The European market has recently seen a positive turn, with the pan-European STOXX Europe 600 Index climbing 1.77% on news of the U.S. federal government reopening, though gains were tempered by cooling sentiment around artificial intelligence. In this context, penny stocks—often smaller or newer companies—remain an intriguing area for investors seeking growth potential at a lower entry cost. While the term might seem outdated, these stocks can still offer significant opportunities when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.628 | €1.26B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.78 | €84.89M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €246.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Altri SGPS (ENXTLS:ALTR) | €4.555 | €934.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Libertas 7 (BME:LIB) | €3.28 | €69.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.34 | SEK203.2M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.30 | €380.05M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €4.01 | €78.44M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.095 | €289.57M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 276 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Inmocemento (BME:IMC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Inmocemento, S.A. operates in the cement and real estate sectors both in Spain and internationally, with a market cap of €1.59 billion.

Operations: The company generates revenue from its cement operations amounting to €651 million and real estate activities totaling €291.10 million.

Market Cap: €1.59B

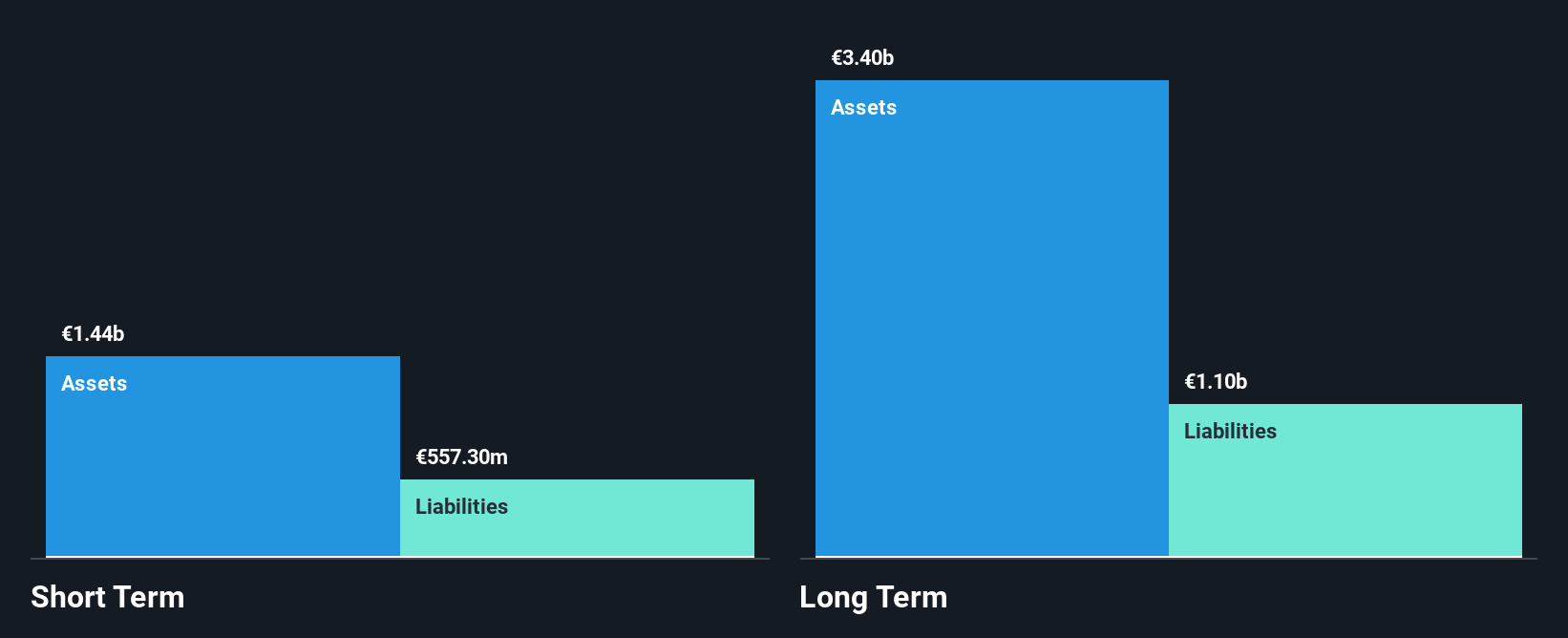

Inmocemento, S.A. demonstrates strong financial health with short-term assets of €1.4 billion exceeding both its short and long-term liabilities, indicating solid liquidity. The company's earnings have shown significant growth, rising 62.6% over the past year and outpacing the industry average, although its Return on Equity remains low at 10.5%. Trading well below estimated fair value suggests potential for price appreciation despite a stable weekly volatility of 3%. However, the board's inexperience could pose governance challenges moving forward. Overall, Inmocemento presents a mix of robust financial metrics and areas requiring caution for investors considering penny stocks in Europe.

- Unlock comprehensive insights into our analysis of Inmocemento stock in this financial health report.

- Understand Inmocemento's track record by examining our performance history report.

S.C. Comcm (BVB:CMCM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.C. Comcm S.A. operates in Romania, focusing on the manufacture and sale of concrete, with a market capitalization of RON74.86 million.

Operations: The company's revenue is primarily derived from space rental income, totaling RON0.32 million.

Market Cap: RON74.86M

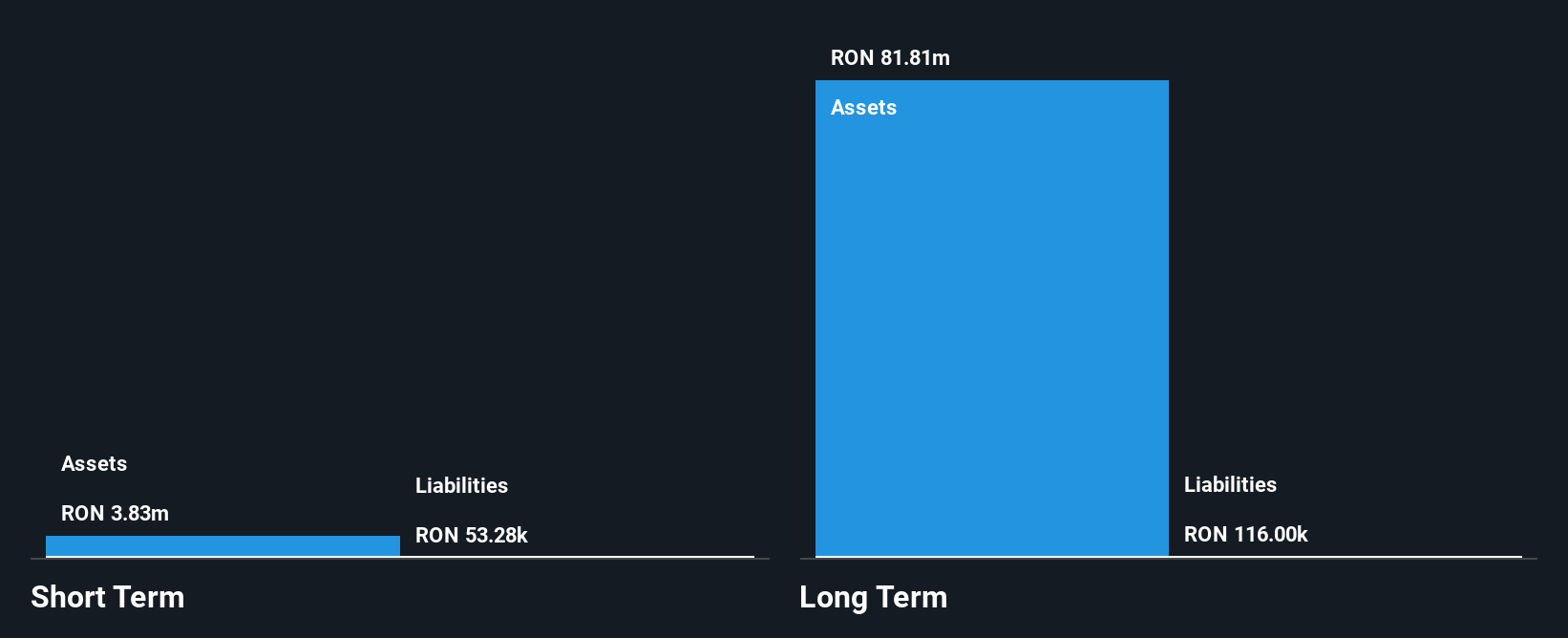

S.C. Comcm S.A., operating in Romania, presents a mixed picture for penny stock investors. The company is pre-revenue with earnings below US$1 million, but it has shown impressive earnings growth of 105.4% over the past year, outpacing the industry average. Despite having no debt and sufficient short-term assets to cover liabilities, its Return on Equity remains low at 5.4%. The price-to-earnings ratio of 16.3x suggests potential undervaluation compared to the industry average of 19.3x. However, high share price volatility and limited management data could pose risks for investors seeking stability in European penny stocks.

- Navigate through the intricacies of S.C. Comcm with our comprehensive balance sheet health report here.

- Gain insights into S.C. Comcm's historical outcomes by reviewing our past performance report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: q.beyond AG operates in the cloud, applications, artificial intelligence (AI), and security sectors both in Germany and internationally, with a market cap of €92.19 million.

Operations: q.beyond AG has not reported specific revenue segments.

Market Cap: €92.19M

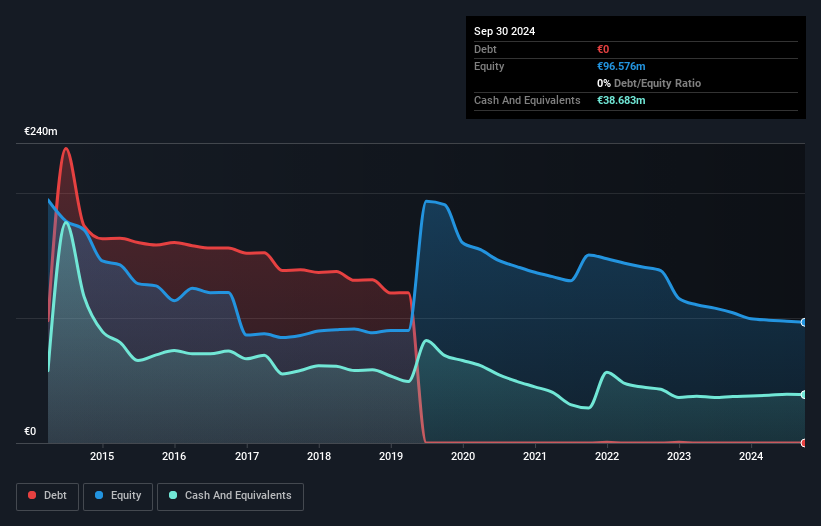

q.beyond AG, with a market cap of €92.19 million, offers an intriguing opportunity in the European penny stock space. Despite being unprofitable, the company has reduced its losses over five years and maintains a strong financial position with no debt and substantial short-term assets exceeding liabilities. Recent earnings reports show improved net income compared to last year, although revenue guidance for 2025 has been lowered due to weak growth in Germany. With positive free cash flow and a sufficient cash runway for over three years, q.beyond is positioned for potential growth amidst industry challenges.

- Click here to discover the nuances of q.beyond with our detailed analytical financial health report.

- Learn about q.beyond's future growth trajectory here.

Key Takeaways

- Reveal the 276 hidden gems among our European Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:QBY

q.beyond

Engages in the cloud, applications, artificial intelligence (AI), and security business in Germany and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives