- Russia

- /

- Telecom Services and Carriers

- /

- MISX:TTLK

Update: Tattelecom (MCX:TTLK) Stock Gained 68% In The Last Five Years

It might be of some concern to shareholders to see the Tattelecom Public Joint-Stock Company (MCX:TTLK) share price down 20% in the last month. On the bright side the share price is up over the last half decade. In that time, it is up 68%, which isn't bad, but is below the market return of 93%.

Check out our latest analysis for Tattelecom

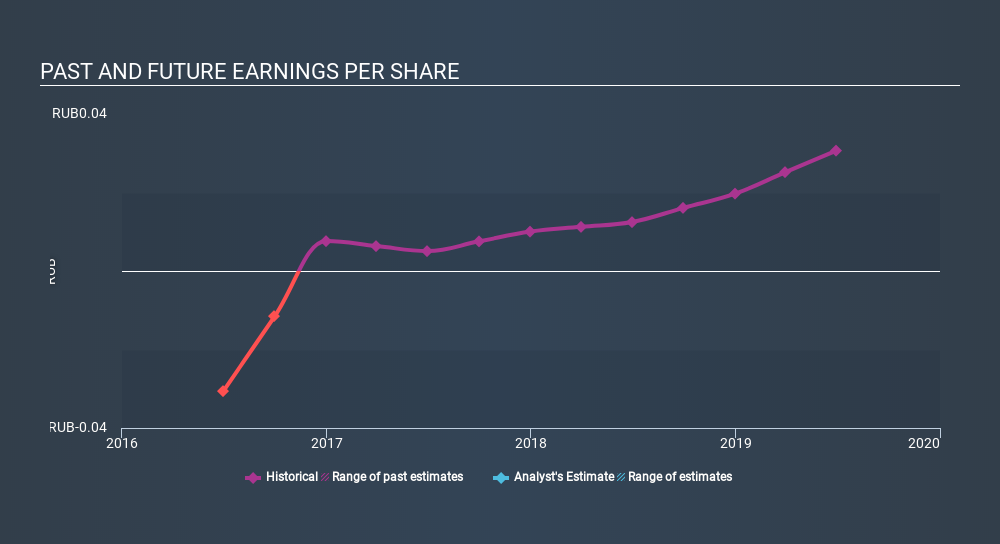

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Tattelecom became profitable. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Tattelecom, it has a TSR of 140% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Tattelecom shareholders have received a total shareholder return of 23% over one year. Of course, that includes the dividend. That's better than the annualised return of 19% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Tattelecom is showing 5 warning signs in our investment analysis , you should know about...

Of course Tattelecom may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About MISX:TTLK

Tattelecom

Tattelecom Public Joint-Stock Company provides telecommunications services for business and home clients in the Republic of Tatarstan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives