- Romania

- /

- Basic Materials

- /

- BVB:PREB

Investors Shouldn't Be Too Comfortable With S.C. Prebet Aiud's (BVB:PREB) Robust Earnings

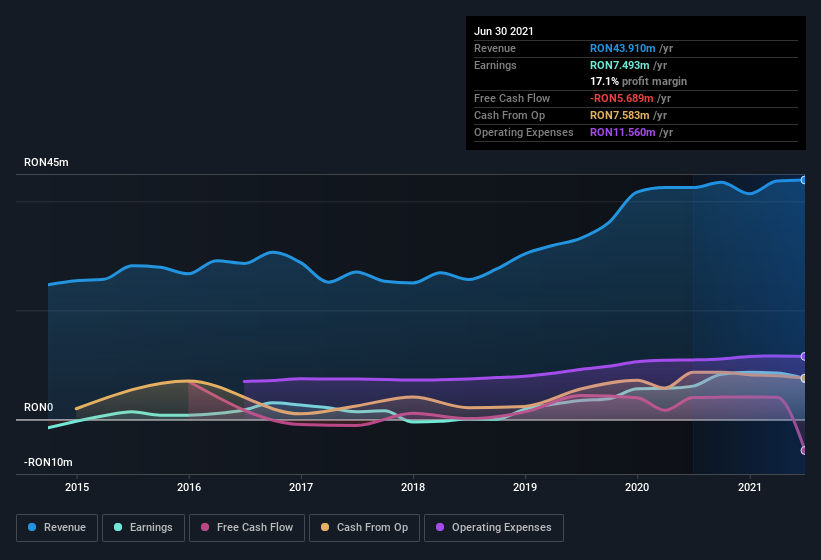

Despite posting some strong earnings, the market for S.C. Prebet Aiud S.A.'s (BVB:PREB) stock hasn't moved much. We did some digging, and we found some concerning factors in the details.

View our latest analysis for S.C. Prebet Aiud

Zooming In On S.C. Prebet Aiud's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to June 2021, S.C. Prebet Aiud recorded an accrual ratio of 0.37. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of RON5.7m despite its profit of RON7.49m, mentioned above. It's worth noting that S.C. Prebet Aiud generated positive FCF of RON4.0m a year ago, so at least they've done it in the past.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of S.C. Prebet Aiud.

Our Take On S.C. Prebet Aiud's Profit Performance

As we discussed above, we think S.C. Prebet Aiud's earnings were not supported by free cash flow, which might concern some investors. For this reason, we think that S.C. Prebet Aiud's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But at least holders can take some solace from the 53% EPS growth in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Every company has risks, and we've spotted 3 warning signs for S.C. Prebet Aiud (of which 1 is a bit concerning!) you should know about.

This note has only looked at a single factor that sheds light on the nature of S.C. Prebet Aiud's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:PREB

S.C. Prebet Aiud

Produces and sells prestressed ferro-concrete and concrete prefabs for construction works.

Slight risk with acceptable track record.

Market Insights

Community Narratives