- Romania

- /

- Food and Staples Retail

- /

- BVB:OMAL

Comaliment SA (Resita) (BVB:OMAL) May Have Run Too Fast Too Soon With Recent 31% Price Plummet

Comaliment SA (Resita) (BVB:OMAL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 40% in that time.

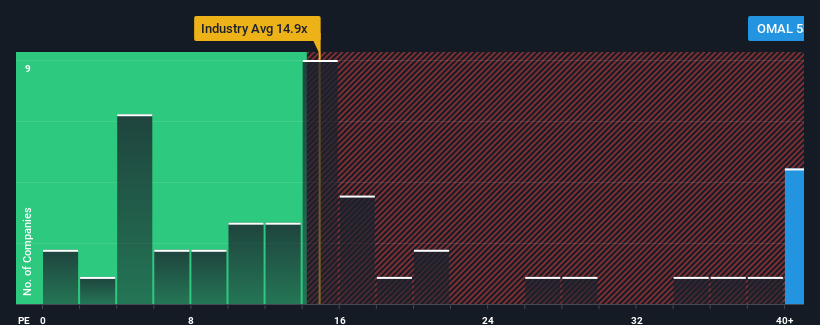

Even after such a large drop in price, Comaliment SA (Resita) may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 53.1x, since almost half of all companies in Romania have P/E ratios under 13x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Comaliment SA (Resita)'s receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Comaliment SA (Resita)

Is There Enough Growth For Comaliment SA (Resita)?

The only time you'd be truly comfortable seeing a P/E as steep as Comaliment SA (Resita)'s is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 48%. The last three years don't look nice either as the company has shrunk EPS by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to decline by 7.0% over the next year, or less than the company's recent medium-term annualised earnings decline.

With this information, it's strange that Comaliment SA (Resita) is trading at a higher P/E in comparison. In general, when earnings shrink rapidly the P/E premium often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Even after such a strong price drop, Comaliment SA (Resita)'s P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Comaliment SA (Resita) revealed its sharp three-year contraction in earnings isn't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to shrink less severely. When we see below average earnings, we suspect the share price is at risk of declining, sending the high P/E lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader market turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Comaliment SA (Resita) that you should be aware of.

You might be able to find a better investment than Comaliment SA (Resita). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:OMAL

Flawless balance sheet with solid track record.

Market Insights

Community Narratives