- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1322

Al Masane Al Kobra Mining Company's (TADAWUL:1322) Earnings Haven't Escaped The Attention Of Investors

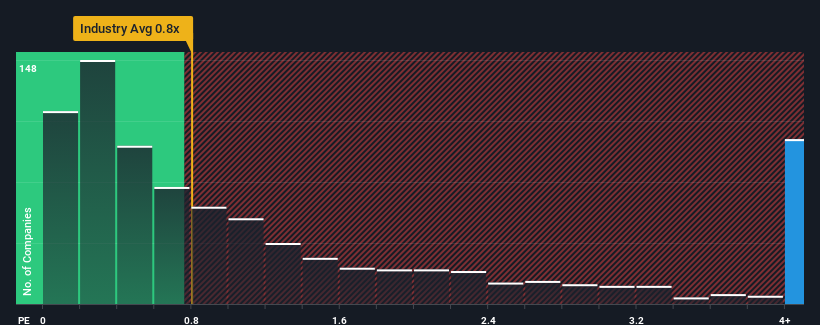

When close to half the companies in the Metals and Mining industry in Saudi Arabia have price-to-sales ratios (or "P/S") below 1.7x, you may consider Al Masane Al Kobra Mining Company (TADAWUL:1322) as a stock to avoid entirely with its 10.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Al Masane Al Kobra Mining

What Does Al Masane Al Kobra Mining's P/S Mean For Shareholders?

Recent times have been more advantageous for Al Masane Al Kobra Mining as its revenue hasn't fallen as much as the rest of the industry. The P/S ratio is probably high because investors think this comparatively better revenue performance will continue. While you'd prefer that its revenue trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Al Masane Al Kobra Mining will help you uncover what's on the horizon.How Is Al Masane Al Kobra Mining's Revenue Growth Trending?

Al Masane Al Kobra Mining's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 30% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 19% per year during the coming three years according to the only analyst following the company. With the industry only predicted to deliver 7.4% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Al Masane Al Kobra Mining is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Al Masane Al Kobra Mining's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Al Masane Al Kobra Mining (including 1 which is significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1322

Al Masane Al Kobra Mining

Engages in the production of non-ferrous metal ores and precious metals in Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success