2.55 billion.

Inner Mongolia North Hauler, a small cap player in the machinery sector, has shown robust financial health with earnings growth of 14.1% over the past year, outpacing the industry average of -0.4%. The company’s debt-to-equity ratio impressively decreased from 49% to 6% over five years, indicating strong financial management. Despite not being free cash flow positive recently, their price-to-earnings ratio of 22.4x suggests good value compared to China's market average of 34.3x. Recent earnings reports revealed net income increased to CNY 108 million from CNY 93 million last year, highlighting its potential for future profitability and growth.

- Click here to discover the nuances of Inner Mongolia North Hauler with our detailed analytical health report.

Learn about Inner Mongolia North Hauler's historical performance.

Telsys (TASE:TLSY)

Simply Wall St Value Rating: ★★★★★☆

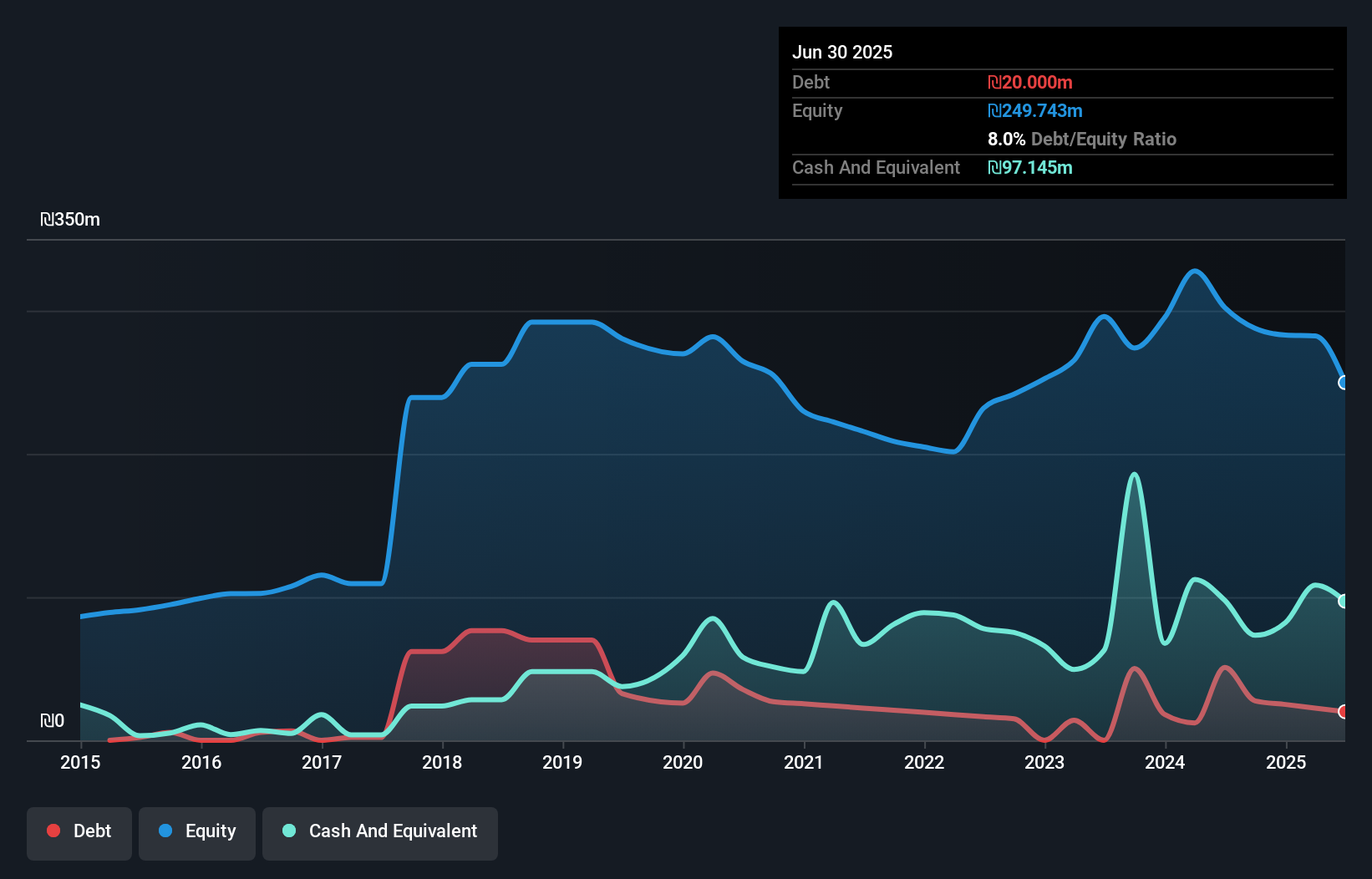

Overview: Telsys Ltd. is a company that markets and distributes electronic components in Israel, with a market capitalization of ₪1.62 billion.

Operations: Telsys generates revenue primarily from its SOM Sector and Distribution segments, contributing ₪335.90 million and ₪144.62 million, respectively.

With Telsys, investors find a company that combines ample cash reserves exceeding its total debt with a debt-to-equity ratio climbing from 11.6% to 16.8% over five years, indicating some increased leverage. Despite this, it trades at a significant discount of 61% below estimated fair value and maintains positive free cash flow, reflecting financial resilience. However, earnings growth has been negative at -12%, contrasting the electronic industry's slight dip of -0.3%. Recent inclusion in the S&P Global BMI Index suggests growing recognition amidst challenges like shareholder dilution over the past year and industry-wide headwinds.

- Get an in-depth perspective on Telsys' performance by reading our health report here.

Review our historical performance report to gain insights into Telsys''s past performance.

Sakata INX (TSE:4633)

Simply Wall St Value Rating: ★★★★★☆

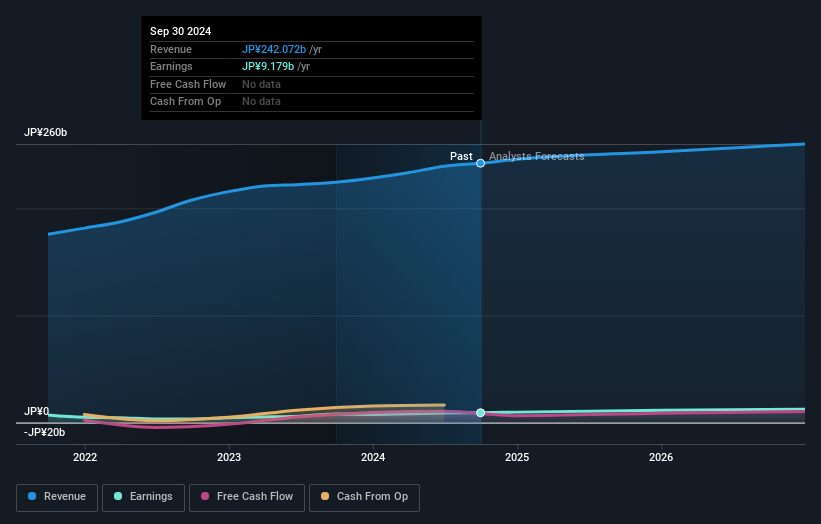

Overview: Sakata INX Corporation is engaged in the manufacturing and sale of diverse printing inks and auxiliary agents both in Japan and globally, with a market cap of ¥76.09 billion.

Operations: Sakata INX generates revenue through the sale of printing inks and auxiliary agents, catering to both domestic and international markets. The company has a market capitalization of ¥76.09 billion.

Sakata INX, a smaller player in the industry, showcases strong financial health with its earnings growing 14.9% annually over the past five years. Despite a debt to equity ratio increase from 22.2% to 28.5%, interest payments remain well covered by EBIT at 57 times, indicating robust profitability management. Trading at nearly 72% below estimated fair value suggests significant upside potential compared to peers and industry standards. However, recent growth of 13.3% lagged behind the broader chemicals sector's performance of 16.1%. With high-quality earnings and positive free cash flow, Sakata INX seems positioned for steady future growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Sakata INX.

Examine Sakata INX's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Navigate through the entire inventory of 4651 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600262

Inner Mongolia North Hauler

Inner Mongolia North Hauler Joint Stock Co., Ltd.

Excellent balance sheet with proven track record.