- Saudi Arabia

- /

- Hospitality

- /

- SASE:1820

Abdulmohsen Al-Hokair Group for Tourism and Development (TADAWUL:1820) Share Prices Have Dropped 54% In The Last Five Years

It is doubtless a positive to see that the Abdulmohsen Al-Hokair Group for Tourism and Development Company (TADAWUL:1820) share price has gained some 72% in the last three months. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 54% in the period. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

View our latest analysis for Abdulmohsen Al-Hokair Group for Tourism and Development

Abdulmohsen Al-Hokair Group for Tourism and Development wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Abdulmohsen Al-Hokair Group for Tourism and Development saw its revenue shrink by 3.6% per year. That's not what investors generally want to see. The share price decline of 9% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

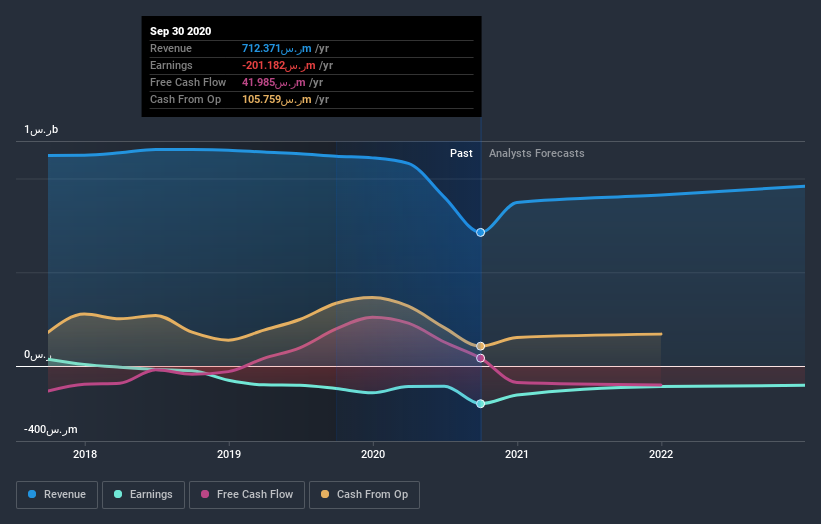

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Abdulmohsen Al-Hokair Group for Tourism and Development's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Abdulmohsen Al-Hokair Group for Tourism and Development's TSR, which was a 51% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's good to see that Abdulmohsen Al-Hokair Group for Tourism and Development has rewarded shareholders with a total shareholder return of 21% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Abdulmohsen Al-Hokair Group for Tourism and Development better, we need to consider many other factors. For instance, we've identified 2 warning signs for Abdulmohsen Al-Hokair Group for Tourism and Development (1 is a bit unpleasant) that you should be aware of.

But note: Abdulmohsen Al-Hokair Group for Tourism and Development may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading Abdulmohsen Al-Hokair Group for Tourism and Development or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BAAN Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:1820

BAAN Holding Group

BAAN Holding Group Company for Tourism and Development Company provides hospitality and entertainment services in the Kingdom of Saudi Arabia, the United Arab Emirates, and Egypt.

Reasonable growth potential and fair value.

Market Insights

Community Narratives