Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In a period marked by global market volatility, with the U.S. Federal Reserve holding interest rates steady and the European Central Bank cutting rates, small-cap stocks have faced mixed outcomes as investors navigate economic uncertainties and geopolitical tensions. Despite these challenges, certain small-cap companies continue to show promise, driven by robust fundamentals and strategic positioning that can potentially thrive in this dynamic environment. As we explore these undiscovered gems, it's crucial to focus on businesses with strong growth potential and resilience amidst changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Powertip Image | 0.57% | 10.95% | 29.26% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Alltek Technology | 166.36% | 7.57% | 13.88% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Arabian Shield Cooperative Insurance (SASE:8070)

Simply Wall St Value Rating: ★★★★★★

Overview: Arabian Shield Cooperative Insurance Company offers a range of insurance products in the Kingdom of Saudi Arabia, with a market capitalization of SAR1.67 billion.

Operations: The company's primary revenue streams are derived from insurance operations, with the medical segment contributing SAR553.18 million and the motor segment adding SAR293.14 million. Protection & Savings Non-Linked also plays a role with SAR97.57 million in revenue.

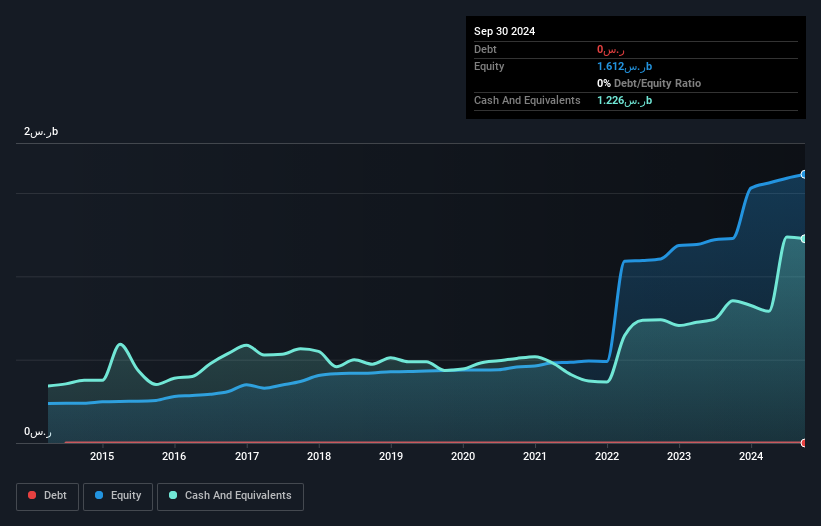

Arabian Shield Cooperative Insurance, a relatively small player in the insurance sector, has shown impressive earnings growth of 142.7% over the past year, significantly outpacing the industry average of -6.9%. This debt-free company boasts high-quality earnings with a price-to-earnings ratio of 20.1x, which is more attractive compared to the SA market's 24.1x. Recent results highlight net income for Q3 at SAR 23 million, up from SAR 6 million last year, while nine-month figures reached SAR 76.94 million versus SAR 38.3 million previously—an indicator of strong operational performance and potential value for investors seeking growth opportunities in this space.

- Take a closer look at Arabian Shield Cooperative Insurance's potential here in our health report.

Understand Arabian Shield Cooperative Insurance's track record by examining our Past report.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Value Rating: ★★★★★★

Overview: Global New Material International Holdings Limited is an investment holding company that produces and sells pearlescent pigment, functional mica filler, and related products in China and internationally, with a market cap of HK$4.50 billion.

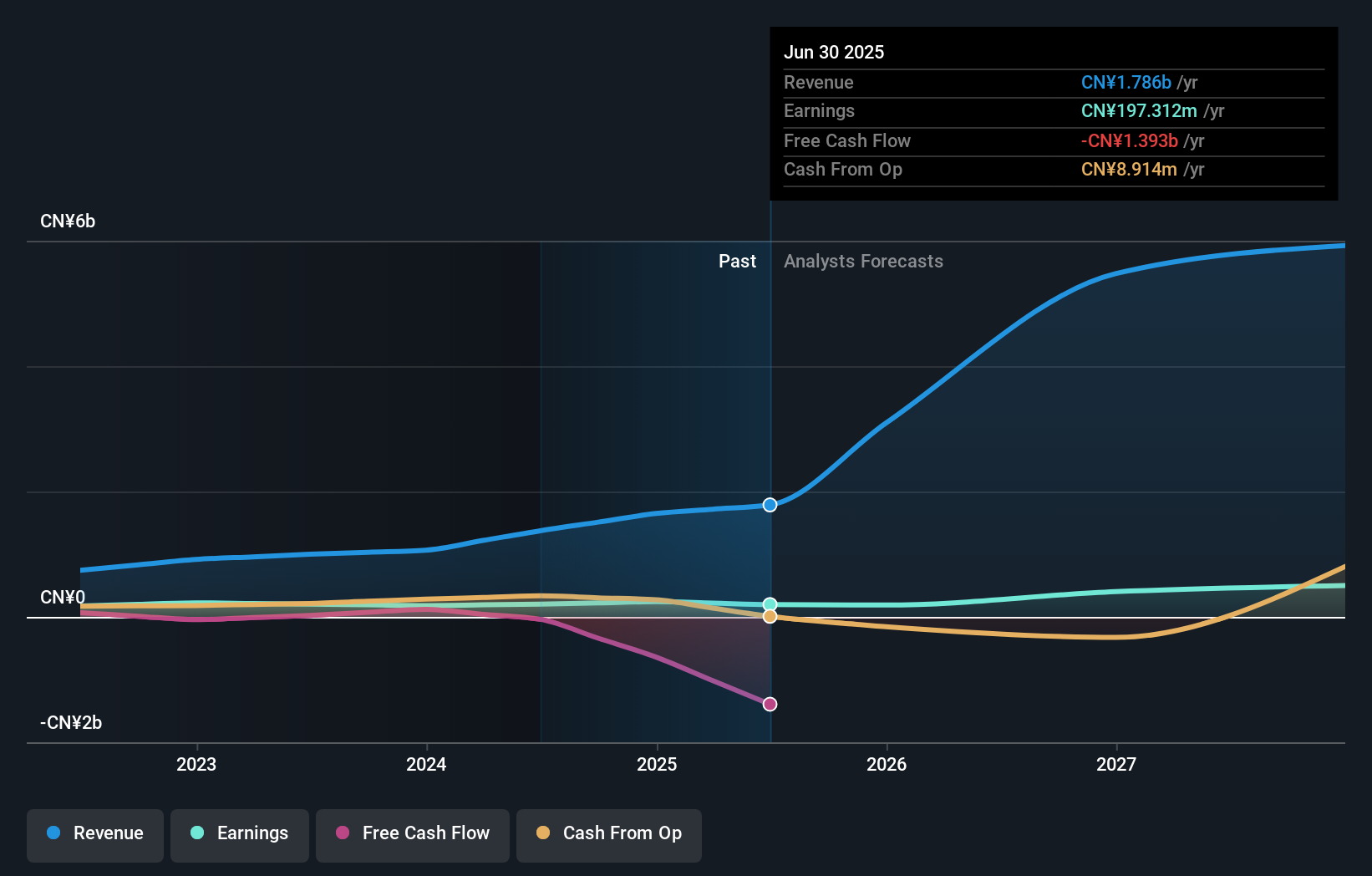

Operations: The company generates revenue primarily from its PRC Business Operation, amounting to CN¥1.11 billion. The net profit margin for the company is a crucial metric to consider when evaluating its financial health and profitability trends over time.

Global New Material International Holdings, a smaller player in the chemicals sector, showcases promising financial health. Its earnings growth of 0.9% last year outpaced the industry's -21.5%, indicating resilience. The company trades at 0.8% below its estimated fair value, suggesting potential for upward movement in valuation. With interest payments well-covered by EBIT at 6.3 times and more cash than total debt, it demonstrates strong fiscal management. Over five years, its debt-to-equity ratio improved from 33.4% to 32.7%. Looking forward, earnings are projected to grow annually by over 31%, highlighting robust future prospects in a challenging industry landscape.

Bourbon (TSE:2208)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bourbon Corporation is a Japanese company that manufactures and sells food and beverage products, with a market capitalization of approximately ¥60.85 billion.

Operations: Bourbon Corporation generates revenue primarily through the sale of food and beverage products in Japan. The company has a market capitalization of approximately ¥60.85 billion.

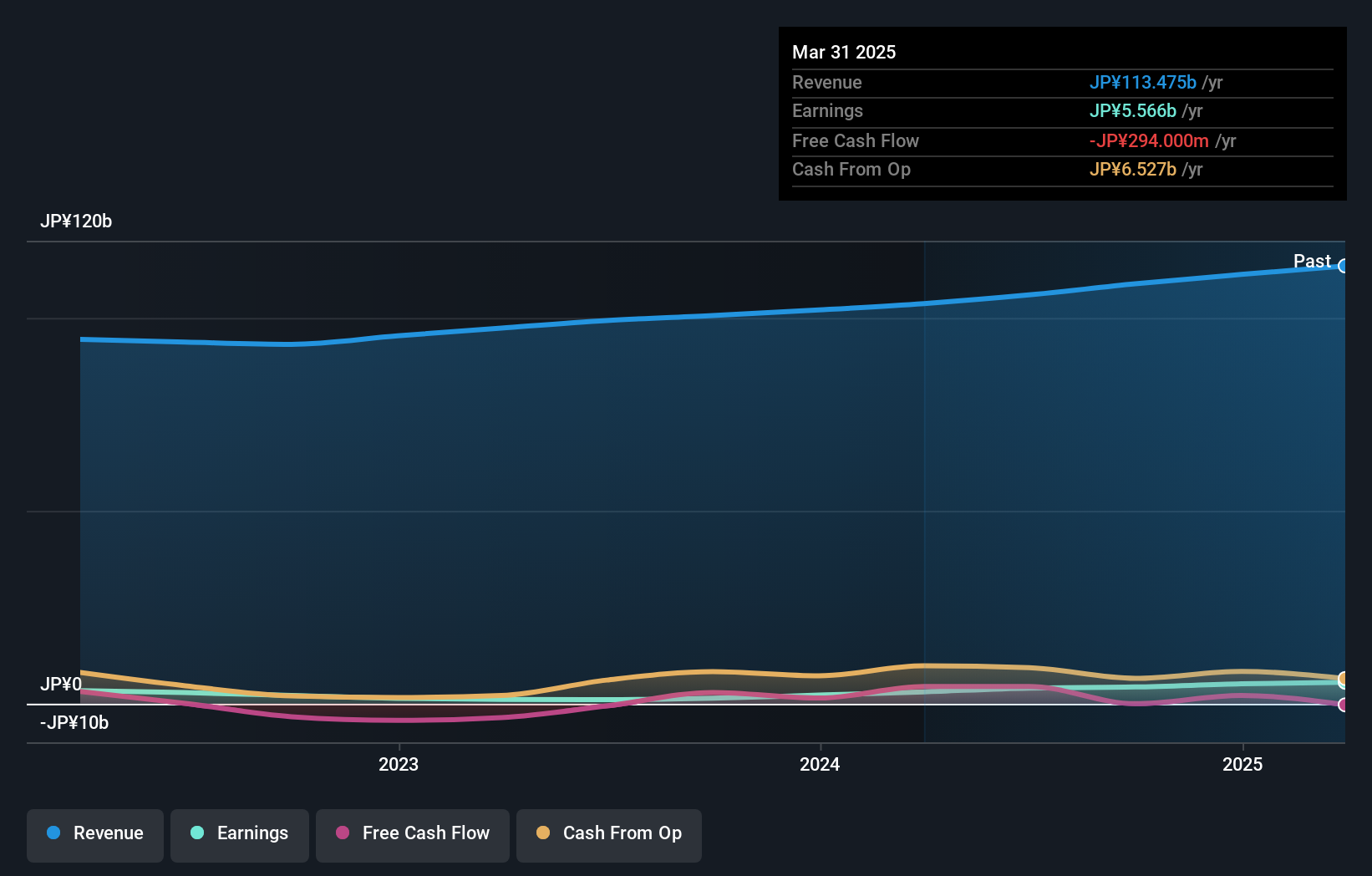

Bourbon's financials paint a promising picture, with earnings growth of 131% over the past year, outpacing the food industry's 20%. This growth is complemented by a price-to-earnings ratio of 11.8x, which sits below the JP market average of 13.7x, suggesting potential undervaluation. Despite an increase in its debt to equity ratio from 4.6% to 6.8% over five years, Bourbon remains profitable and boasts high-quality earnings alongside sufficient interest coverage. The company also holds more cash than total debt and has shown positive free cash flow recently at US$4.46 billion as of June 2024.

- Get an in-depth perspective on Bourbon's performance by reading our health report here.

Explore historical data to track Bourbon's performance over time in our Past section.

Next Steps

- Dive into all 4687 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6616

Global New Material International Holdings

An investment holding company, produces and sells pearlescent pigment, functional mica filler, and related products in the People’s Republic of China and South Korea.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives