- Romania

- /

- Construction

- /

- BVB:CHIA

After Leaping 46% S.C. Constructii Hidrotehnice S.A. (BVB:CHIA) Shares Are Not Flying Under The Radar

S.C. Constructii Hidrotehnice S.A. (BVB:CHIA) shareholders would be excited to see that the share price has had a great month, posting a 46% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

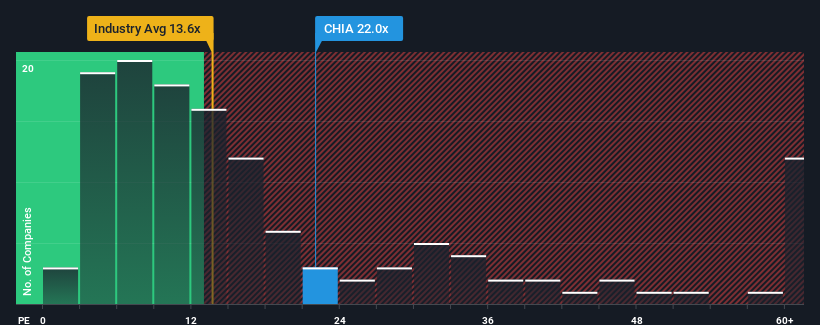

After such a large jump in price, S.C. Constructii Hidrotehnice may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 22x, since almost half of all companies in Romania have P/E ratios under 13x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, S.C. Constructii Hidrotehnice has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for S.C. Constructii Hidrotehnice

Is There Enough Growth For S.C. Constructii Hidrotehnice?

The only time you'd be truly comfortable seeing a P/E as steep as S.C. Constructii Hidrotehnice's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 104% last year. Pleasingly, EPS has also lifted 719% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to shrink 6.4% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's understandable that S.C. Constructii Hidrotehnice's P/E sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On S.C. Constructii Hidrotehnice's P/E

Shares in S.C. Constructii Hidrotehnice have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of S.C. Constructii Hidrotehnice revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with S.C. Constructii Hidrotehnice (at least 2 which are a bit unpleasant), and understanding these should be part of your investment process.

If you're unsure about the strength of S.C. Constructii Hidrotehnice's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:CHIA

S.C. Constructii Hidrotehnice

Operates in construction sector primarily in Romania.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026