- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:2230

Why Investors Shouldn't Be Surprised By Saudi Chemical Holding Company's (TADAWUL:2230) P/E

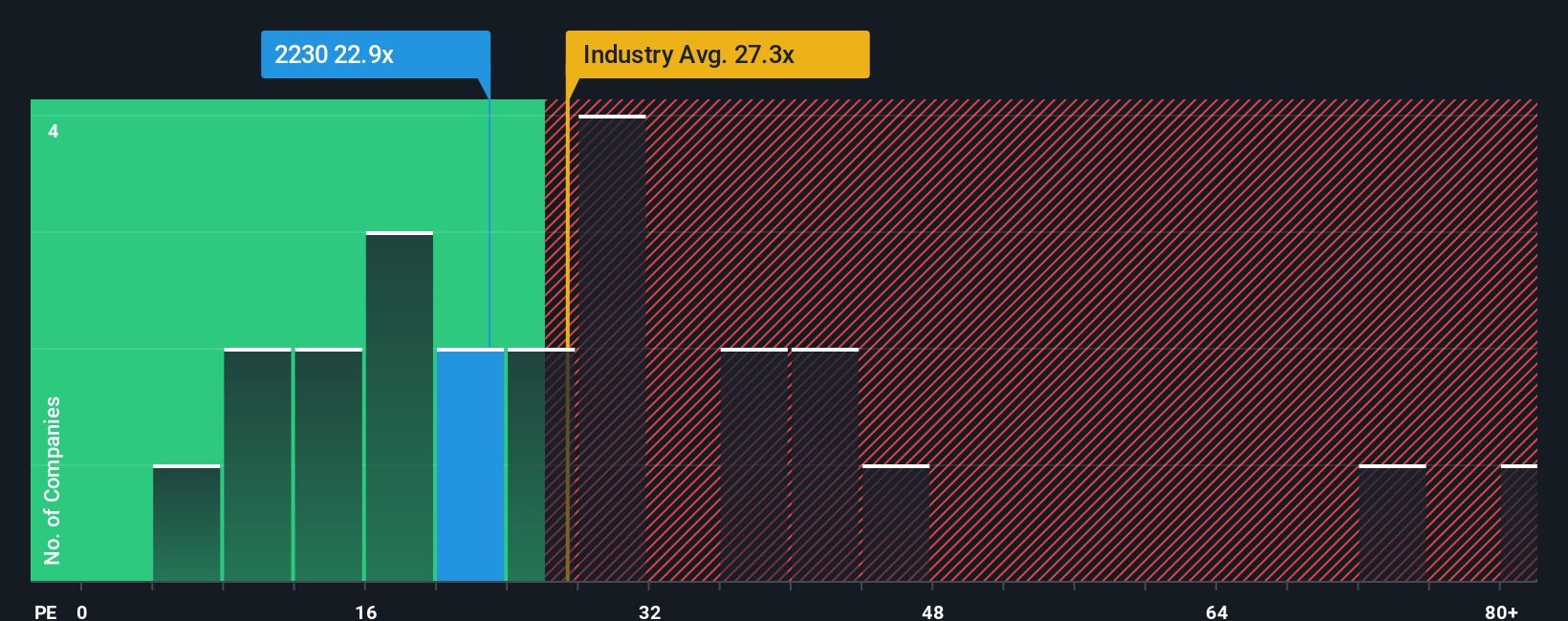

Saudi Chemical Holding Company's (TADAWUL:2230) price-to-earnings (or "P/E") ratio of 22.9x might make it look like a sell right now compared to the market in Saudi Arabia, where around half of the companies have P/E ratios below 20x and even P/E's below 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Saudi Chemical Holding's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Saudi Chemical Holding

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Saudi Chemical Holding's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 3.3%. Even so, admirably EPS has lifted 482% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Saudi Chemical Holding is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From Saudi Chemical Holding's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Saudi Chemical Holding revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Saudi Chemical Holding.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2230

Saudi Chemical Holding

Manufactures, wholesale and retail trade in medicines, medical materials and solutions, pharmaceutical preparations, medical and surgical tools, equipment, instruments, hospital and medical center supplies and spare parts, detergents, and food products in the Kingdom of Saudi Arabia and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives