- Saudi Arabia

- /

- Trade Distributors

- /

- SASE:1214

Capital Allocation Trends At Al Hassan Ghazi Ibrahim Shaker (TADAWUL:1214) Aren't Ideal

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. On that note, looking into Al Hassan Ghazi Ibrahim Shaker (TADAWUL:1214), we weren't too upbeat about how things were going.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Al Hassan Ghazi Ibrahim Shaker:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0067 = ر.س5.0m ÷ (ر.س1.5b - ر.س791m) (Based on the trailing twelve months to September 2021).

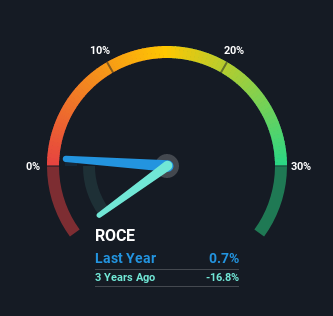

Therefore, Al Hassan Ghazi Ibrahim Shaker has an ROCE of 0.7%. Ultimately, that's a low return and it under-performs the Trade Distributors industry average of 7.3%.

View our latest analysis for Al Hassan Ghazi Ibrahim Shaker

In the above chart we have measured Al Hassan Ghazi Ibrahim Shaker's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Al Hassan Ghazi Ibrahim Shaker here for free.

What Can We Tell From Al Hassan Ghazi Ibrahim Shaker's ROCE Trend?

The trend of returns that Al Hassan Ghazi Ibrahim Shaker is generating are raising some concerns. To be more specific, today's ROCE was 4.4% five years ago but has since fallen to 0.7%. On top of that, the business is utilizing 40% less capital within its operations. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

On a separate but related note, it's important to know that Al Hassan Ghazi Ibrahim Shaker has a current liabilities to total assets ratio of 52%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

What We Can Learn From Al Hassan Ghazi Ibrahim Shaker's ROCE

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. Investors must expect better things on the horizon though because the stock has risen 34% in the last five years. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

Al Hassan Ghazi Ibrahim Shaker does have some risks, we noticed 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

While Al Hassan Ghazi Ibrahim Shaker may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1214

Al Hassan Ghazi Ibrahim Shaker

Engages in the trading, wholesale, and maintenance of spare parts, electronic equipment, household equipment, and air-conditioners in Saudi Arabia.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026