- Romania

- /

- Marine and Shipping

- /

- BVB:BRNA

Not Many Are Piling Into S.C. Romnav S.A. (BVB:BRNA) Stock Yet As It Plummets 34%

Unfortunately for some shareholders, the S.C. Romnav S.A. (BVB:BRNA) share price has dived 34% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

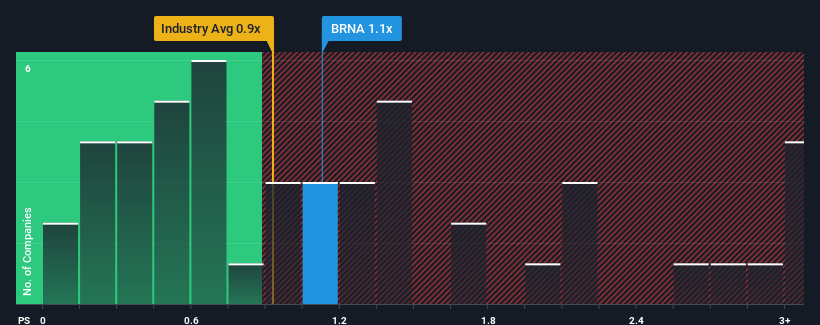

Even after such a large drop in price, it's still not a stretch to say that S.C. Romnav's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Shipping industry in Romania, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 4 warning signs investors should be aware of before investing in S.C. Romnav. Read for free now.Check out our latest analysis for S.C. Romnav

What Does S.C. Romnav's Recent Performance Look Like?

For instance, S.C. Romnav's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for S.C. Romnav, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For S.C. Romnav?

There's an inherent assumption that a company should be matching the industry for P/S ratios like S.C. Romnav's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 56% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 6.0% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's peculiar that S.C. Romnav's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

With its share price dropping off a cliff, the P/S for S.C. Romnav looks to be in line with the rest of the Shipping industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of S.C. Romnav revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for S.C. Romnav (1 is a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on S.C. Romnav, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:BRNA

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.