- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4061

How Much Have Anaam International Holding Group (TADAWUL:4061) Shareholders Earned On Their Investment Over The Last Five Years?

Anaam International Holding Group Company (TADAWUL:4061) shareholders should be happy to see the share price up 12% in the last month.

See our latest analysis for Anaam International Holding Group

Because Anaam International Holding Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Anaam International Holding Group saw its revenue shrink by 38% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 10% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

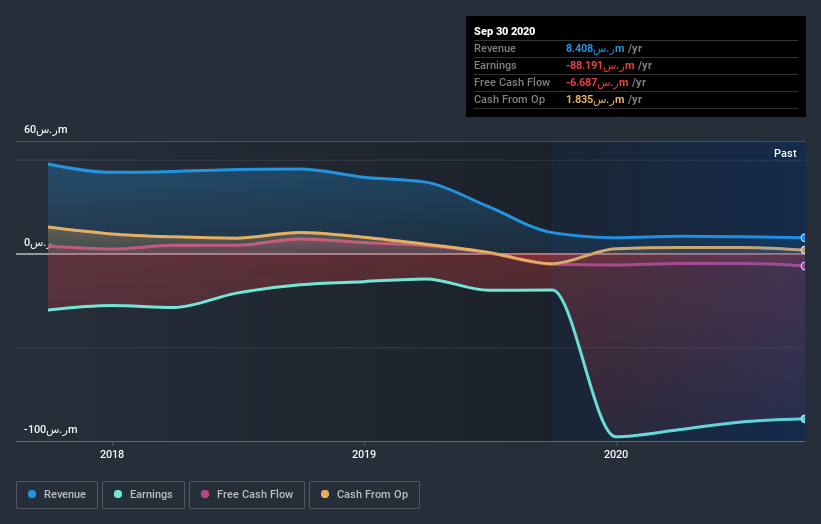

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Anaam International Holding Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Anaam International Holding Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Anaam International Holding Group hasn't been paying dividends, but its TSR of 153% exceeds its share price return of -58%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Anaam International Holding Group has rewarded shareholders with a total shareholder return of 379% in the last twelve months. That's better than the annualised return of 20% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Anaam International Holding Group better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Anaam International Holding Group you should be aware of, and 2 of them can't be ignored.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading Anaam International Holding Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4061

Anaam International Holding Group

Through its subsidiaries, engages in the agricultural activities, foodstuff trading, and entertainment and beauty businesses.

Very low with weak fundamentals.

Market Insights

Community Narratives