- Saudi Arabia

- /

- Paper and Forestry Products

- /

- SASE:1202

Middle East Company for Manufacturing and Producing Paper's (TADAWUL:1202) Price In Tune With Revenues

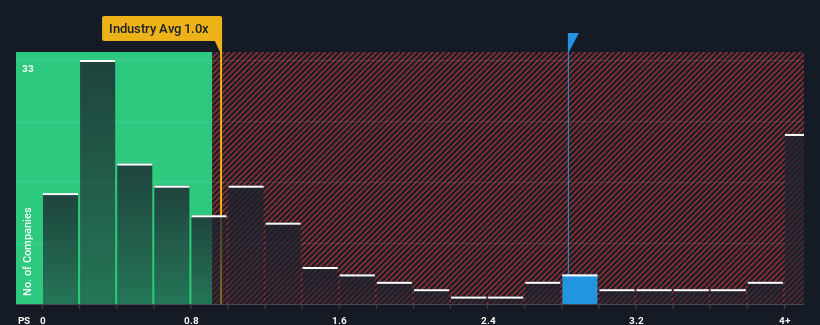

Middle East Company for Manufacturing and Producing Paper's (TADAWUL:1202) price-to-sales (or "P/S") ratio of 2.8x may not look like an appealing investment opportunity when you consider close to half the companies in the Forestry industry in Saudi Arabia have P/S ratios below 1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Middle East Company for Manufacturing and Producing Paper

What Does Middle East Company for Manufacturing and Producing Paper's P/S Mean For Shareholders?

Middle East Company for Manufacturing and Producing Paper could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Middle East Company for Manufacturing and Producing Paper's future stacks up against the industry? In that case, our free report is a great place to start.How Is Middle East Company for Manufacturing and Producing Paper's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Middle East Company for Manufacturing and Producing Paper's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 32%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 14% per annum as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 5.5% each year growth forecast for the broader industry.

With this information, we can see why Middle East Company for Manufacturing and Producing Paper is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Middle East Company for Manufacturing and Producing Paper's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Middle East Company for Manufacturing and Producing Paper shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Middle East Company for Manufacturing and Producing Paper (1 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Middle East Company for Manufacturing and Producing Paper's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1202

Middle East Company for Manufacturing and Producing Paper

Engages in the production and sale of container boards and industrial papers in the Kingdom of Saudi Arabia, the Middle East, Africa, Asia, and Europe.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives