Philip Morris Operations a.d. Nis' (BELEX:DINN) Price Is Out Of Tune With Earnings

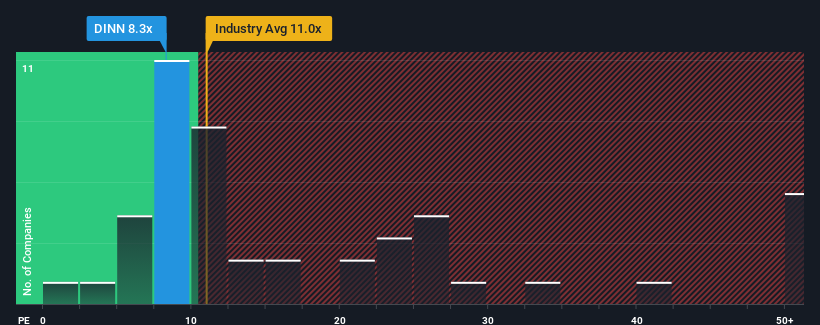

It's not a stretch to say that Philip Morris Operations a.d. Nis' (BELEX:DINN) price-to-earnings (or "P/E") ratio of 8.3x right now seems quite "middle-of-the-road" compared to the market in Serbia, where the median P/E ratio is around 8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We'd have to say that with no tangible growth over the last year, Philip Morris Operations a.d. Nis' earnings have been unimpressive. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

See our latest analysis for Philip Morris Operations a.d. Nis

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Philip Morris Operations a.d. Nis would need to produce growth that's similar to the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow EPS by 30% in total over the last three years. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Philip Morris Operations a.d. Nis is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Philip Morris Operations a.d. Nis' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Philip Morris Operations a.d. Nis currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Philip Morris Operations a.d. Nis is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

Of course, you might also be able to find a better stock than Philip Morris Operations a.d. Nis. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BELEX:DINN

Philip Morris Operations a.d. Nis

Engages in the production and sale of tobacco products in Serbia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.