Investors Still Aren't Entirely Convinced By SC Aages SA's (BVB:AAG) Earnings Despite 29% Price Jump

Despite an already strong run, SC Aages SA (BVB:AAG) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 52%.

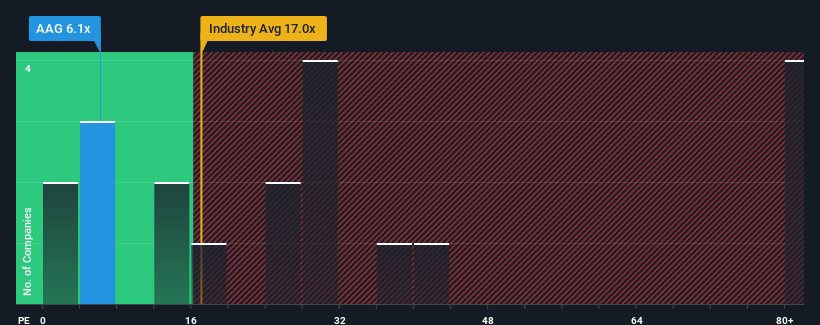

In spite of the firm bounce in price, given about half the companies in Romania have price-to-earnings ratios (or "P/E's") above 17x, you may still consider SC Aages as a highly attractive investment with its 6.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for SC Aages as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for SC Aages

How Is SC Aages' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as SC Aages' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 40%. The latest three year period has also seen an excellent 142% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to shrink 10% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

With this information, we find it very odd that SC Aages is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On SC Aages' P/E

Even after such a strong price move, SC Aages' P/E still trails the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of SC Aages revealed its growing earnings over the medium-term aren't contributing to its P/E anywhere near as much as we would have predicted, given the market is set to shrink. We think potential risks might be placing significant pressure on the P/E ratio and share price. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

Having said that, be aware SC Aages is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on SC Aages, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:AAG

SC Aages

Designs, manufactures, and sells induction heating machines in Europe, Asia, South America, the United States, and Russia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives