- Romania

- /

- Construction

- /

- BVB:CHIA

S.C. Constructii Hidrotehnice S.A.'s (BVB:CHIA) Share Price Matching Investor Opinion

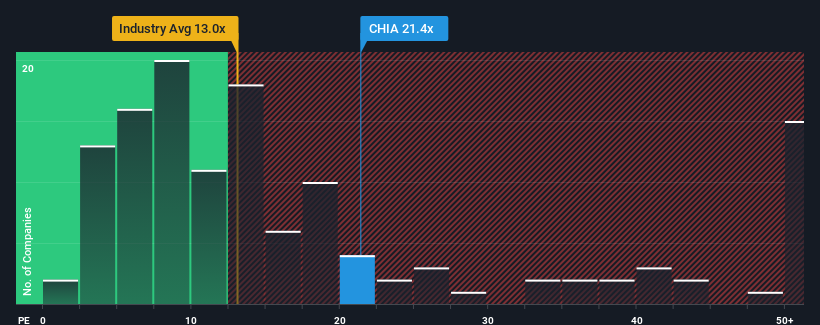

S.C. Constructii Hidrotehnice S.A.'s (BVB:CHIA) price-to-earnings (or "P/E") ratio of 21.4x might make it look like a sell right now compared to the market in Romania, where around half of the companies have P/E ratios below 14x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been quite advantageous for S.C. Constructii Hidrotehnice as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for S.C. Constructii Hidrotehnice

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like S.C. Constructii Hidrotehnice's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 104%. The strong recent performance means it was also able to grow EPS by 719% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to shrink 3.8% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's understandable that S.C. Constructii Hidrotehnice's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

What We Can Learn From S.C. Constructii Hidrotehnice's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of S.C. Constructii Hidrotehnice revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with S.C. Constructii Hidrotehnice (including 2 which are a bit concerning).

Of course, you might also be able to find a better stock than S.C. Constructii Hidrotehnice. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:CHIA

S.C. Constructii Hidrotehnice

Operates in construction sector primarily in Romania.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success