- Saudi Arabia

- /

- Luxury

- /

- SASE:4012

Thob Al Aseel Company's (TADAWUL:4012) Popularity With Investors Is Under Threat From Overpricing

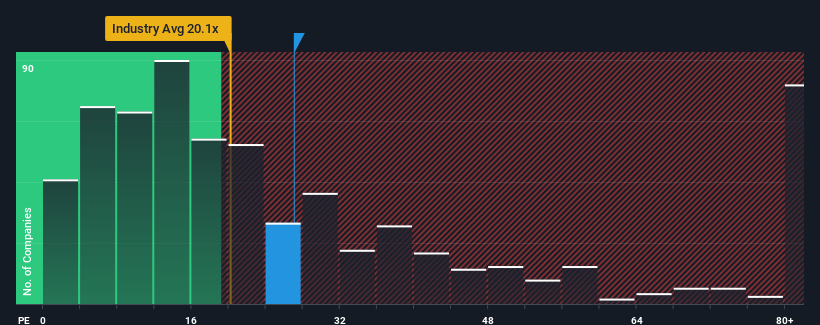

There wouldn't be many who think Thob Al Aseel Company's (TADAWUL:4012) price-to-earnings (or "P/E") ratio of 27x is worth a mention when the median P/E in Saudi Arabia is similar at about 28x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Thob Al Aseel certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Thob Al Aseel

How Is Thob Al Aseel's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Thob Al Aseel's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 44% gain to the company's bottom line. Still, incredibly EPS has fallen 6.6% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 19% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Thob Al Aseel is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Thob Al Aseel revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Thob Al Aseel (1 is significant!) that you need to be mindful of.

You might be able to find a better investment than Thob Al Aseel. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Thob Al Aseel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4012

Thob Al Aseel

Develops, imports, exports, wholesales, and retails fabrics and readymade clothes.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives