- Saudi Arabia

- /

- Consumer Durables

- /

- SASE:2130

Further weakness as Saudi Industrial Development (TADAWUL:2130) drops 10% this week, taking three-year losses to 33%

While it may not be enough for some shareholders, we think it is good to see the Saudi Industrial Development Co. (TADAWUL:2130) share price up 16% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 33% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Because Saudi Industrial Development made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Saudi Industrial Development's revenue dropped 7.9% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 10%, annualized. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

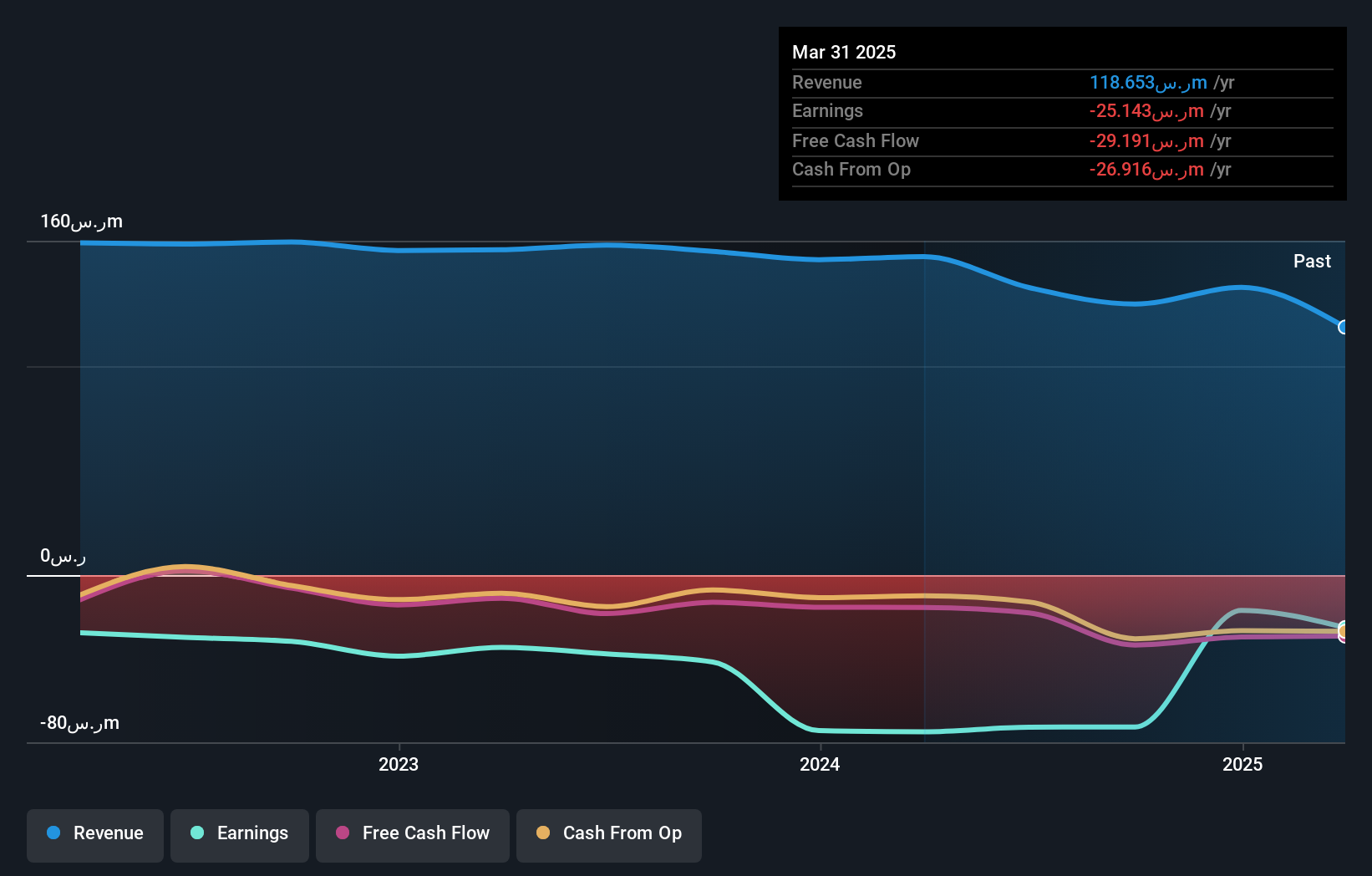

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Saudi Industrial Development has rewarded shareholders with a total shareholder return of 13% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 1.4% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Saudi Industrial Development better, we need to consider many other factors. Take risks, for example - Saudi Industrial Development has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

But note: Saudi Industrial Development may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2130

Saudi Industrial Development

Manufactures and sells sanitary wares and sponge products in the Kingdom of Saudi Arabia and the Arab Republic of Egypt.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives