- Saudi Arabia

- /

- Insurance

- /

- SASE:8310

Amana Cooperative Insurance (TADAWUL:8310 shareholders incur further losses as stock declines 13% this week, taking three-year losses to 80%

As an investor, mistakes are inevitable. But really bad investments should be rare. So spare a thought for the long term shareholders of Amana Cooperative Insurance Company (TADAWUL:8310); the share price is down a whopping 82% in the last three years. That'd be enough to cause even the strongest minds some disquiet. Furthermore, it's down 28% in about a quarter. That's not much fun for holders. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Amana Cooperative Insurance

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Amana Cooperative Insurance moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We think that the revenue decline over three years, at a rate of 15% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

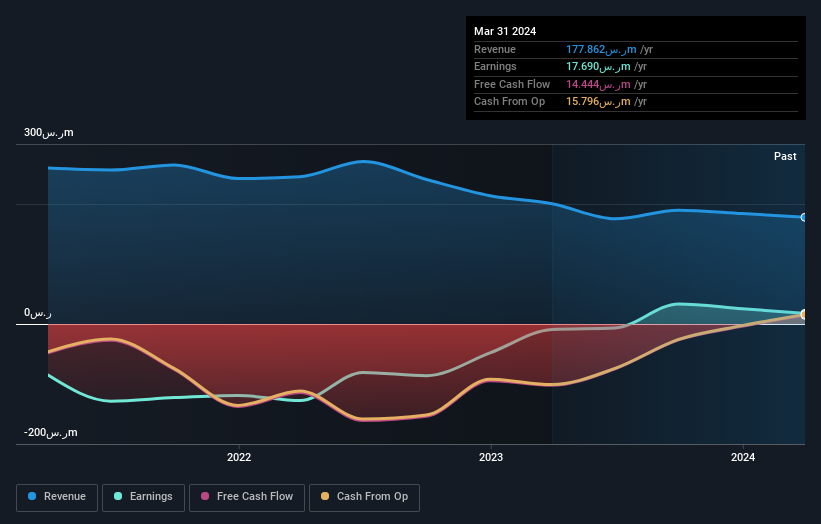

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Amana Cooperative Insurance's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Amana Cooperative Insurance's TSR, at -80% is higher than its share price return of -82%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market lost about 7.4% in the twelve months, Amana Cooperative Insurance shareholders did even worse, losing 9.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 8% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before forming an opinion on Amana Cooperative Insurance you might want to consider these 3 valuation metrics.

We will like Amana Cooperative Insurance better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8310

Amana Cooperative Insurance

Provides various insurance products and services in the Kingdom of Saudi Arabia.

Flawless balance sheet with acceptable track record.