European Market Highlights: Cairo Communication And 2 Other Top Penny Stocks

Reviewed by Simply Wall St

The European market has shown resilience, with key indices like Italy’s FTSE MIB and Germany’s DAX posting gains as investors navigate interest rate policies and trade concerns. Amidst these broader economic dynamics, the appeal of penny stocks remains significant for those seeking opportunities in smaller or less-established companies. While the term "penny stocks" may seem outdated, these investments can present valuable growth prospects when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.14 | €1.43B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.17 | €17.38M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.27 | €43.43M | ✅ 5 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.59 | DKK116.05M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.86 | €39.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.34 | SEK203.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.04 | €83.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €306.85M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 272 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairo Communication S.p.A. operates as a communication company in Italy and Spain with a market cap of €338.84 million.

Operations: The company's revenue is primarily derived from RCS at €860.3 million, Licensee activities contributing €352.9 million, Editoria periodici Cairo Editore generating €78.2 million, and La7 Television Publishing and Network Operator adding €123.7 million.

Market Cap: €338.84M

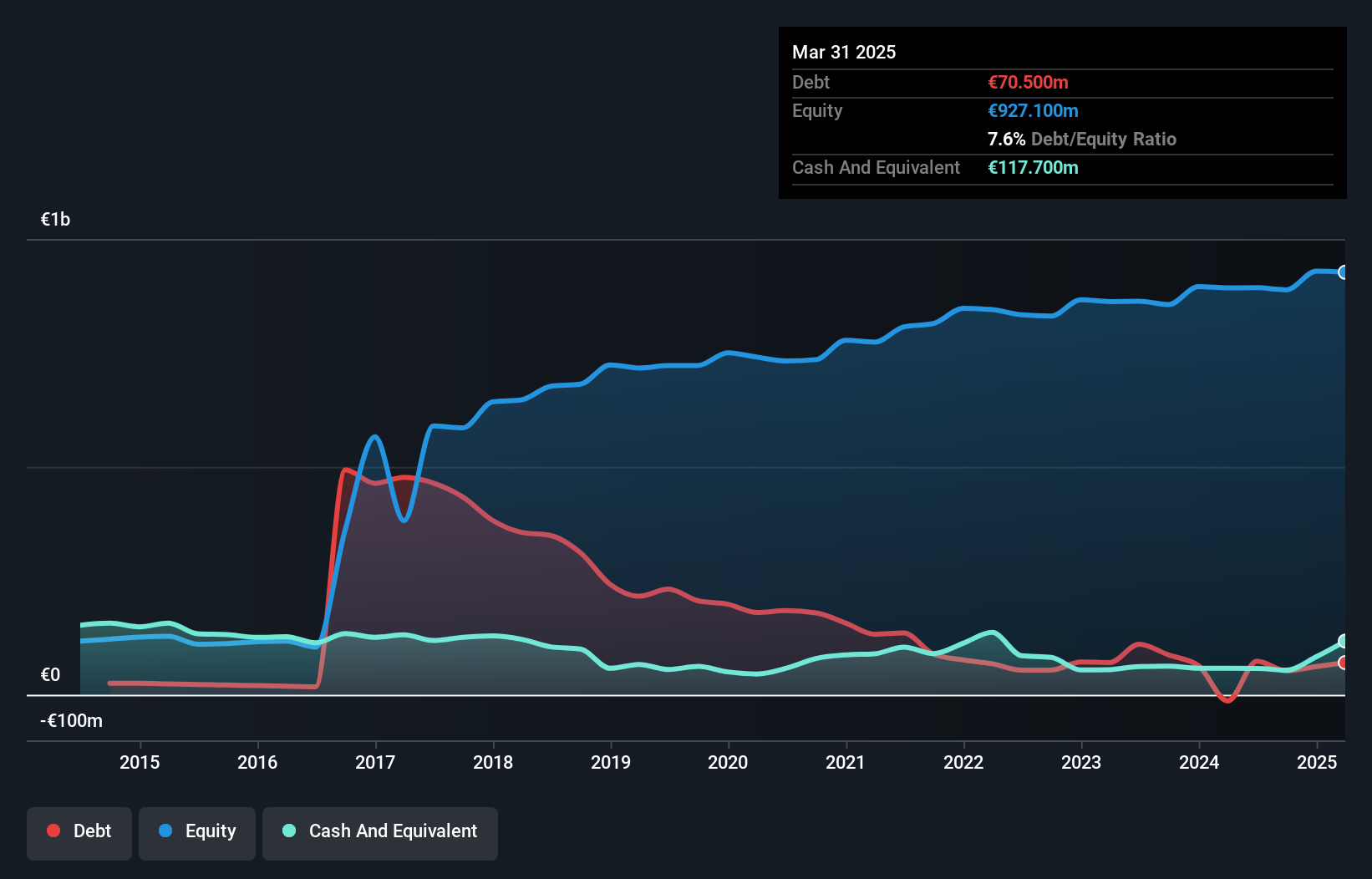

Cairo Communication S.p.A., with a market cap of €338.84 million, has shown stable weekly volatility and trades below its estimated fair value, suggesting it may offer good relative value compared to peers. Despite a slight decline in half-year sales and revenue, the company maintains profitability with net income of €20.4 million for the period ending June 2025. Its debt is well covered by operating cash flow, and it holds more cash than total debt, indicating financial stability. However, short-term liabilities exceed short-term assets slightly. The board's extensive experience adds governance strength to the company's profile in the penny stock landscape.

- Click here to discover the nuances of Cairo Communication with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Cairo Communication's future.

S.C. Bucur Obor (BVB:BUCU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.C. Bucur Obor S.A. operates in Romania, focusing on the rental of commercial spaces, with a market capitalization of RON40.66 million.

Operations: The company generates revenue of RON34.33 million from its retail specialty segment.

Market Cap: RON40.66M

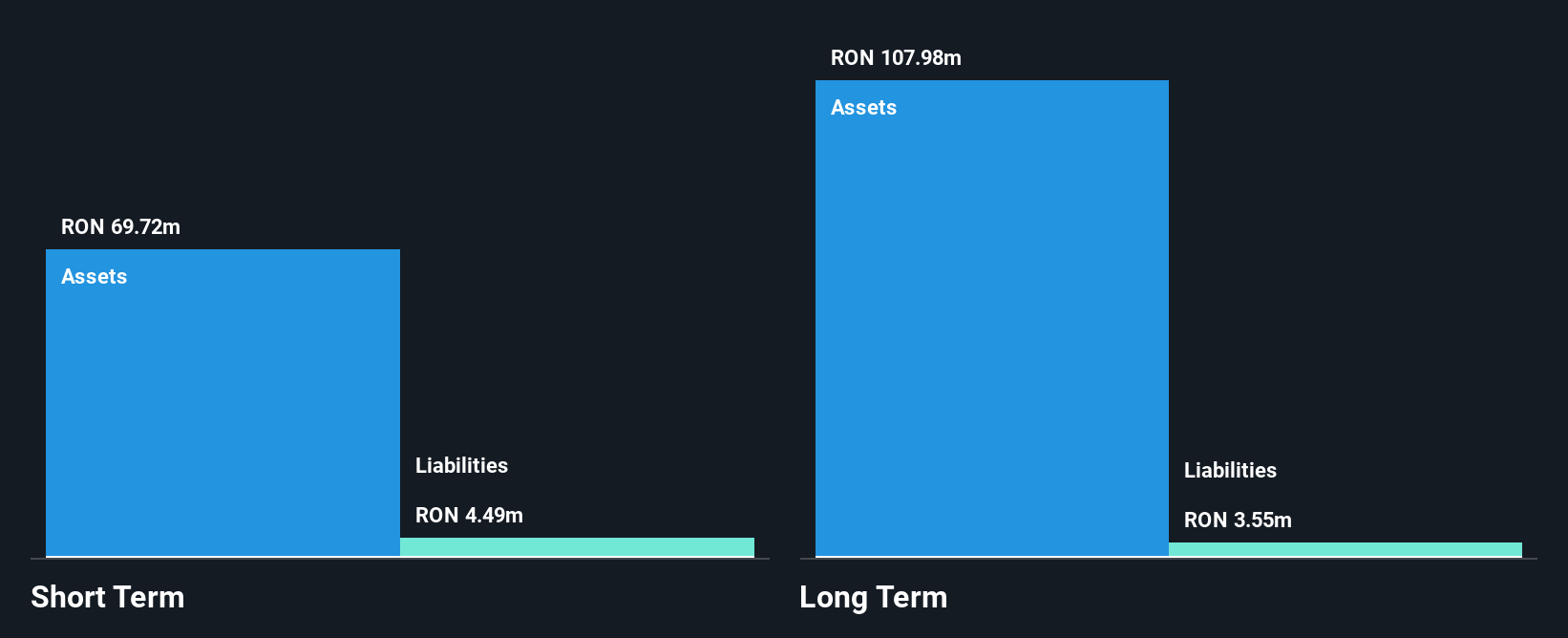

S.C. Bucur Obor S.A., with a market cap of RON40.66 million, operates debt-free and trades significantly below its estimated fair value, suggesting potential undervaluation in the penny stock arena. Despite a decline in revenue to RON16.3 million for the half-year ending June 2025, the company maintains high-quality earnings and sufficient short-term assets (RON69.7M) to cover liabilities (RON8.1M). However, negative earnings growth over the past year and reduced profit margins indicate challenges in profitability trends. The experienced board adds stability, though management tenure data is insufficient to assess leadership strength fully.

- Take a closer look at S.C. Bucur Obor's potential here in our financial health report.

- Gain insights into S.C. Bucur Obor's past trends and performance with our report on the company's historical track record.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC) with operations in Germany, the United States, and internationally, and has a market cap of €148.20 million.

Operations: Heidelberg Pharma's revenue is primarily generated from its ADC Technology and Customer Specific Research segment, amounting to €4.18 million.

Market Cap: €148.2M

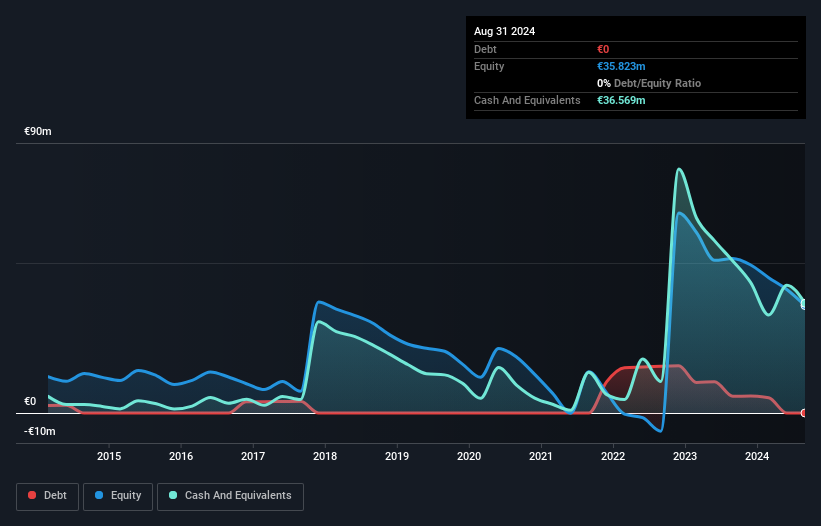

Heidelberg Pharma AG, with a market cap of €148.20 million, is navigating the penny stock landscape with promising yet challenging prospects. The company recently initiated Cohort 9 in its HDP-101 trial for multiple myeloma, showing favorable safety and clinical activity outcomes. Despite this progress, Heidelberg Pharma remains unprofitable and forecasts declining earnings over the next three years. Its revenue of €4 million is not deemed meaningful, reflecting its pre-revenue status typical in biotech sectors. While debt-free and possessing sufficient short-term assets to cover liabilities, the firm plans significant workforce reductions by mid-2026 to manage operational costs effectively.

- Click here and access our complete financial health analysis report to understand the dynamics of Heidelberg Pharma.

- Learn about Heidelberg Pharma's future growth trajectory here.

Turning Ideas Into Actions

- Gain an insight into the universe of 272 European Penny Stocks by clicking here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HPHA

Heidelberg Pharma

A biopharmaceutical company, focuses on oncology and antibody targeted amanitin conjugates (ATAC) in Germany, the United States, and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success