- Saudi Arabia

- /

- Professional Services

- /

- SASE:1833

Undiscovered Gems To Explore This February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility, with the Federal Reserve holding rates steady and earnings season revealing mixed results, small-cap stocks are capturing attention amidst broader market fluctuations. In this dynamic environment, identifying promising small-cap companies requires an eye for innovation and resilience—qualities that can transform these lesser-known entities into potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training, with a market capitalization of AED3.02 billion.

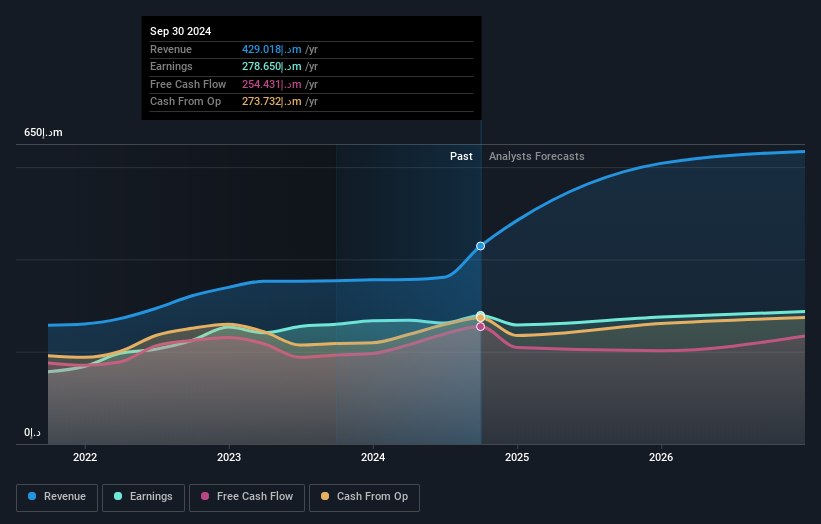

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily through its car and other related services, amounting to AED429.02 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability and efficiency in managing costs relative to its revenue streams.

Emirates Driving Company, a promising player in its sector, shows robust financial health with no debt over the past five years and trades at 14.5% below its estimated fair value. Its earnings have grown impressively by 21.4% annually over the last five years, although recent growth of 7.4% lagged behind the industry average of 10.5%. The company is debt-free and profitable, ensuring a stable cash runway for future operations. With high-quality past earnings and revenue projected to grow by 16.81% annually, it seems well-positioned within its market context despite certain growth challenges.

Almawarid Manpower (SASE:1833)

Simply Wall St Value Rating: ★★★★★★

Overview: Almawarid Manpower Company offers professional manpower services to individuals and businesses in Saudi Arabia, with a market capitalization of SAR2.04 billion.

Operations: Almawarid Manpower generates revenue primarily from three segments: Corporate (SAR1.19 billion), Individual (SAR255.28 million), and Hourly (SAR154.09 million). The Corporate segment is the largest contributor to its revenue stream, indicating a strong focus on business clients within Saudi Arabia.

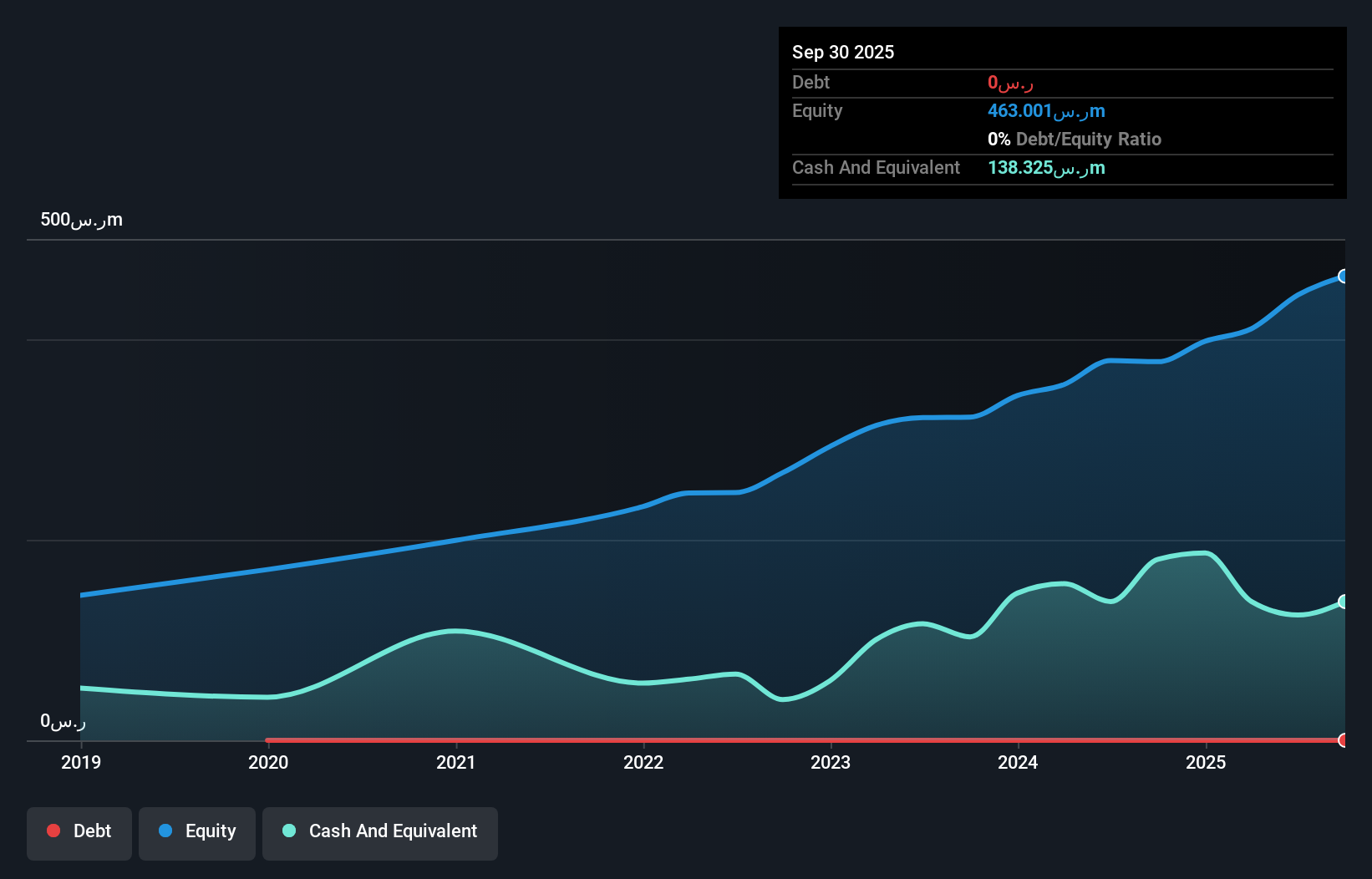

Almawarid Manpower, a smaller player in the manpower industry, showcases a mixed financial landscape. With sales for the third quarter hitting SAR 468.03 million, up from SAR 320.07 million last year, it seems to be expanding its market reach despite net income dipping to SAR 17.1 million from SAR 22.93 million. The company is debt-free and has reduced its debt over five years from a debt-to-equity ratio of 10.1%. Although earnings growth was negative at -5.2%, Almawarid maintains high-quality past earnings and forecasts suggest a promising annual growth rate of 19.55%.

- Click here to discover the nuances of Almawarid Manpower with our detailed analytical health report.

Understand Almawarid Manpower's track record by examining our Past report.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪970.65 million, operates in Israel offering a range of insurance products through its subsidiaries.

Operations: Ayalon Insurance generates revenue primarily from its General Insurance segment, with significant contributions from Automobile Property Insurance (₪679.72 million) and Other Liabilities Divisions (₪895.78 million). The Health insurance segment also plays a crucial role, contributing ₪597.48 million to the total revenue.

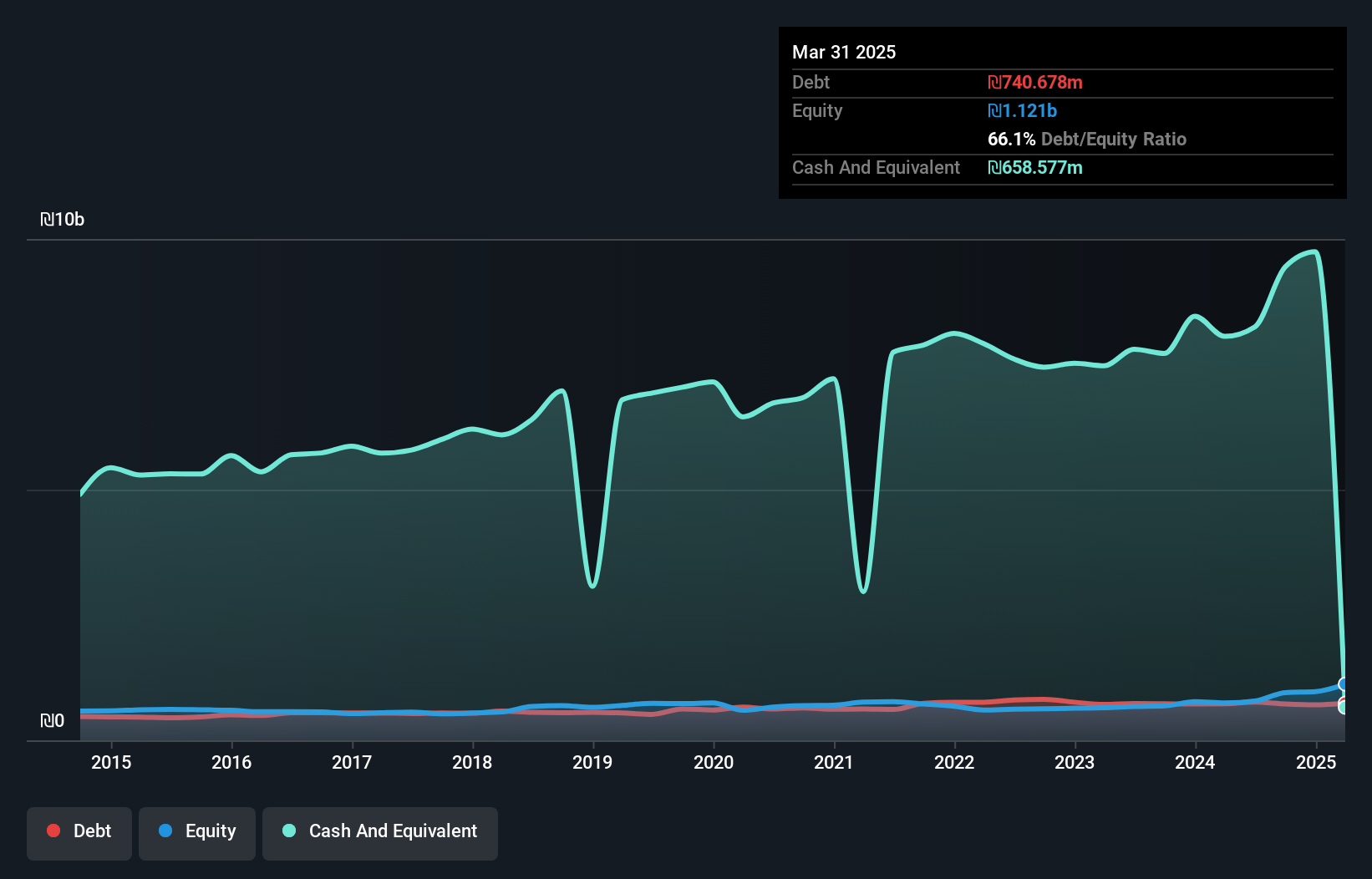

Ayalon Insurance, a nimble player in the market, has shown impressive earnings growth of 278.7% over the past year, outpacing its industry peers. This performance is underpinned by high-quality earnings and a debt-to-equity ratio that improved from 85.2% to 76.1% over five years, indicating prudent financial management. Trading at nearly half its estimated fair value suggests potential undervaluation for investors seeking opportunities in smaller companies. Recent strategic moves include a reinsurance agreement with Phoenix Financial Ltd., enhancing Ayalon's P&C operations without impacting solvency, and an M&A transaction reducing Wesure Global Tech's stake to approximately 70%.

- Take a closer look at Ayalon Insurance's potential here in our health report.

Examine Ayalon Insurance's past performance report to understand how it has performed in the past.

Where To Now?

- Unlock our comprehensive list of 4666 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1833

Almawarid Manpower

Provides recruitment services for domestic workers, expatriate labor services, and operates temporary employment agency for domestic services in the Kingdom of Saudi Arabia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success