- Russia

- /

- Gas Utilities

- /

- MISX:RTGZ

The Gazprom Gazoraspredelenie Rostov-na-Donu (MCX:RTGZ) Share Price Is Up 105% And Shareholders Are Boasting About It

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For instance, the price of Public Joint Stock Company Gazprom Gazoraspredelenie Rostov-na-Donu (MCX:RTGZ) stock is up an impressive 105% over the last five years. Also pleasing for shareholders was the 21% gain in the last three months.

Check out our latest analysis for Gazprom Gazoraspredelenie Rostov-na-Donu

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

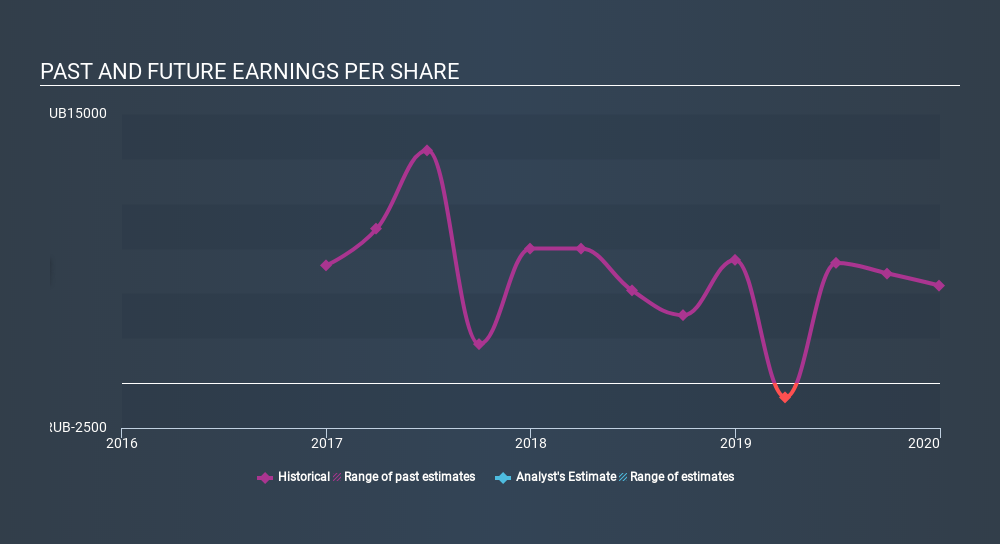

Over half a decade, Gazprom Gazoraspredelenie Rostov-na-Donu managed to grow its earnings per share at 0.5% a year. This EPS growth is slower than the share price growth of 15% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Gazprom Gazoraspredelenie Rostov-na-Donu's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Gazprom Gazoraspredelenie Rostov-na-Donu's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Gazprom Gazoraspredelenie Rostov-na-Donu shareholders, and that cash payout contributed to why its TSR of 108%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that Gazprom Gazoraspredelenie Rostov-na-Donu shareholders have received a total shareholder return of 63% over one year. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Gazprom Gazoraspredelenie Rostov-na-Donu better, we need to consider many other factors. For example, we've discovered 2 warning signs for Gazprom Gazoraspredelenie Rostov-na-Donu (1 doesn't sit too well with us!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About MISX:RTGZ

Gazprom Gazoraspredelenie Rostov-na-Donu

Public Joint Stock Company Gazprom Gazoraspredelenie Rostov-na-Donu engages in the transportation of natural gas in Russia.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion