- Romania

- /

- Energy Services

- /

- BVB:PRSN

Not Many Are Piling Into S.C.Prospectiuni S.A. (BVB:PRSN) Stock Yet As It Plummets 26%

Unfortunately for some shareholders, the S.C.Prospectiuni S.A. (BVB:PRSN) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

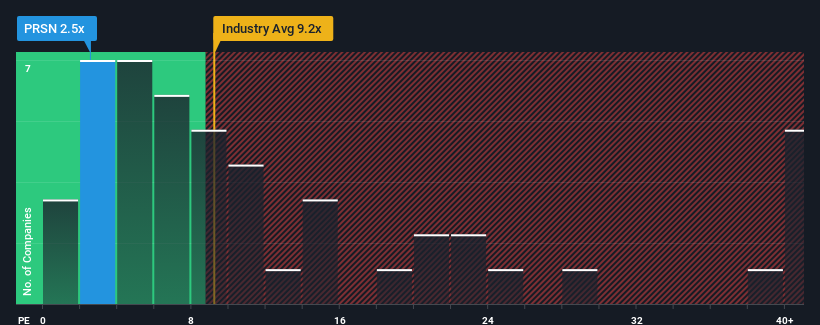

Following the heavy fall in price, S.C.Prospectiuni may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 2.5x, since almost half of all companies in Romania have P/E ratios greater than 14x and even P/E's higher than 36x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for S.C.Prospectiuni as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for S.C.Prospectiuni

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like S.C.Prospectiuni's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 181% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to shrink 7.0% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's quite peculiar that S.C.Prospectiuni's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Having almost fallen off a cliff, S.C.Prospectiuni's share price has pulled its P/E way down as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that S.C.Prospectiuni currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for S.C.Prospectiuni you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:PRSN

S.C.Prospectiuni

Provides geological and geophysical services for oil and gas industries in Romania and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives