- Saudi Arabia

- /

- Hospitality

- /

- SASE:6012

Update: Raydan Food (TADAWUL:6012) Stock Gained 84% In The Last Year

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Raydan Food Co. (TADAWUL:6012) share price is 84% higher than it was a year ago, much better than the market decline of around 0.1% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! And shareholders have also done well over the long term, with an increase of 83% in the last three years.

See our latest analysis for Raydan Food

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Raydan Food saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

Raydan Food's revenue actually dropped 35% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

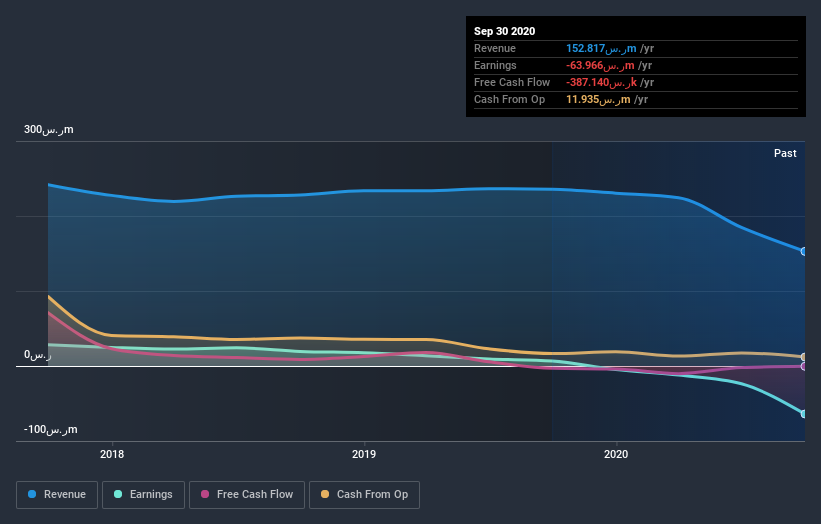

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Raydan Food stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Raydan Food shareholders have gained 84% (in total) over the last year. That gain actually surpasses the 22% TSR it generated (per year) over three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Raydan Food is showing 2 warning signs in our investment analysis , and 1 of those is significant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Raydan Food, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:6012

Raydan Food

Operates and franchises restaurants in the Kingdom of Saudi Arabia.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives