- Qatar

- /

- Medical Equipment

- /

- DSM:QGMD

Shareholders Are Raving About How The Qatari German Company for Medical Devices Q.P.S.C (DSM:QGMD) Share Price Increased 329%

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you find (and hold) a big winner, you can markedly improve your finances. For example, Qatari German Company for Medical Devices Q.P.S.C. (DSM:QGMD) has generated a beautiful 329% return in just a single year. The last week saw the share price soften some 2.3%. It is also impressive that the stock is up 242% over three years, adding to the sense that it is a real winner.

Check out our latest analysis for Qatari German Company for Medical Devices Q.P.S.C

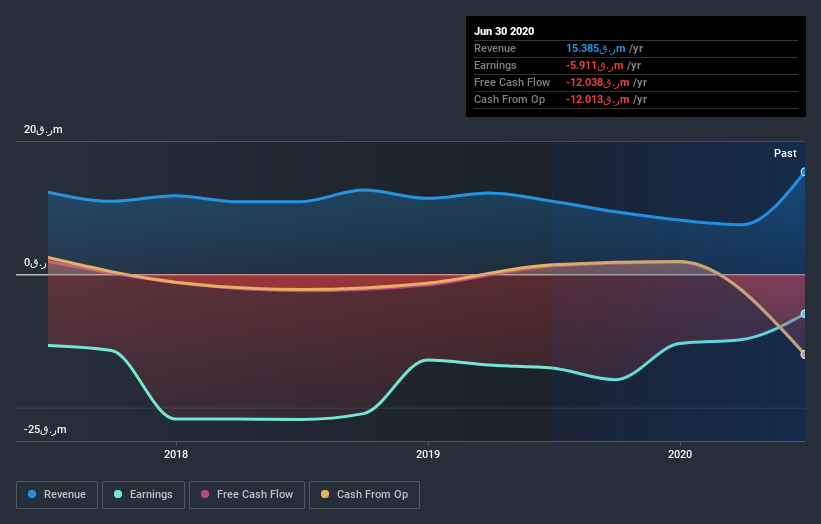

Given that Qatari German Company for Medical Devices Q.P.S.C didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Qatari German Company for Medical Devices Q.P.S.C's revenue grew by 41%. We respect that sort of growth, no doubt. But the market is even more excited about it, with the price apparently bound for the moon, up 329% in one of earth's orbits. We're always cautious when the share price is up so much, but there's certainly enough revenue growth to justify taking a closer look at Qatari German Company for Medical Devices Q.P.S.C.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Qatari German Company for Medical Devices Q.P.S.C shareholders have received a total shareholder return of 329% over one year. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Qatari German Company for Medical Devices Q.P.S.C better, we need to consider many other factors. Take risks, for example - Qatari German Company for Medical Devices Q.P.S.C has 5 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on QA exchanges.

If you decide to trade Qatari German Company for Medical Devices Q.P.S.C, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qatari German Company for Medical Devices (Q.P.S.C.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:QGMD

Qatari German Company for Medical Devices (Q.P.S.C.)

Manufactures and sells single use disposable syringes in Qatar and internationally.

Moderate risk with weak fundamentals.

Market Insights

Community Narratives