Market Participants Recognise Stofe Buhusi S.A.'s (BVB:STOF) Earnings Pushing Shares 28% Higher

Stofe Buhusi S.A. (BVB:STOF) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

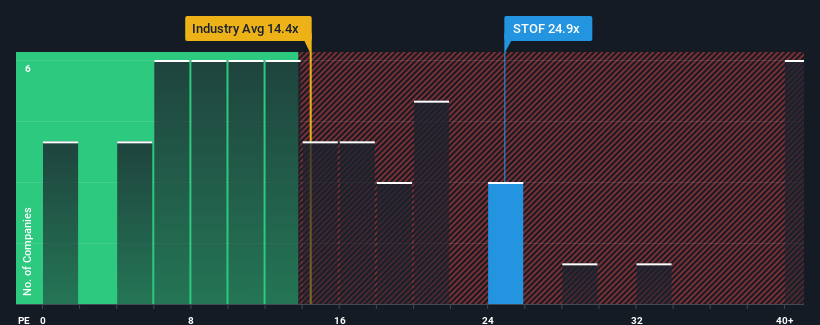

Following the firm bounce in price, Stofe Buhusi's price-to-earnings (or "P/E") ratio of 24.9x might make it look like a strong sell right now compared to the market in Romania, where around half of the companies have P/E ratios below 14x and even P/E's below 8x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Stofe Buhusi's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Stofe Buhusi

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Stofe Buhusi's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to shrink 3.8% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

With this information, we can see why Stofe Buhusi is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What We Can Learn From Stofe Buhusi's P/E?

The strong share price surge has got Stofe Buhusi's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Stofe Buhusi maintains its high P/E on the strength of its recentthree-year growth beating forecasts for a struggling market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Stofe Buhusi (2 are a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Stofe Buhusi, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:STOF

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026