- Romania

- /

- Energy Services

- /

- BVB:ARAX

Take Care Before Diving Into The Deep End On Armax Gaz SA (BVB:ARAX)

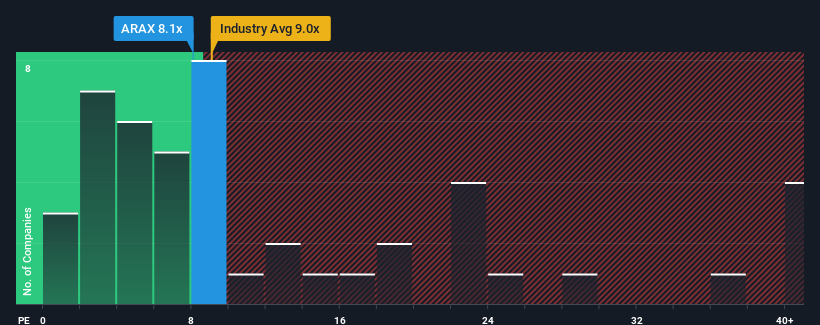

When close to half the companies in Romania have price-to-earnings ratios (or "P/E's") above 13x, you may consider Armax Gaz SA (BVB:ARAX) as an attractive investment with its 8.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Armax Gaz's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Armax Gaz

Does Growth Match The Low P/E?

Armax Gaz's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 55%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

In contrast to the company, the rest of the market is expected to decline by 6.2% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that Armax Gaz is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Armax Gaz's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Armax Gaz currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. We think potential risks might be placing significant pressure on the P/E ratio and share price. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Armax Gaz you should be aware of, and 2 of them shouldn't be ignored.

Of course, you might also be able to find a better stock than Armax Gaz. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:ARAX

Armax Gaz

Manufactures and sells equipment and devices for the gas and oil industry in Romania.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives