The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Public Joint-Stock Company Enel Russia (MCX:ENRU) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Enel Russia

How Much Debt Does Enel Russia Carry?

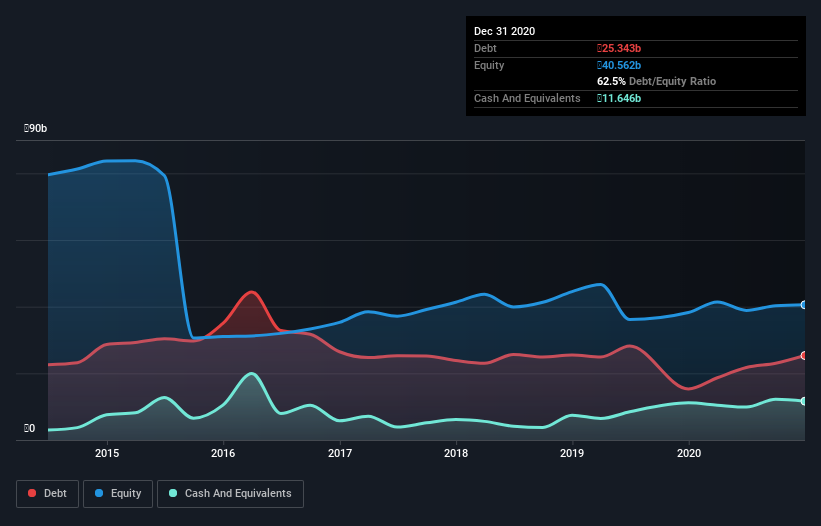

As you can see below, at the end of December 2020, Enel Russia had ₽25.3b of debt, up from ₽15.3b a year ago. Click the image for more detail. On the flip side, it has ₽11.6b in cash leading to net debt of about ₽13.7b.

A Look At Enel Russia's Liabilities

According to the last reported balance sheet, Enel Russia had liabilities of ₽14.3b due within 12 months, and liabilities of ₽21.8b due beyond 12 months. Offsetting this, it had ₽11.6b in cash and ₽5.36b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₽19.2b.

This deficit is considerable relative to its market capitalization of ₽27.6b, so it does suggest shareholders should keep an eye on Enel Russia's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Enel Russia's net debt to EBITDA ratio of about 1.6 suggests only moderate use of debt. And its strong interest cover of 80.6 times, makes us even more comfortable. The modesty of its debt load may become crucial for Enel Russia if management cannot prevent a repeat of the 47% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Enel Russia's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Enel Russia recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Mulling over Enel Russia's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But on the bright side, its interest cover is a good sign, and makes us more optimistic. We should also note that Electric Utilities industry companies like Enel Russia commonly do use debt without problems. Once we consider all the factors above, together, it seems to us that Enel Russia's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with Enel Russia (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Enel Russia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enel Russia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:ENRU

Enel Russia

Public Joint-Stock Company Enel Russia generates and sells electric power and heat in Russia.

Questionable track record with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026