- Romania

- /

- Food and Staples Retail

- /

- BVB:BUCV

Market Might Still Lack Some Conviction On S.C. Bucur S.A. (BVB:BUCV) Even After 26% Share Price Boost

S.C. Bucur S.A. (BVB:BUCV) shareholders have had their patience rewarded with a 26% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

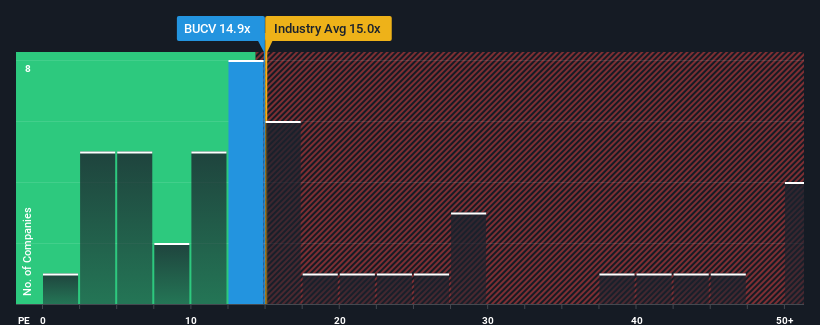

Although its price has surged higher, you could still be forgiven for feeling indifferent about S.C. Bucur's P/E ratio of 14.9x, since the median price-to-earnings (or "P/E") ratio in Romania is also close to 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

S.C. Bucur certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for S.C. Bucur

How Is S.C. Bucur's Growth Trending?

In order to justify its P/E ratio, S.C. Bucur would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 224% last year. Pleasingly, EPS has also lifted 364% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to shrink 10% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

With this information, we find it odd that S.C. Bucur is trading at a fairly similar P/E to the market. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader market.

What We Can Learn From S.C. Bucur's P/E?

S.C. Bucur's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of S.C. Bucur revealed its growing earnings over the medium-term aren't contributing to its P/E as much as we would have predicted, given the market is set to shrink. When we see its superior earnings with some actual growth, we assume potential risks are what might be placing pressure on the P/E ratio. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. It appears some are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for S.C. Bucur (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on S.C. Bucur, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:BUCV

S.C. Bucur

Engages in the wholesale and retail of food and non-food products in Europe.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026