- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:9544

Discovering Hidden Gems With Potential In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, driven by stronger-than-expected U.S. labor data and persistent inflation concerns, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index entering correction territory. In this uncertain environment, identifying potential "hidden gems" requires a focus on companies that demonstrate resilience and adaptability to economic shifts while maintaining strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

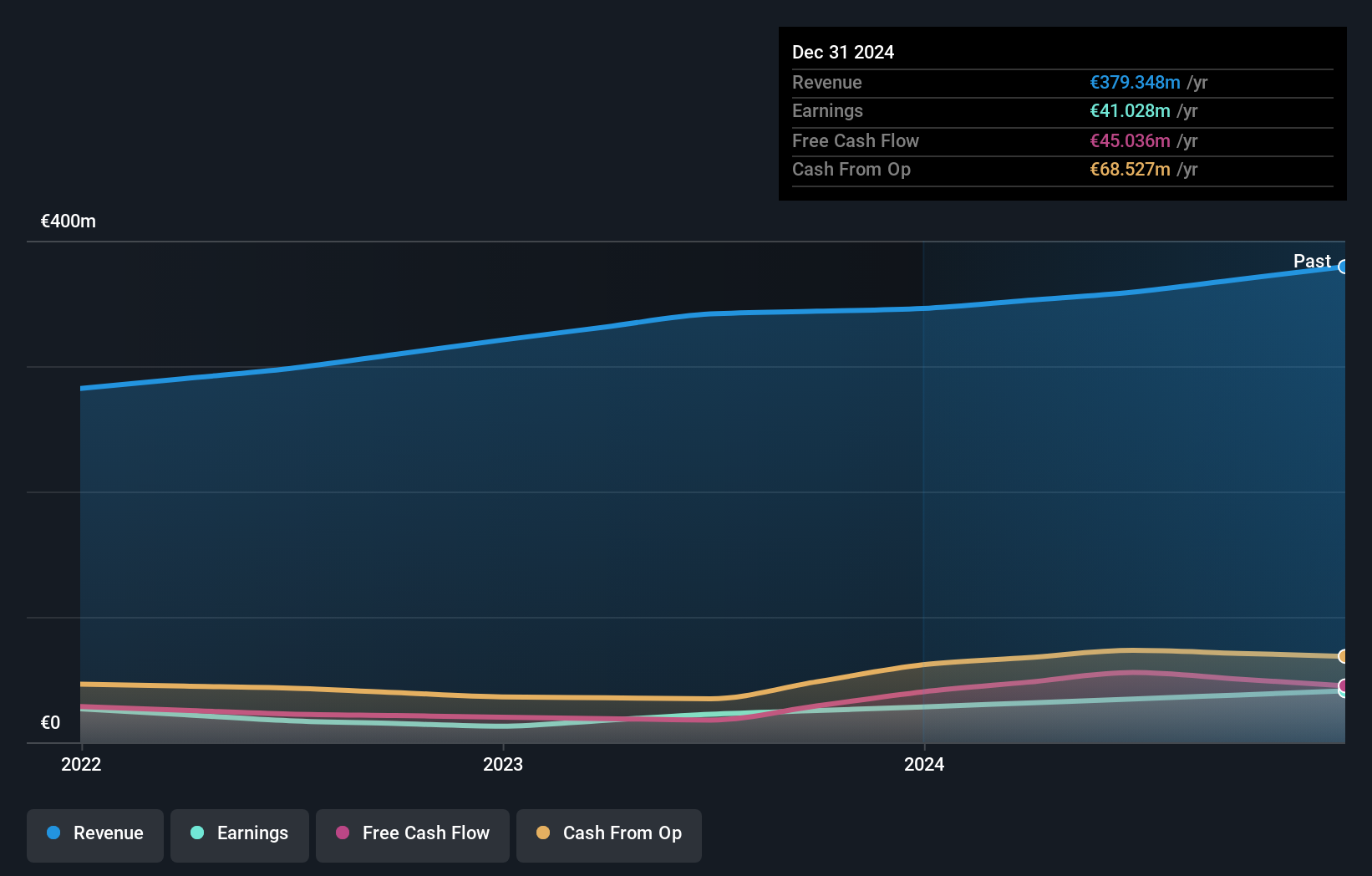

Overview: Spadel SA is a company based in Belgium that specializes in the production and marketing of natural mineral water, with a market capitalization of €784.42 million.

Operations: Spadel generates its revenue primarily from the non-alcoholic beverages segment, amounting to €359.03 million. The company has a market capitalization of €784.42 million.

Spadel, a nimble player in the beverage industry, has shown impressive resilience with earnings growth of 54% over the past year, outpacing the industry's -4.8%. The company stands out for its high-quality earnings and is currently trading at a significant discount of 74.3% below estimated fair value. Spadel's debt-free status marks a stark contrast to five years ago when it had a debt-to-equity ratio of 7%, highlighting effective financial management. With positive free cash flow and no concerns over interest payments, Spadel seems well-positioned for future opportunities in its sector.

- Click here and access our complete health analysis report to understand the dynamics of Spadel.

Assess Spadel's past performance with our detailed historical performance reports.

Future Care Trading (SASE:9544)

Simply Wall St Value Rating: ★★★★★★

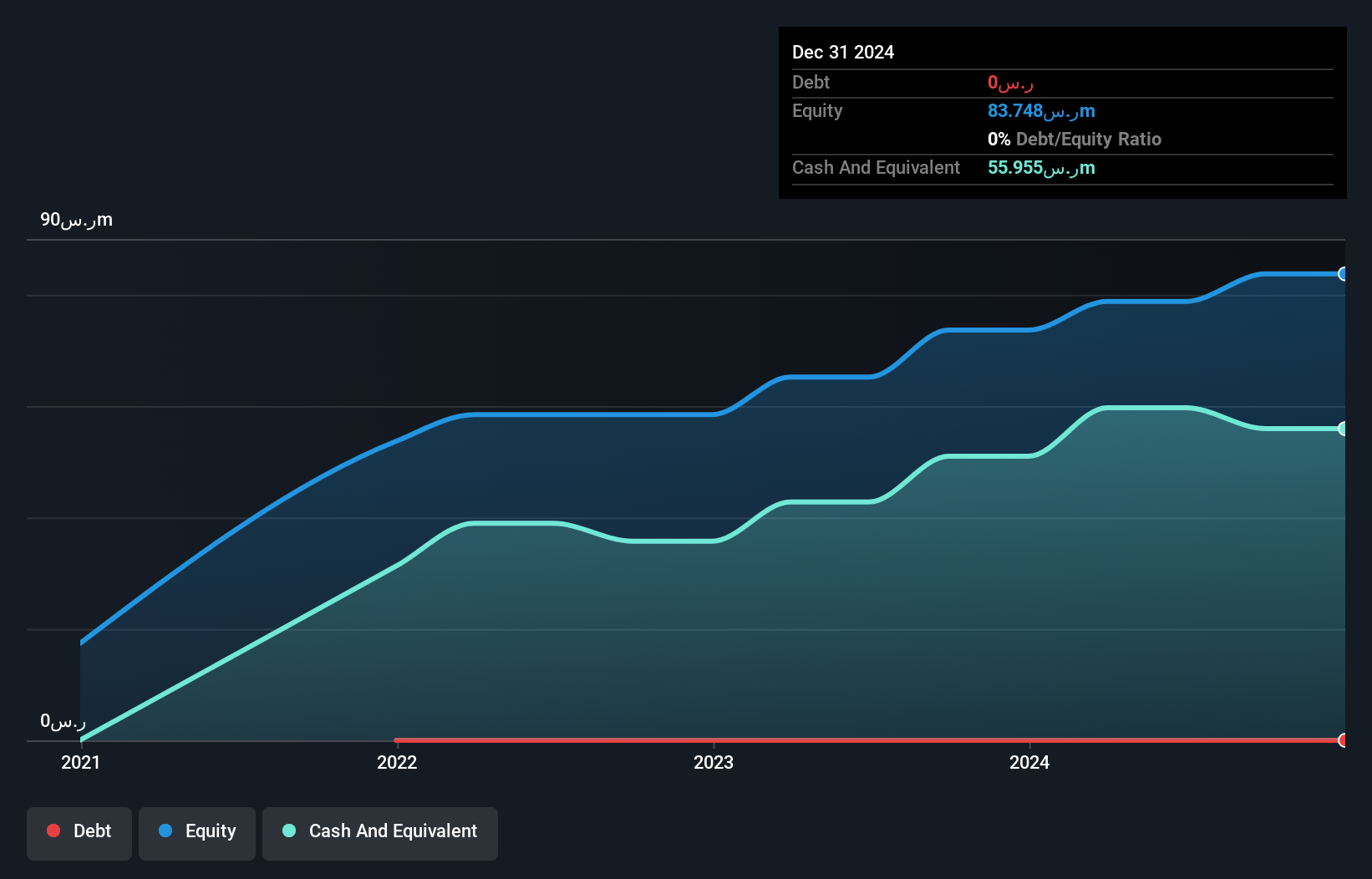

Overview: Future Care Trading Co. offers home medical and laboratory services throughout Saudi Arabia, with a market capitalization of SAR4.80 billion.

Operations: Future Care Trading Co. generates revenue primarily from healthcare facilities and services, amounting to SAR52.91 million. The company's net profit margin is a key financial metric to consider, reflecting its profitability after all expenses are deducted from total revenue.

Future Care Trading, a promising player in the healthcare sector, showcases impressive financial stability with no debt over the past five years. The company's earnings surged by 106.9% last year, outpacing the industry's 13.3% growth rate, highlighting its robust performance amidst market volatility. Despite a volatile share price recently, Future Care's high-quality earnings and positive free cash flow position it well for future opportunities. Levered free cash flow reached US$14.48 million as of March 2024 and US$10.99 million by June 2024, suggesting efficient capital management likely bolstered by strategic investment decisions and operational efficiency improvements.

Zhuzhou Smelter GroupLtd (SHSE:600961)

Simply Wall St Value Rating: ★★★★★☆

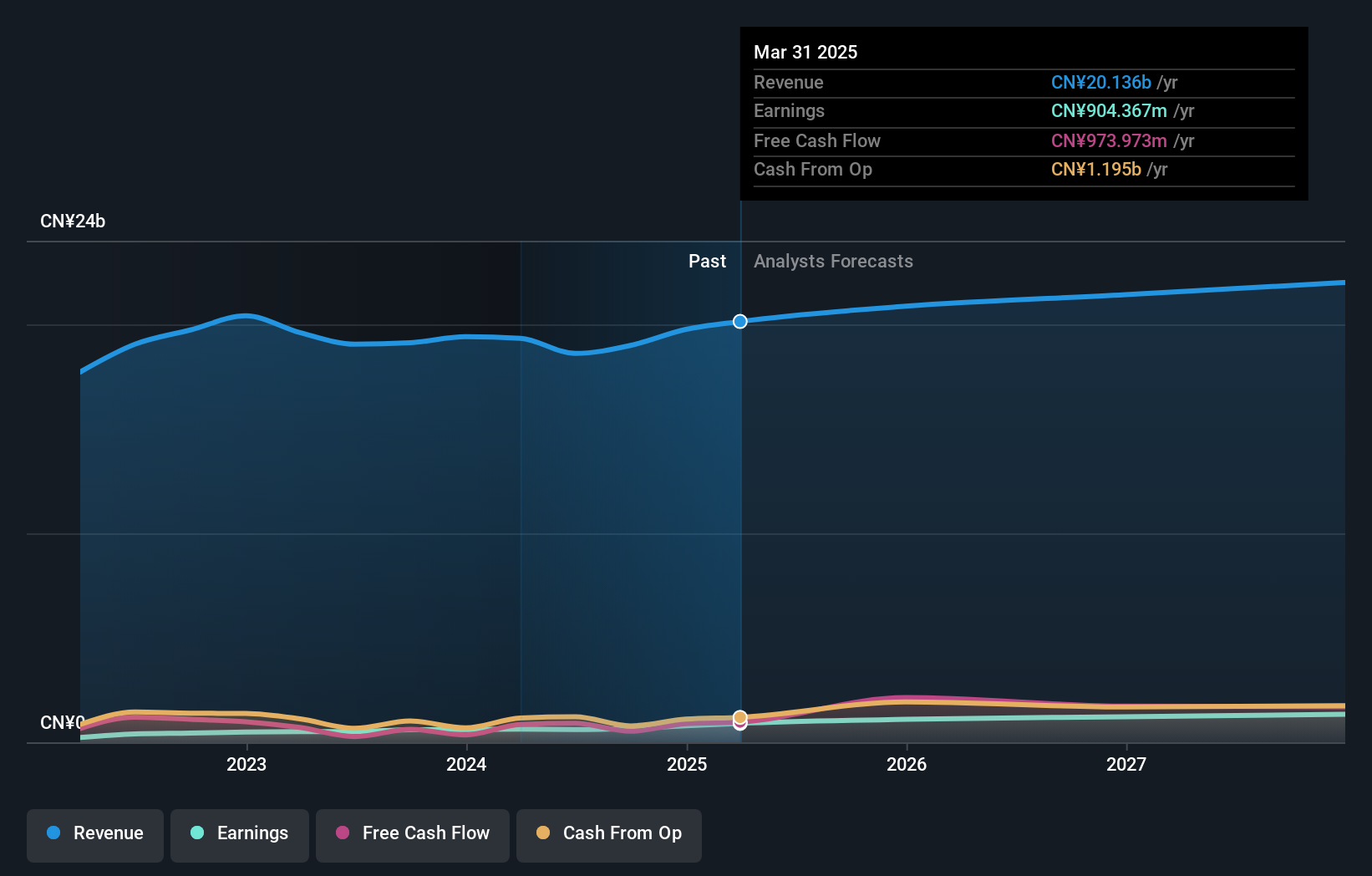

Overview: Zhuzhou Smelter Group Co., Ltd. is a Chinese company engaged in the production and sale of lead, zinc, and alloy products with a market capitalization of CN¥9.01 billion.

Operations: Zhuzhou Smelter generates revenue primarily from lead and zinc products, amounting to CN¥18.99 billion. The company's net profit margin is 2.5%, reflecting its profitability in the metals industry.

Zhuzhou Smelter Group, a prominent player in the metals and mining sector, showcases a satisfactory net debt to equity ratio of 35.9%, indicating prudent financial management. Over the past five years, their debt to equity has impressively decreased from 607.8% to 46.7%, strengthening their balance sheet significantly. Despite a slight dip in revenue from CNY 14,806 million to CNY 14,388 million for the nine months ending September 2024, net income rose from CNY 531 million to CNY 582 million. With earnings growth outpacing the industry at 10.2% versus -2.3%, Zhuzhou appears well-positioned for future profitability amid industry challenges.

- Click here to discover the nuances of Zhuzhou Smelter GroupLtd with our detailed analytical health report.

Gain insights into Zhuzhou Smelter GroupLtd's past trends and performance with our Past report.

Taking Advantage

- Dive into all 4628 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9544

Future Care Trading

Provides a range of home medical and laboratory services in the Kingdom of Saudi Arabia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives