- Sweden

- /

- Electrical

- /

- OM:SOLT

European Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and slowing inflation, investor attention is increasingly drawn to opportunities in niche areas like penny stocks. While the term "penny stocks" might seem a bit outdated, it still refers to smaller or newer companies that can offer unique growth prospects at lower price points. In this article, we explore three European penny stocks that stand out for their financial resilience and potential for impressive returns amidst evolving market conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.996 | SEK541.22M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.61 | SEK270.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.97 | €62.64M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.79 | €17.91M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.62 | SEK220.24M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.19 | €302.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.922 | €30.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 450 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bittnet Systems (BVB:BNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bittnet Systems SA is a Romanian company specializing in IT training and integration solutions, with a market cap of RON107.49 million.

Operations: Bittnet Systems SA has not reported any specific revenue segments.

Market Cap: RON107.49M

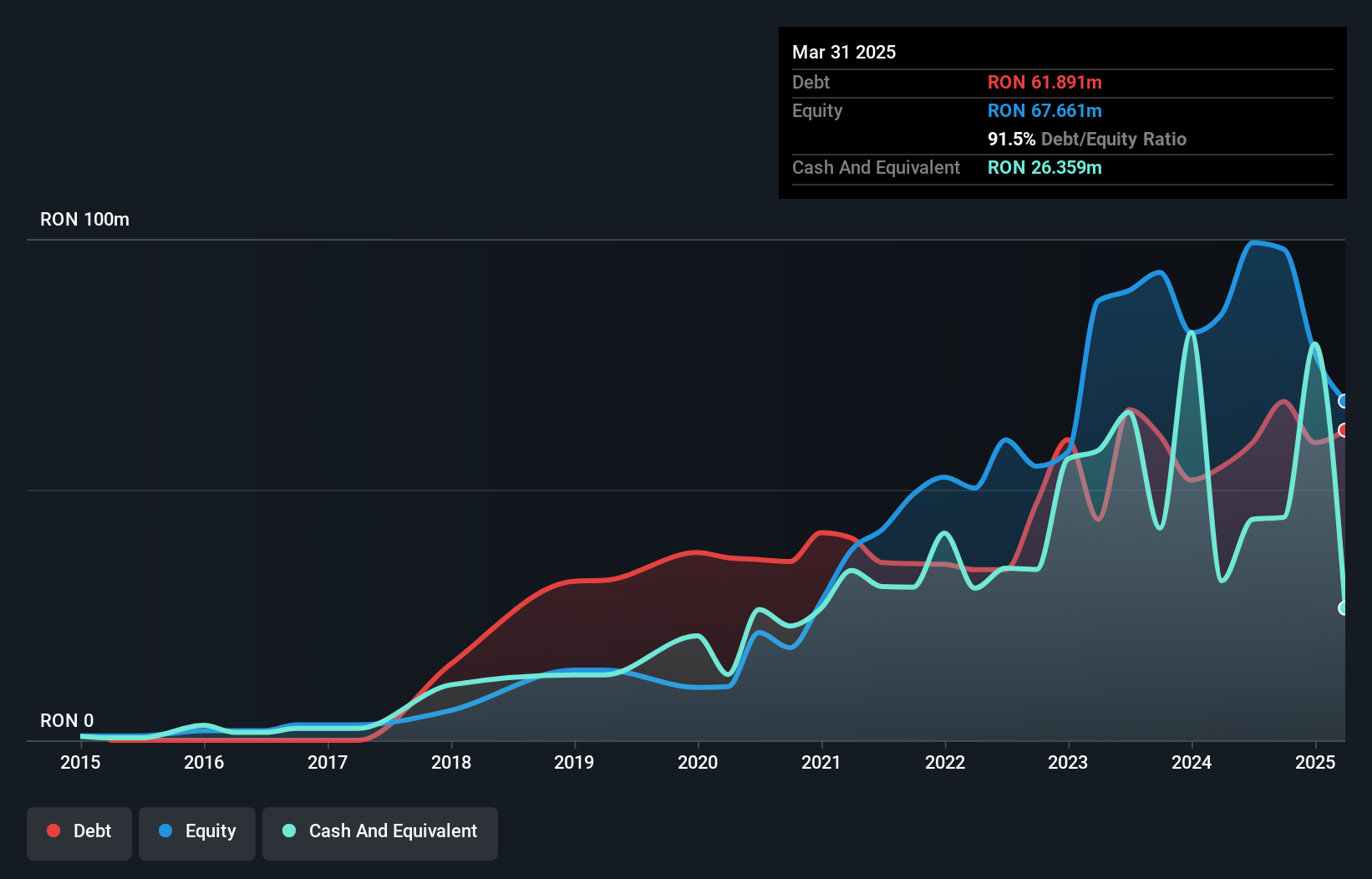

Bittnet Systems SA, with a market cap of RON107.49 million, is experiencing growth in sales, reporting RON46.43 million for Q1 2025 compared to RON41.17 million the previous year. Despite this revenue increase, the company remains unprofitable with a net loss of RON9.44 million for the quarter. Bittnet has a robust cash runway exceeding three years due to positive and growing free cash flow and its short-term assets surpass long-term liabilities significantly. However, it faces challenges such as high debt levels and negative return on equity (-3.24%), which investors should consider carefully.

- Click here and access our complete financial health analysis report to understand the dynamics of Bittnet Systems.

- Explore historical data to track Bittnet Systems' performance over time in our past results report.

SolTech Energy Sweden (OM:SOLT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SolTech Energy Sweden AB (publ) develops, sells, and installs energy and solar cell solutions in Sweden and China, with a market cap of SEK309.53 million.

Operations: SolTech Energy Sweden AB (publ) does not report specific revenue segments.

Market Cap: SEK309.53M

SolTech Energy Sweden AB, with a market cap of SEK309.53 million, reported Q1 2025 sales of SEK446.21 million but remains unprofitable, with a net loss increasing to SEK47.67 million from the previous year. The company has reduced its debt to equity ratio significantly over five years, now at 40.9%, and maintains short-term assets exceeding both short- and long-term liabilities. Recent amendments to its articles of association allow for an increase in share capital limits, potentially facilitating future fundraising efforts despite ongoing volatility and negative return on equity (-42.54%).

- Dive into the specifics of SolTech Energy Sweden here with our thorough balance sheet health report.

- Evaluate SolTech Energy Sweden's historical performance by accessing our past performance report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: q.beyond AG operates in the cloud, applications, artificial intelligence (AI), and security sectors both in Germany and internationally, with a market cap of €108.88 million.

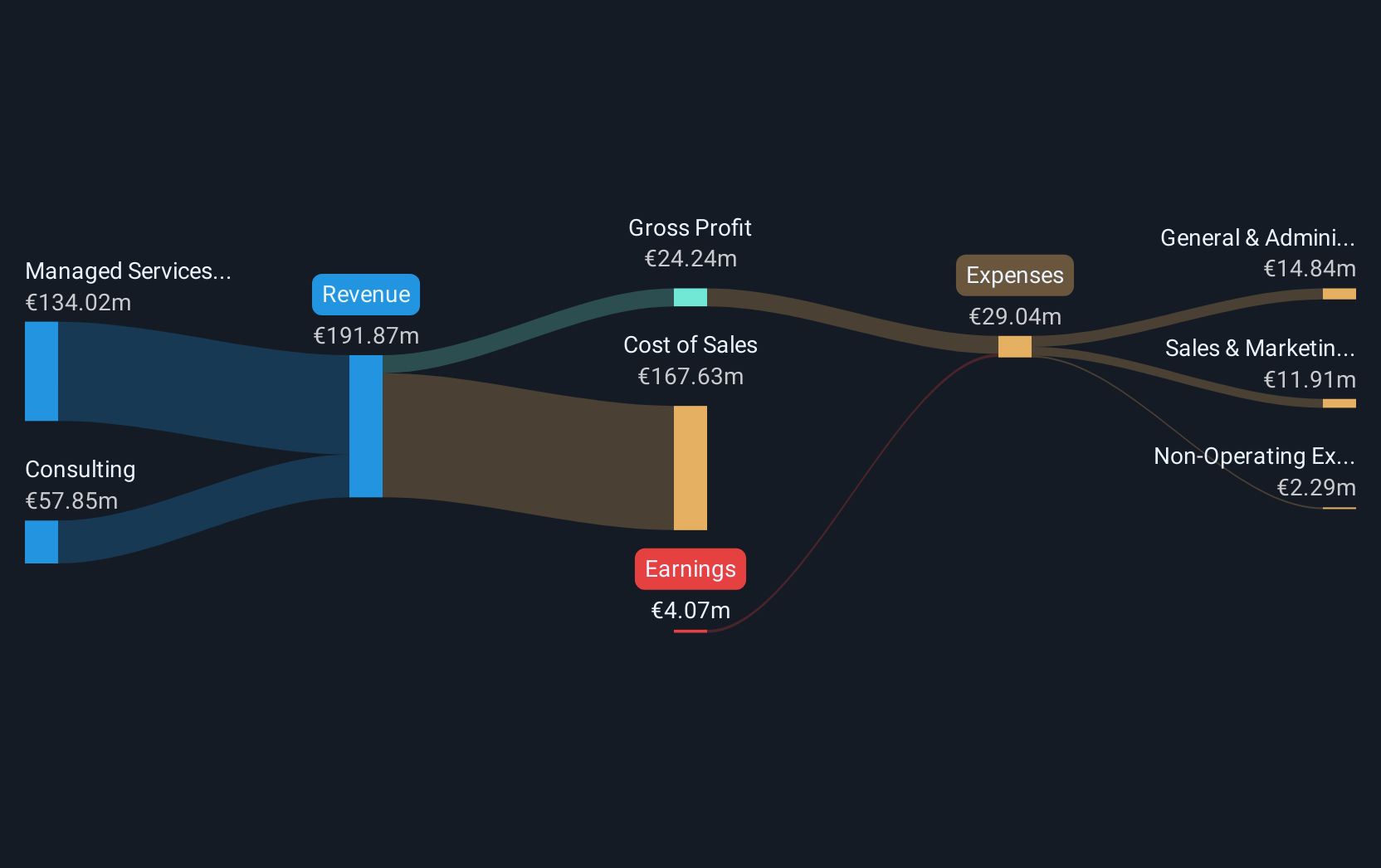

Operations: The company's revenue is derived from two main segments: Consulting, which generated €57.85 million, and Managed Services, contributing €134.02 million.

Market Cap: €108.88M

q.beyond AG, with a market cap of €108.88 million, is unprofitable but has maintained positive free cash flow, ensuring a cash runway for over three years. The company operates without debt and trades at a value below analyst estimates. Recent expansions in its security services include new partnerships and the opening of a second Cyber Defence Center in Riga to enhance protection against cyber threats for its SME clients. Despite reporting a Q1 2025 net loss of €0.495 million, down from €1.37 million the previous year, q.beyond continues to focus on AI-driven security solutions.

- Take a closer look at q.beyond's potential here in our financial health report.

- Examine q.beyond's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Reveal the 450 hidden gems among our European Penny Stocks screener with a single click here.

- Interested In Other Possibilities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SOLT

SolTech Energy Sweden

Develops, sells, and installs energy and solar cell solutions in Sweden and China.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives