- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4061

Anaam International Holding Group Company (TADAWUL:4061) Looks Just Right With A 27% Price Jump

Anaam International Holding Group Company (TADAWUL:4061) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 52%.

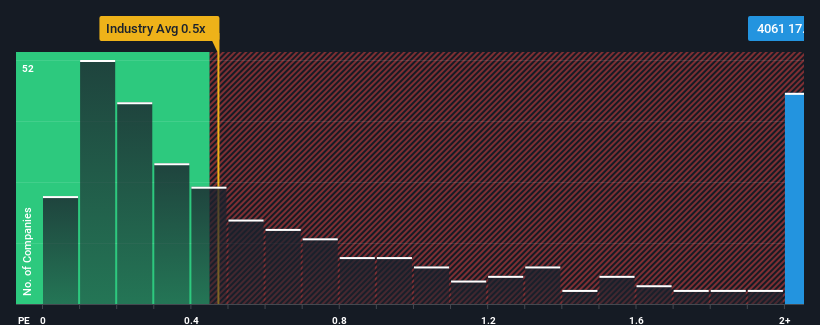

After such a large jump in price, when almost half of the companies in Saudi Arabia's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Anaam International Holding Group as a stock not worth researching with its 17.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Anaam International Holding Group

How Has Anaam International Holding Group Performed Recently?

Revenue has risen firmly for Anaam International Holding Group recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Anaam International Holding Group will help you shine a light on its historical performance.How Is Anaam International Holding Group's Revenue Growth Trending?

In order to justify its P/S ratio, Anaam International Holding Group would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 6.4% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Anaam International Holding Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Anaam International Holding Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Anaam International Holding Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you take the next step, you should know about the 2 warning signs for Anaam International Holding Group (1 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Anaam International Holding Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4061

Anaam International Holding Group

Through its subsidiaries, engages in the agricultural activities, foodstuff trading, and entertainment and beauty businesses.

Very low with weak fundamentals.

Market Insights

Community Narratives