- Russia

- /

- Electric Utilities

- /

- MISX:KTSB

Is Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania (MCX:KTSB) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Publichnoe Akcionernoe Obshestvo "Kostromskaya Sbytovaya Compania" (MCX:KTSB) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania

How Much Debt Does Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania Carry?

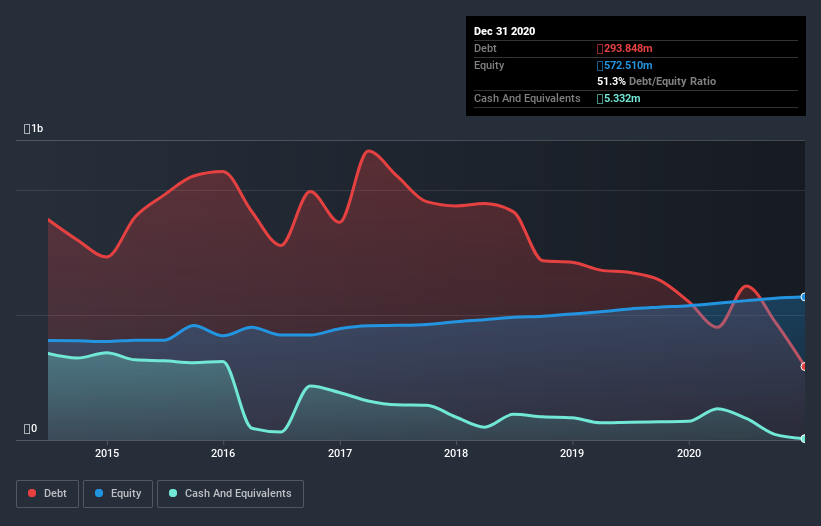

As you can see below, Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania had ₽293.8m of debt at December 2020, down from ₽554.6m a year prior. Net debt is about the same, since the it doesn't have much cash.

A Look At Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania's Liabilities

According to the last reported balance sheet, Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania had liabilities of ₽1.30b due within 12 months, and liabilities of ₽291.0k due beyond 12 months. On the other hand, it had cash of ₽5.33m and ₽1.67b worth of receivables due within a year. So it can boast ₽374.5m more liquid assets than total liabilities.

This luscious liquidity implies that Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With net debt sitting at just 1.0 times EBITDA, Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 7.9 times the interest expense over the last year. On top of that, Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania grew its EBIT by 46% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania recorded free cash flow worth a fulsome 81% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Happily, Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! It's also worth noting that Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania is in the Electric Utilities industry, which is often considered to be quite defensive. Based on the data we have reviewed, it's as clear as day that Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania's balance sheet is as healthy as a vaccinated Olympian. We're no more concerned about its debt than sailing off the edge of the earth. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania you should be aware of, and 1 of them can't be ignored.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:KTSB

Publichnoe Akcionernoe Obshestvo Kostromskaya Sbytovaya Compania

Publichnoe Akcionernoe Obshestvo "Kostromskaya Sbytovaya Compania" engages in the supply of electricity to consumers in Russia.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026