Stock Analysis

- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:RADL3

Three Top Growth Stocks With Insider Ownership Reaching 26%

Reviewed by Simply Wall St

As global markets navigate through a mixed performance landscape, with significant shifts favoring small-cap and value stocks, investors are closely monitoring the evolving economic indicators and trade tensions. In this context, exploring growth companies with substantial insider ownership might offer unique insights into firms whose leadership teams are deeply invested in their future success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Here we highlight a subset of our preferred stocks from the screener.

Raia Drogasil (BOVESPA:RADL3)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raia Drogasil S.A. is a Brazilian retailer specializing in medicines, personal care, beauty products, and specialty medications, with a market capitalization of approximately R$44.76 billion.

Operations: The company primarily generates revenue through the sale of medicines, cosmetics, and hygiene products, totaling R$35.14 billion.

Insider Ownership: 21.2%

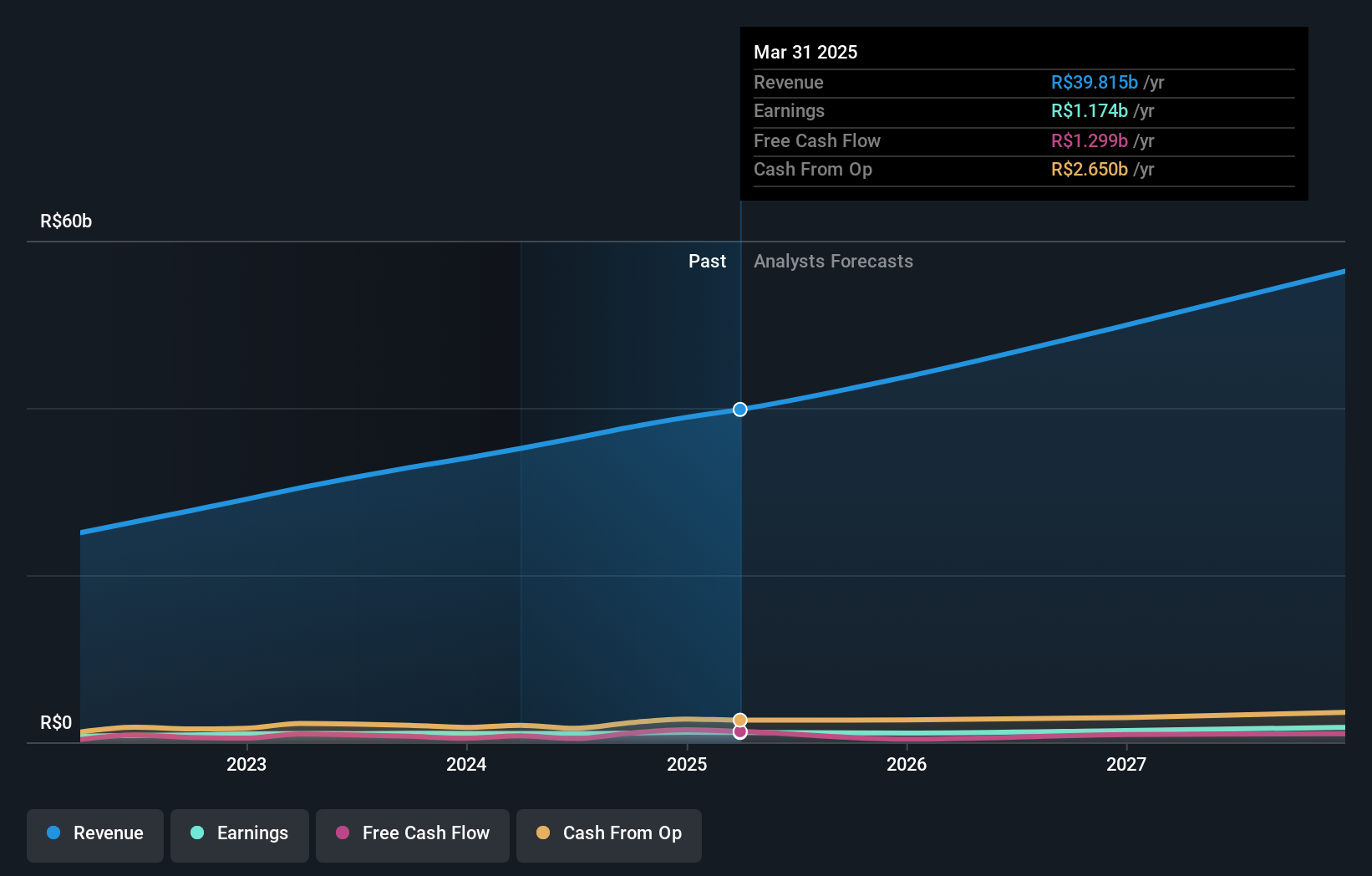

Raia Drogasil, a Brazilian retail pharmacy, has shown solid financial performance with first quarter sales reaching BRL 9.10 billion, up from BRL 7.93 billion year-over-year. Despite a slight dip in net income to BRL 187.81 million, the company maintains robust growth forecasts with revenue expected to grow at 12.8% annually and earnings projected to increase by 22.6% per year over the next three years—both figures outpacing the broader Brazilian market rates of 7.4% and 13.6%, respectively.

- Click here and access our complete growth analysis report to understand the dynamics of Raia Drogasil.

- Our valuation report unveils the possibility Raia Drogasil's shares may be trading at a premium.

Maharah for Human Resources (SASE:1831)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maharah for Human Resources Company offers manpower services to both public and private sectors in Saudi Arabia and the United Arab Emirates, with a market capitalization of SAR 3.24 billion.

Operations: The company's revenue is primarily generated through its Corporate segment at SAR 1.40 billion, followed by the Individual segment at SAR 437.42 million and Facility Management at SAR 119.18 million.

Insider Ownership: 26.4%

Maharah for Human Resources, amidst a backdrop of multiple executive and board changes, has reported a Q1 2024 revenue of SAR 518.53 million with net income at SAR 50.03 million. Despite this, the company's dividend track record remains unstable. However, it is set to outpace the Saudi market with its revenue projected to grow by 8.6% annually and earnings expected to surge by 27.3% per year over the next three years, significantly ahead of market growth rates. These figures underscore potential in an otherwise volatile share price environment and concerns over interest coverage by earnings.

- Get an in-depth perspective on Maharah for Human Resources' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Maharah for Human Resources' current price could be inflated.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. operates in the healthcare technology sector, providing integrated solutions and services, with a market capitalization of approximately CN¥11.87 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 22.7%

Winning Health Technology Group, with a price-to-earnings ratio of 28.5x below the industry average, shows promising financial recovery and growth prospects. In Q1 2024, it reversed a prior loss, posting net income of CNY 16.62 million with revenue up to CNY 494.49 million from CNY 449.17 million year-over-year. Forecasted earnings growth is significant at approximately 25.56% annually over three years, outpacing the Chinese market's expectation by a considerable margin despite concerns about quality due to one-off items impacting results.

- Click to explore a detailed breakdown of our findings in Winning Health Technology Group's earnings growth report.

- The analysis detailed in our Winning Health Technology Group valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1446 Fast Growing Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:RADL3

Raia Drogasil

Engages in the retail sale of medicines, perfumery, personal care and beauty products, cosmetics, dermocosmetics, and specialty medicines in Brazil.

High growth potential with excellent balance sheet.