- Russia

- /

- Marine and Shipping

- /

- MISX:FESH

Investors Who Bought Far-Eastern Shipping (MCX:FESH) Shares Five Years Ago Are Now Up 173%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. One great example is Far-Eastern Shipping Company PLC. (MCX:FESH) which saw its share price drive 173% higher over five years. It's also good to see the share price up 18% over the last quarter.

See our latest analysis for Far-Eastern Shipping

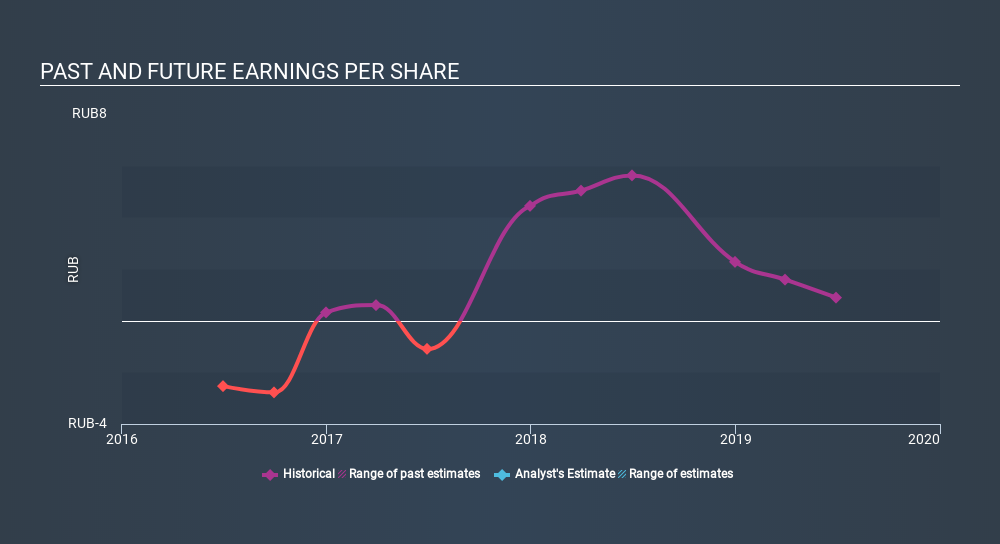

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Far-Eastern Shipping became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Far-Eastern Shipping's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Far-Eastern Shipping shareholders have received a total shareholder return of 62% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 22% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Far-Eastern Shipping better, we need to consider many other factors. Be aware that Far-Eastern Shipping is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

We will like Far-Eastern Shipping better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About MISX:FESH

Far-Eastern Shipping

Far-Eastern Shipping Company PLC. provides logistics services in Russia and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives