- Qatar

- /

- Oil and Gas

- /

- DSM:QFLS

Should You Use Qatar Fuel Company Q.P.S.C.(WOQOD)'s (DSM:QFLS) Statutory Earnings To Analyse It?

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Qatar Fuel Company Q.P.S.C.(WOQOD)'s (DSM:QFLS) statutory profits are a good guide to its underlying earnings.

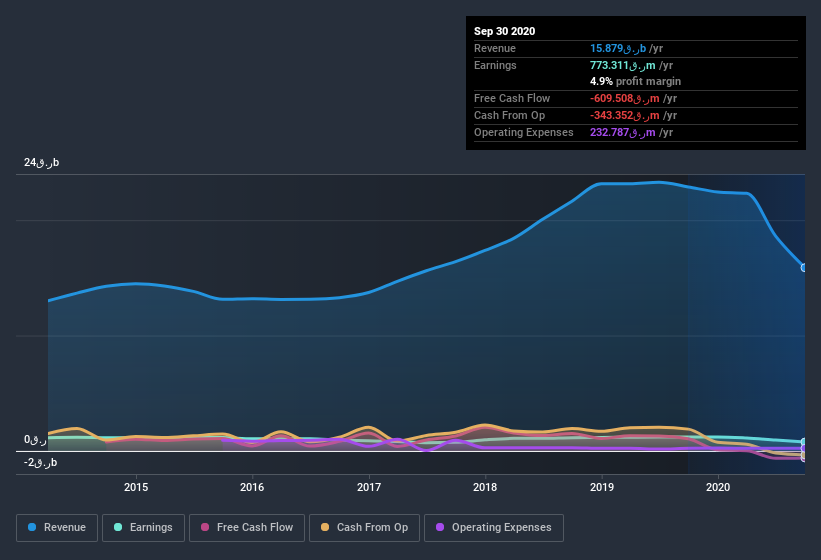

We like the fact that Qatar Fuel Company Q.P.S.C.(WOQOD) made a profit of ر.ق773.3m on its revenue of ر.ق15.9b, in the last year. Even though its revenue is down over the last three years, its profit has actually increased, as you can see, below.

Check out our latest analysis for Qatar Fuel Company Q.P.S.C.(WOQOD)

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Today, we'll discuss Qatar Fuel Company Q.P.S.C.(WOQOD)'s free cashflow relative to its earnings, and consider what that tells us about the company. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Qatar Fuel Company Q.P.S.C.(WOQOD)'s Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to September 2020, Qatar Fuel Company Q.P.S.C.(WOQOD) recorded an accrual ratio of 0.27. Unfortunately, that means its free cash flow fell significantly short of its reported profits. In the last twelve months it actually had negative free cash flow, with an outflow of ر.ق610m despite its profit of ر.ق773.3m, mentioned above. We saw that FCF was ر.ق1.0b a year ago though, so Qatar Fuel Company Q.P.S.C.(WOQOD) has at least been able to generate positive FCF in the past.

Our Take On Qatar Fuel Company Q.P.S.C.(WOQOD)'s Profit Performance

Qatar Fuel Company Q.P.S.C.(WOQOD)'s accrual ratio for the last twelve months signifies cash conversion is less than ideal, which is a negative when it comes to our view of its earnings. Because of this, we think that it may be that Qatar Fuel Company Q.P.S.C.(WOQOD)'s statutory profits are better than its underlying earnings power. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. To that end, you should learn about the 2 warning signs we've spotted with Qatar Fuel Company Q.P.S.C.(WOQOD) (including 1 which is a bit concerning).

Today we've zoomed in on a single data point to better understand the nature of Qatar Fuel Company Q.P.S.C.(WOQOD)'s profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Qatar Fuel Company Q.P.S.C.(WOQOD), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qatar Fuel Company Q.P.S.C. (WOQOD) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:QFLS

Qatar Fuel Company Q.P.S.C. (WOQOD)

Sells, markets, and distributes oil, gas, and refined petroleum products in State of Qatar.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success