- Qatar

- /

- Telecom Services and Carriers

- /

- DSM:ORDS

Ooredoo Q.P.S.C. (DSM:ORDS) Stock Goes Ex-Dividend In Just Three Days

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Ooredoo Q.P.S.C. (DSM:ORDS) is about to trade ex-dividend in the next 3 days. Investors can purchase shares before the 4th of March in order to be eligible for this dividend, which will be paid on the 1st of January.

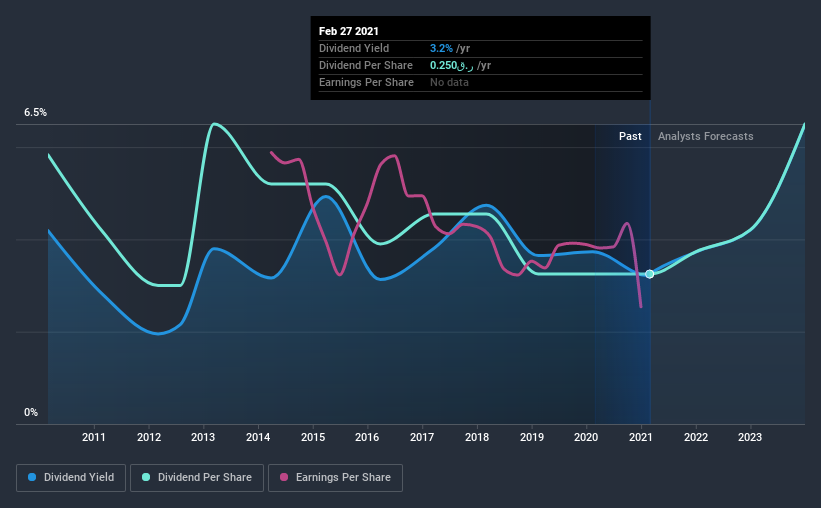

Ooredoo Q.P.S.C's next dividend payment will be ر.ق0.25 per share, and in the last 12 months, the company paid a total of ر.ق0.25 per share. Based on the last year's worth of payments, Ooredoo Q.P.S.C stock has a trailing yield of around 3.2% on the current share price of QAR7.7. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Ooredoo Q.P.S.C

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Ooredoo Q.P.S.C is paying out an acceptable 71% of its profit, a common payout level among most companies. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 16% of its cash flow last year.

It's positive to see that Ooredoo Q.P.S.C's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by Ooredoo Q.P.S.C's 12% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Ooredoo Q.P.S.C's dividend payments per share have declined at 5.7% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

Has Ooredoo Q.P.S.C got what it takes to maintain its dividend payments? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

If you want to look further into Ooredoo Q.P.S.C, it's worth knowing the risks this business faces. We've identified 4 warning signs with Ooredoo Q.P.S.C (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Ooredoo Q.P.S.C or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:ORDS

Ooredoo Q.P.S.C

Provides telecommunications services in Qatar, rest of the Middle East, Asia, and North Africa region.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives