Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, S.C. Aages S.A. (BVB:AAG) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for S.C. Aages

How Much Debt Does S.C. Aages Carry?

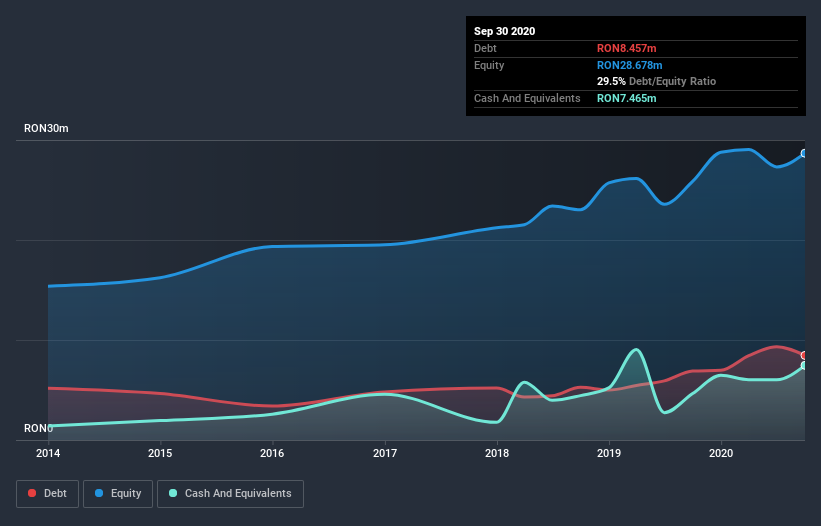

As you can see below, at the end of September 2020, S.C. Aages had RON8.45m of debt, up from RON6.89m a year ago. Click the image for more detail. On the flip side, it has RON7.47m in cash leading to net debt of about RON982.6k.

How Strong Is S.C. Aages's Balance Sheet?

We can see from the most recent balance sheet that S.C. Aages had liabilities of RON13.9m falling due within a year, and liabilities of RON1.80m due beyond that. Offsetting these obligations, it had cash of RON7.47m as well as receivables valued at RON5.56m due within 12 months. So its liabilities total RON2.67m more than the combination of its cash and short-term receivables.

Given S.C. Aages has a market capitalization of RON28.4m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

S.C. Aages has a low net debt to EBITDA ratio of only 0.14. And its EBIT covers its interest expense a whopping 20.1 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. While S.C. Aages doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since S.C. Aages will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, S.C. Aages generated free cash flow amounting to a very robust 80% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that S.C. Aages's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Looking at the bigger picture, we think S.C. Aages's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for S.C. Aages (of which 1 is significant!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade S.C. Aages, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BVB:AAG

SC Aages

Designs, manufactures, and sells induction heating machines in Europe, Asia, South America, the United States, and Russia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives