- Romania

- /

- Consumer Durables

- /

- BVB:ANTE

Earnings Not Telling The Story For Anteco S.A. (BVB:ANTE) After Shares Rise 30%

Anteco S.A. (BVB:ANTE) shares have had a really impressive month, gaining 30% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

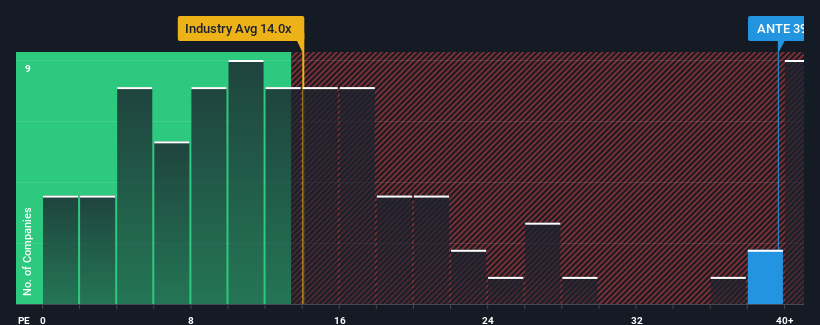

Following the firm bounce in price, Anteco may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 39.6x, since almost half of all companies in Romania have P/E ratios under 16x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, Anteco has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Anteco

How Is Anteco's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Anteco's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 186% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 45% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to decline by 11% over the next year, or less than the company's recent medium-term annualised earnings decline.

In light of this, it's odd that Anteco's P/E sits above the majority of other companies. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Maintaining these prices will be extremely difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Key Takeaway

Shares in Anteco have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Anteco revealed its sharp three-year contraction in earnings isn't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to shrink less severely. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is unlikely to support such positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader market turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Anteco, and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Anteco. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:ANTE

Anteco

Manufactures and markets various furniture in Romania and internationally.

Slight with imperfect balance sheet.

Market Insights

Community Narratives