- Qatar

- /

- Basic Materials

- /

- DSM:QNCD

Why It Might Not Make Sense To Buy Qatar National Cement Company (Q.P.S.C.) (DSM:QNCD) For Its Upcoming Dividend

Readers hoping to buy Qatar National Cement Company (Q.P.S.C.) (DSM:QNCD) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Investors can purchase shares before the 24th of February in order to be eligible for this dividend, which will be paid on the 1st of January.

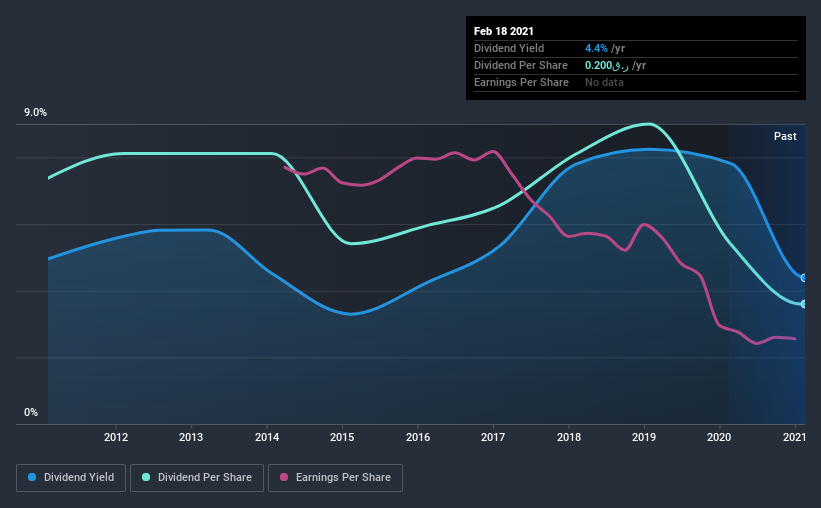

Qatar National Cement Company (Q.P.S.C.)'s next dividend payment will be ر.ق0.20 per share. Last year, in total, the company distributed ر.ق0.20 to shareholders. Calculating the last year's worth of payments shows that Qatar National Cement Company (Q.P.S.C.) has a trailing yield of 4.4% on the current share price of QAR4.56. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Qatar National Cement Company (Q.P.S.C.)

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. It paid out 88% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year it paid out 60% of its free cash flow as dividends, within the usual range for most companies.

It's positive to see that Qatar National Cement Company (Q.P.S.C.)'s dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by Qatar National Cement Company (Q.P.S.C.)'s 20% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Qatar National Cement Company (Q.P.S.C.)'s dividend payments per share have declined at 6.9% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

To Sum It Up

From a dividend perspective, should investors buy or avoid Qatar National Cement Company (Q.P.S.C.)? While earnings per share are shrinking, it's encouraging to see that at least Qatar National Cement Company (Q.P.S.C.)'s dividend appears sustainable, with earnings and cashflow payout ratios that are within reasonable bounds. It's not that we think Qatar National Cement Company (Q.P.S.C.) is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

So if you're still interested in Qatar National Cement Company (Q.P.S.C.) despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Every company has risks, and we've spotted 2 warning signs for Qatar National Cement Company (Q.P.S.C.) (of which 1 makes us a bit uncomfortable!) you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Qatar National Cement Company (Q.P.S.C.), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qatar National Cement Company (Q.P.S.C.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:QNCD

Qatar National Cement Company (Q.P.S.C.)

Manufactures and sells cement, lime, washed sand, and other related products in Qatar.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026