- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4061

Anaam International Holding Group Company's (TADAWUL:4061) P/S Is On The Mark

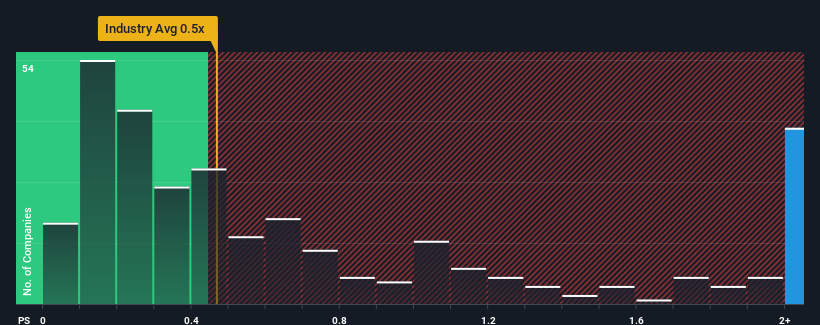

When close to half the companies in the Consumer Retailing industry in Saudi Arabia have price-to-sales ratios (or "P/S") below 1.3x, you may consider Anaam International Holding Group Company (TADAWUL:4061) as a stock to avoid entirely with its 12.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Anaam International Holding Group

How Anaam International Holding Group Has Been Performing

With revenue growth that's exceedingly strong of late, Anaam International Holding Group has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Anaam International Holding Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Anaam International Holding Group's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 166% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.7% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Anaam International Holding Group's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Anaam International Holding Group's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Anaam International Holding Group revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Anaam International Holding Group with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4061

Anaam International Holding Group

Through its subsidiaries, engages in the agricultural activities, foodstuff trading, and entertainment and beauty businesses.

Very low with weak fundamentals.

Market Insights

Community Narratives