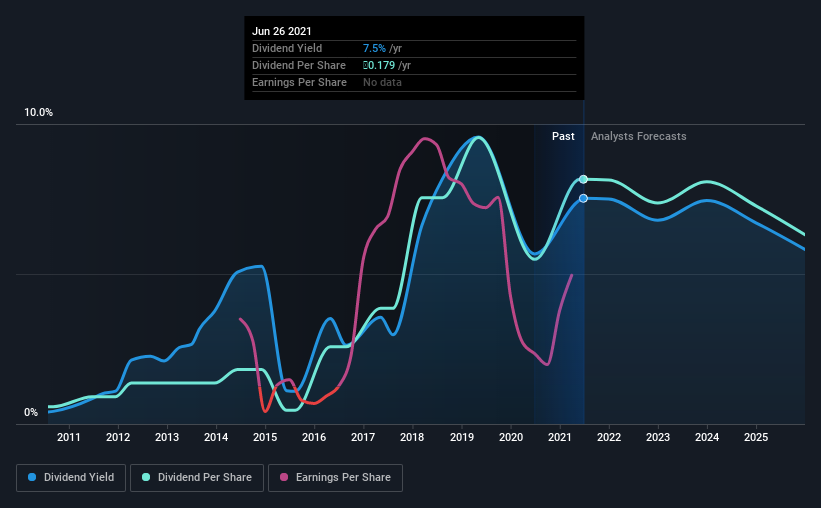

Public Joint Stock Company Mosenergo (MCX:MSNG) has announced that it will be increasing its dividend on the 1st of January to ₽0.18. This takes the dividend yield from 7.5% to 7.5%, which shareholders will be pleased with.

Check out our latest analysis for Mosenergo

Mosenergo's Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Mosenergo was earning enough to cover the previous dividend, but it was paying out quite a large proportion of its free cash flows. The company is clearly earning enough to pay this type of dividend, but it is definitely focused on returning cash to shareholders, rather than growing the business.

EPS is set to fall by 5.5% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could reach 80%, which is definitely on the higher side.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the dividend has gone from ₽0.013 to ₽0.18. This implies that the company grew its distributions at a yearly rate of about 30% over that duration. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Although it's important to note that Mosenergo's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

Our Thoughts On Mosenergo's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Mosenergo has been making. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Mosenergo that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Mosenergo, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:MSNG

Mosenergo

Public Joint Stock Company Mosenergo engages in the production, generation, and distribution of heat and electric power in the Moscow City and Moscow region.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success