Middle Eastern Penny Stocks: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi And 2 Promising Picks

Reviewed by Simply Wall St

The Middle Eastern stock markets have been experiencing a positive trend, with UAE indices edging higher amid rising oil prices and hopes for a U.S. Federal Reserve rate cut. Investing in penny stocks, while an older concept, still holds relevance as it highlights smaller or less-established companies that can offer significant value. By focusing on those with solid financials and potential for growth, investors may discover opportunities in these often-overlooked segments of the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.36B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.89 | ₪207.2M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR5.10 | SAR992M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.45 | AED14.58B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.717 | ₪213.28M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi produces and sells foam products both in Turkey and internationally, with a market cap of TRY998.25 million.

Operations: The company's revenue is generated primarily from its Textile Operation, which accounts for TRY10.58 billion, and its Polyurethane Operations, contributing TRY28.24 million.

Market Cap: TRY998.25M

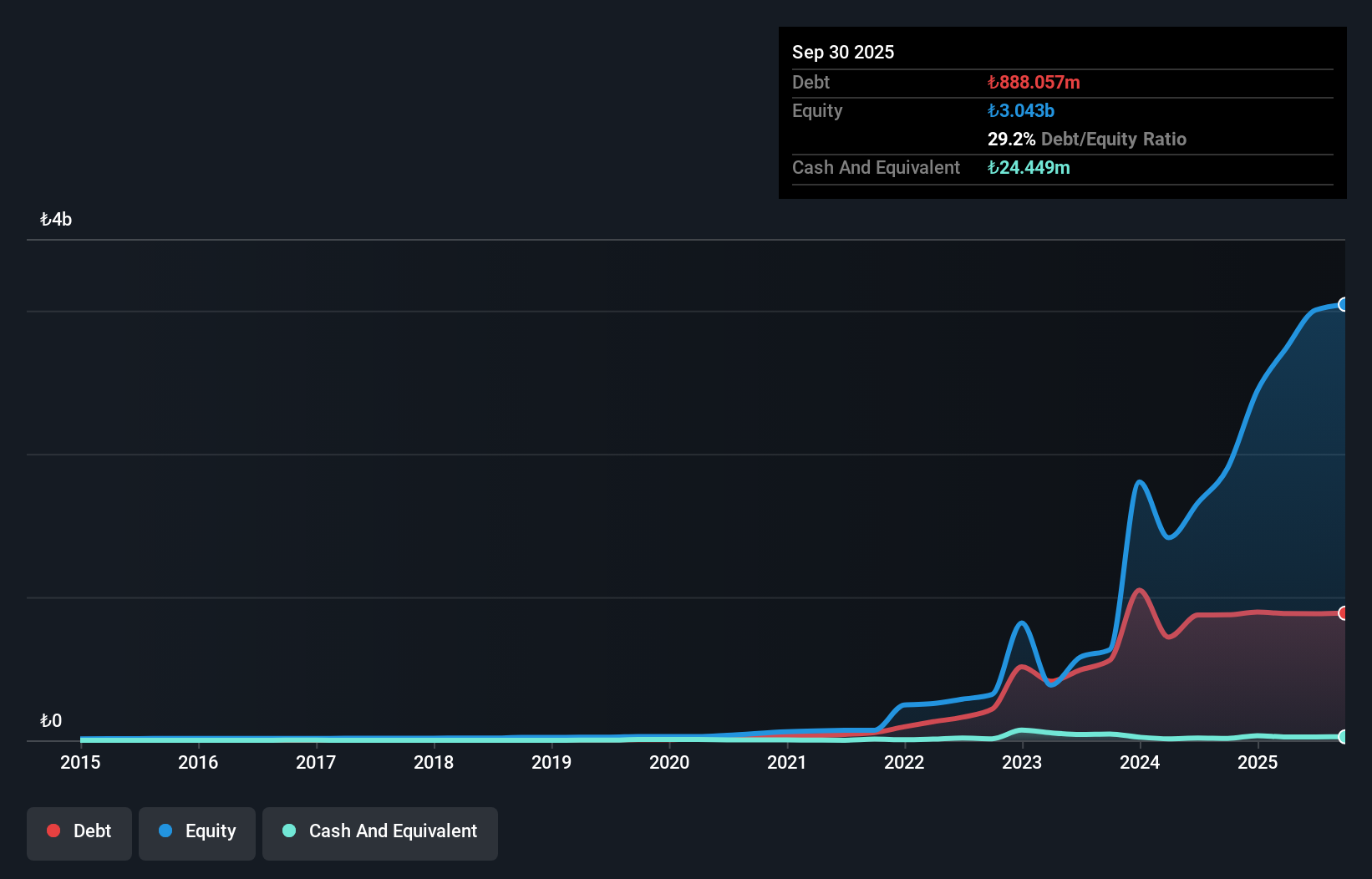

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi has demonstrated significant earnings growth, with a 103.7% increase over the past year, outpacing the luxury industry. Despite this, recent earnings showed a decline in sales and a net loss for Q3 2025 compared to the previous year. The company maintains robust short-term asset coverage over liabilities and has reduced its debt-to-equity ratio significantly over five years. However, operating cash flow does not adequately cover its debt levels. Its price-to-earnings ratio suggests it is undervalued relative to the Turkish market average.

- Take a closer look at Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's potential here in our financial health report.

- Learn about Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's historical performance here.

Arabian Pipes (SASE:2200)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arabian Pipes Company specializes in the production and marketing of steel tubes in Saudi Arabia, with a market capitalization of SAR992 million.

Operations: The company generates revenue primarily from its steel pipe production segment, amounting to SAR895.51 million.

Market Cap: SAR992M

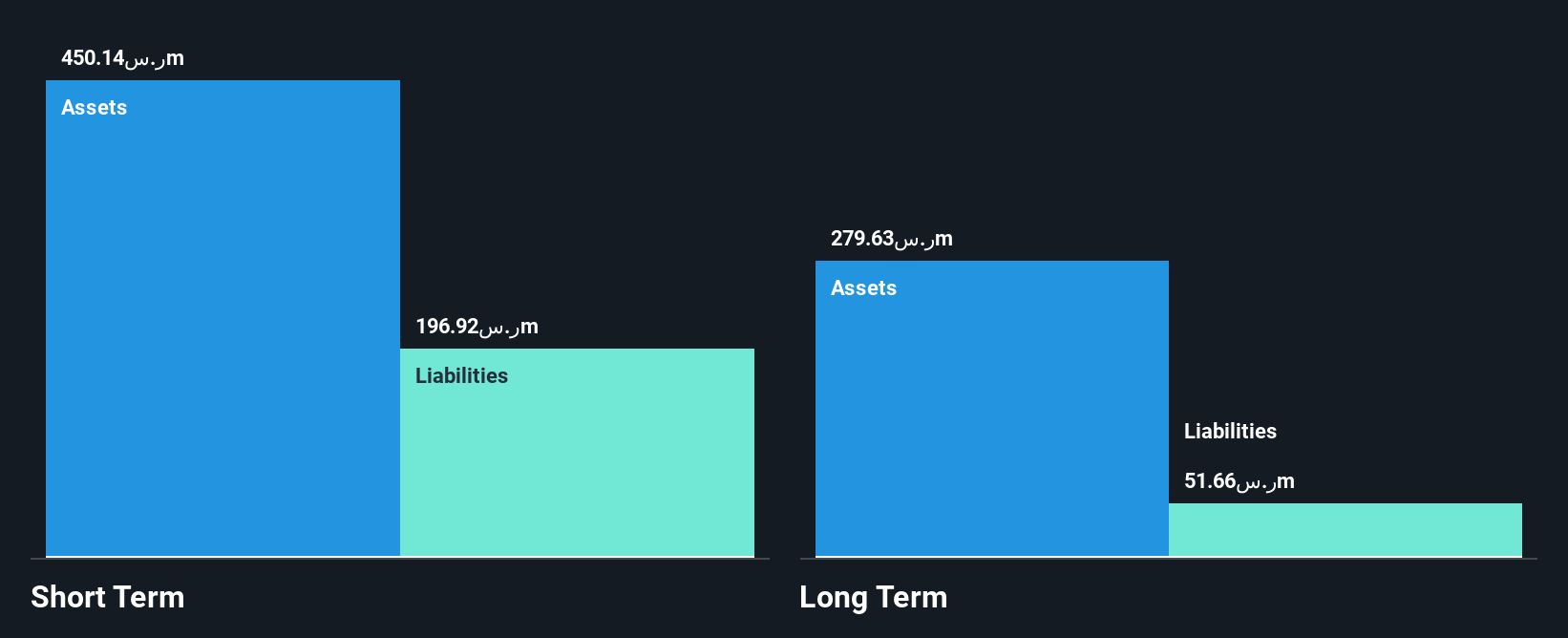

Arabian Pipes Company, with a market capitalization of SAR992 million, has shown resilience despite recent earnings declines. Q3 2025 sales fell to SAR233.29 million from SAR322.32 million the previous year, and net income decreased to SAR27.77 million from SAR43.89 million. Despite this setback, the company maintains strong short-term asset coverage over liabilities and boasts a satisfactory net debt to equity ratio of 6.8%. Trading at 57.4% below its estimated fair value and with high-quality earnings, Arabian Pipes remains an intriguing option for those considering penny stocks in the Middle East region's steel industry sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Arabian Pipes.

- Examine Arabian Pipes' earnings growth report to understand how analysts expect it to perform.

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group operates in Saudi Arabia, offering gold, jewelry, and luxury products with a market cap of SAR792 million.

Operations: The company's revenue is primarily derived from its commercial activity, amounting to SAR46.67 million.

Market Cap: SAR792M

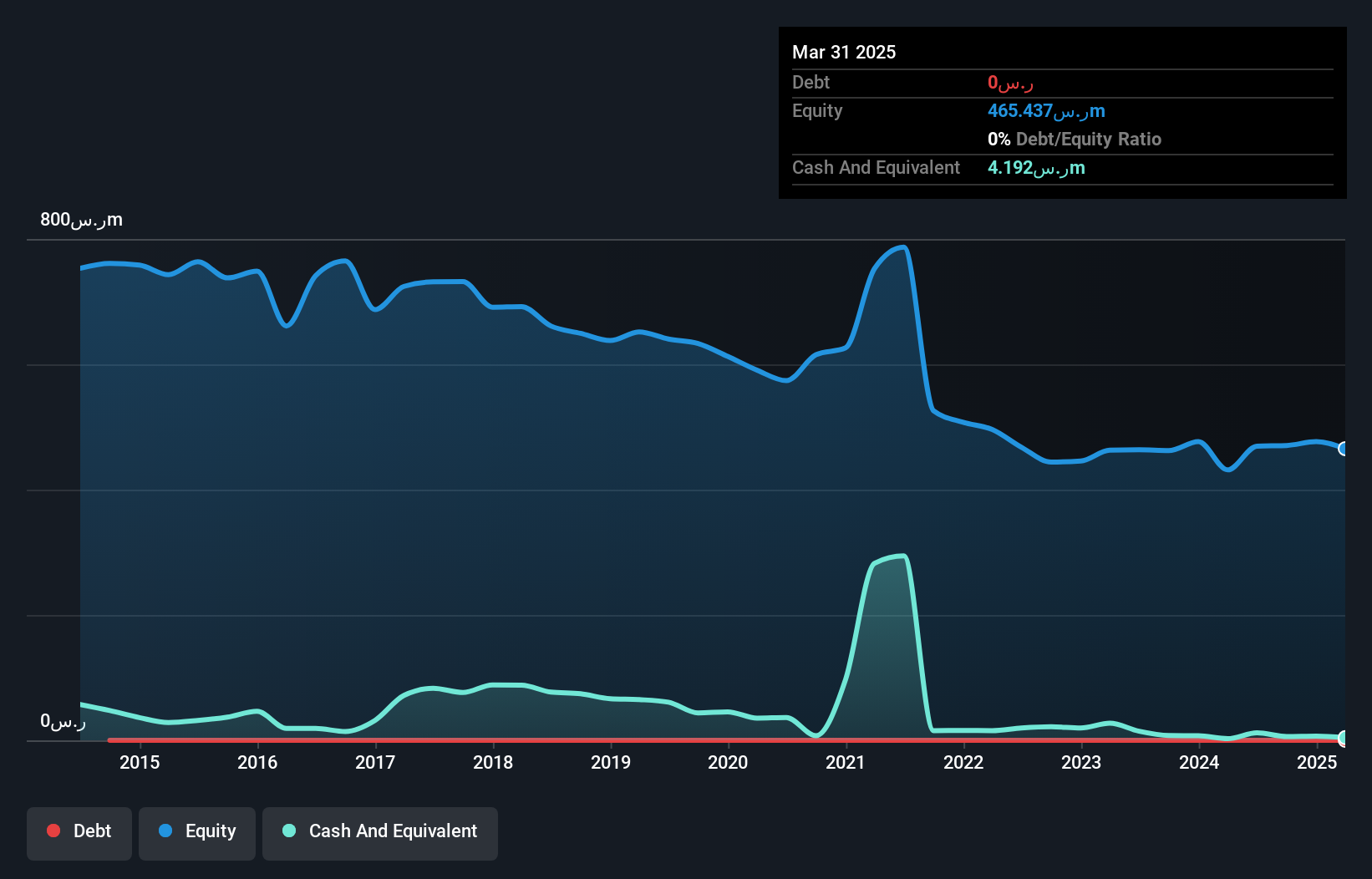

Fitaihi Holding Group, with a market cap of SAR792 million, has faced challenges in the past year. Q3 2025 sales dropped to SAR11.24 million from SAR12.79 million a year earlier, resulting in a net loss of SAR1.87 million compared to last year's profit. Despite these setbacks, the company remains debt-free and its short-term assets significantly exceed liabilities, providing financial stability. However, earnings have declined by 49.4% annually over five years and recent profit margins are lower than before at 17%. The board is experienced but management tenure data is insufficient for evaluation.

- Navigate through the intricacies of Fitaihi Holding Group with our comprehensive balance sheet health report here.

- Assess Fitaihi Holding Group's previous results with our detailed historical performance reports.

Key Takeaways

- Explore the 78 names from our Middle Eastern Penny Stocks screener here.

- Contemplating Other Strategies? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:MEGAP

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi

Produces and sells foam products in Turkey and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026