- Romania

- /

- Food and Staples Retail

- /

- BVB:OMAL

Comaliment SA (Resita)'s (BVB:OMAL) Stock Retreats 29% But Earnings Haven't Escaped The Attention Of Investors

To the annoyance of some shareholders, Comaliment SA (Resita) (BVB:OMAL) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

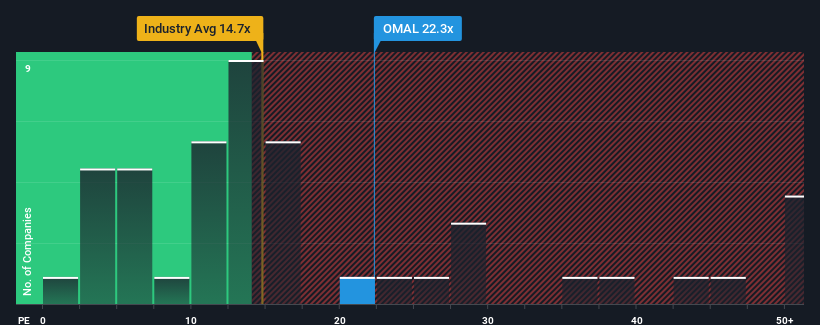

Although its price has dipped substantially, given around half the companies in Romania have price-to-earnings ratios (or "P/E's") below 17x, you may still consider Comaliment SA (Resita) as a stock to potentially avoid with its 22.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Comaliment SA (Resita)'s financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Comaliment SA (Resita)

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Comaliment SA (Resita)'s is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.8%. Even so, admirably EPS has lifted 1,537% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to shrink 11% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's understandable that Comaliment SA (Resita)'s P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On Comaliment SA (Resita)'s P/E

There's still some solid strength behind Comaliment SA (Resita)'s P/E, if not its share price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Comaliment SA (Resita) revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

Plus, you should also learn about these 3 warning signs we've spotted with Comaliment SA (Resita).

If you're unsure about the strength of Comaliment SA (Resita)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:OMAL

Flawless balance sheet with solid track record.

Market Insights

Community Narratives