- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:GMPC

3 Middle Eastern Dividend Stocks To Consider With Up To 7.0% Yield

Reviewed by Simply Wall St

As Gulf bourses experience a mixed performance with investors seeking new catalysts amid fading optimism over the U.S.-China trade agreement, dividend stocks in the Middle East remain an attractive option for those looking to secure steady income. In such fluctuating markets, selecting stocks that offer reliable dividends can provide a cushion against volatility while potentially enhancing overall portfolio returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.87% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.49% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.27% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.69% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.22% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.99% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.74% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.69% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.78% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.25% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

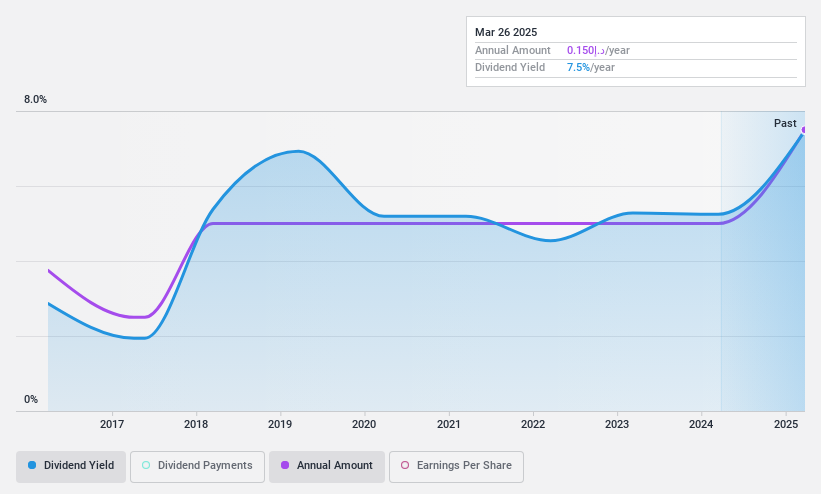

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gulf Medical Projects Company (PJSC) operates hospitals in the United Arab Emirates and has a market cap of AED 1.50 billion.

Operations: Gulf Medical Projects Company (PJSC) generates revenue primarily through the management of hospitals in the United Arab Emirates.

Dividend Yield: 7.0%

Gulf Medical Projects Company (PJSC) recently reported a rise in Q1 earnings, with net income increasing to AED 22.47 million. The company declared cash dividends totaling AED 104.84 million, yet its high payout ratio of 125.6% indicates dividends are not well covered by earnings, although cash flows provide some coverage at a 73.1% ratio. Despite offering a competitive yield of 7.01%, the dividend history has been volatile and unreliable over the past decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Gulf Medical Projects Company (PJSC).

- Our comprehensive valuation report raises the possibility that Gulf Medical Projects Company (PJSC) is priced lower than what may be justified by its financials.

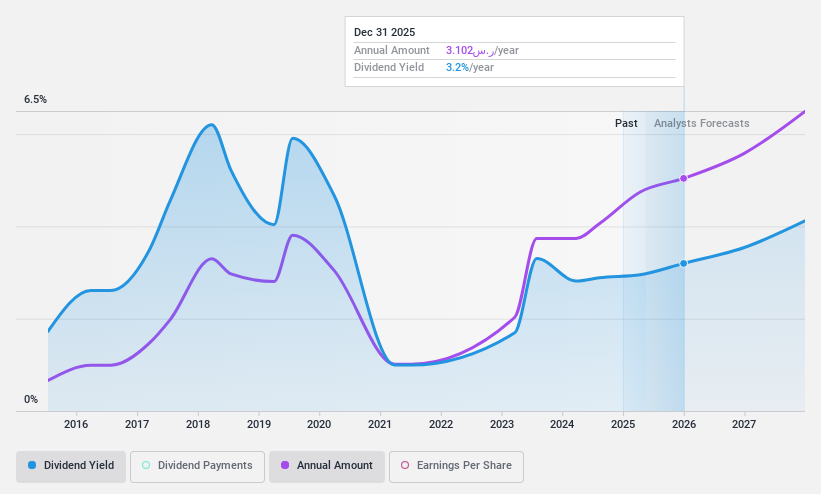

Al Rajhi Banking and Investment (SASE:1120)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi Banking and Investment Corporation, along with its subsidiaries, offers banking and investment services both within Saudi Arabia and internationally, with a market cap of SAR391.20 billion.

Operations: Al Rajhi Banking and Investment Corporation generates revenue from its Retail Segment (SAR18.59 billion), Treasury Segment (SAR4.85 billion), Corporate Segment (SAR6.79 billion), and Investment Services, Brokerage, and Other Segments (SAR1.58 billion).

Dividend Yield: 3%

Al Rajhi Banking and Investment's dividend history shows volatility over the past decade, though dividends are currently covered by earnings with a payout ratio of 53.8% and forecasted to remain sustainable. Despite a lower yield of 3.01% compared to top-tier payers, recent financial performance is strong, with Q1 net income rising to SAR 5.91 billion from SAR 4.40 billion year-on-year, supporting its capacity for future dividend distributions amidst revenue growth forecasts of 12.72% annually.

- Click here to discover the nuances of Al Rajhi Banking and Investment with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Al Rajhi Banking and Investment is priced higher than what may be justified by its financials.

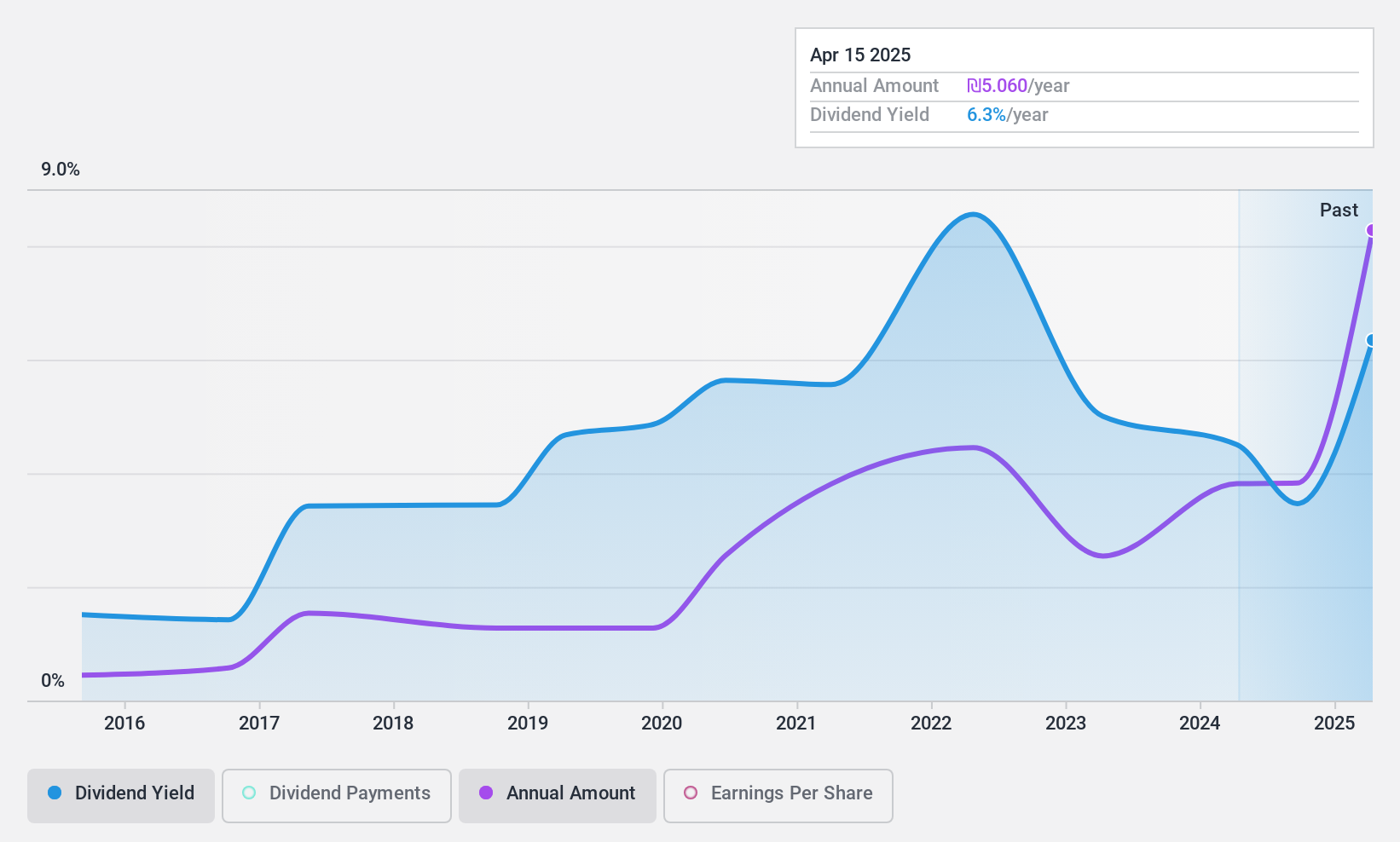

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Palram Industries (1990) Ltd specializes in the manufacturing and sale of thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market cap of ₪2.07 billion.

Operations: Palram Industries (1990) Ltd generates revenue through its PVC sector at ₪445.89 million, polycarbonate sector at ₪984.33 million, home finished products sector at ₪263.28 million, and sales and display stands sector at ₪197.96 million.

Dividend Yield: 6.3%

Palram Industries offers a dividend yield of 6.28%, placing it in the top tier of payers in the IL market. While dividends are covered by earnings (payout ratio: 56.2%) and cash flows (cash payout ratio: 69.4%), their history is marked by volatility, with significant annual drops over the past decade. Recent financial results show improved performance, with net income rising to ILS 231.69 million from ILS 164.34 million year-on-year, potentially supporting future dividends despite past unreliability.

- Unlock comprehensive insights into our analysis of Palram Industries (1990) stock in this dividend report.

- In light of our recent valuation report, it seems possible that Palram Industries (1990) is trading beyond its estimated value.

Where To Now?

- Investigate our full lineup of 75 Top Middle Eastern Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:GMPC

Gulf Medical Projects Company (PJSC)

Manages hospitals in the United Arab Emirates.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion