- Qatar

- /

- Real Estate

- /

- DSM:MRDS

Mazaya Real Estate Development Q.P.S.C's (DSM:MRDS) Anemic Earnings Might Be Worse Than You Think

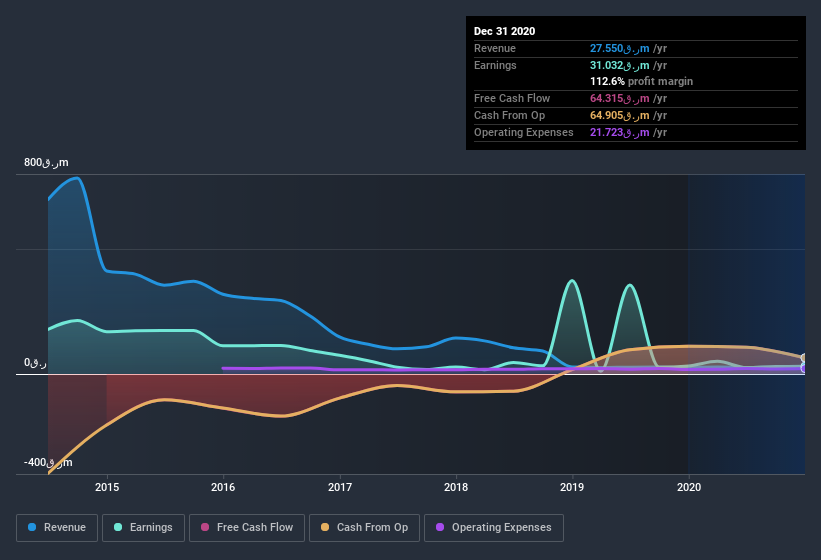

Mazaya Real Estate Development Q.P.S.C.'s (DSM:MRDS) recent weak earnings report didn't cause a big stock movement. However, we believe that investors should be aware of some underlying factors which may be of concern.

View our latest analysis for Mazaya Real Estate Development Q.P.S.C

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Mazaya Real Estate Development Q.P.S.C's profit received a boost of ر.ق1.5m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Mazaya Real Estate Development Q.P.S.C.

Our Take On Mazaya Real Estate Development Q.P.S.C's Profit Performance

Arguably, Mazaya Real Estate Development Q.P.S.C's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Mazaya Real Estate Development Q.P.S.C's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 12% per annum growth in EPS for the last three. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, we've found that Mazaya Real Estate Development Q.P.S.C has 3 warning signs (2 don't sit too well with us!) that deserve your attention before going any further with your analysis.

Today we've zoomed in on a single data point to better understand the nature of Mazaya Real Estate Development Q.P.S.C's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Mazaya Real Estate Development Q.P.S.C, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:MRDS

Mazaya Real Estate Development Q.P.S.C

Mazaya Real Estate Development Q.P.S.C. buys, builds, operates, and sells residential and commercial real estate projects.

Acceptable track record with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026