- Qatar

- /

- Industrials

- /

- DSM:MCCS

Here's What's Concerning About Mannai Corporation Q.P.S.C's (DSM:MCCS) Returns On Capital

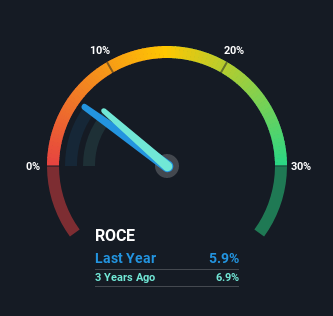

There are a few key trends to look for if we want to identify the next multi-bagger. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. In light of that, when we looked at Mannai Corporation Q.P.S.C (DSM:MCCS) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Mannai Corporation Q.P.S.C, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.059 = ر.ق503m ÷ (ر.ق16b - ر.ق7.8b) (Based on the trailing twelve months to March 2021).

Thus, Mannai Corporation Q.P.S.C has an ROCE of 5.9%. In absolute terms, that's a low return but it's around the Industrials industry average of 5.4%.

Check out our latest analysis for Mannai Corporation Q.P.S.C

Historical performance is a great place to start when researching a stock so above you can see the gauge for Mannai Corporation Q.P.S.C's ROCE against it's prior returns. If you'd like to look at how Mannai Corporation Q.P.S.C has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

In terms of Mannai Corporation Q.P.S.C's historical ROCE movements, the trend isn't fantastic. Around five years ago the returns on capital were 9.7%, but since then they've fallen to 5.9%. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. If these investments prove successful, this can bode very well for long term stock performance.

On a separate but related note, it's important to know that Mannai Corporation Q.P.S.C has a current liabilities to total assets ratio of 48%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Key Takeaway

In summary, despite lower returns in the short term, we're encouraged to see that Mannai Corporation Q.P.S.C is reinvesting for growth and has higher sales as a result. However, despite the promising trends, the stock has fallen 45% over the last five years, so there might be an opportunity here for astute investors. As a result, we'd recommend researching this stock further to uncover what other fundamentals of the business can show us.

If you want to know some of the risks facing Mannai Corporation Q.P.S.C we've found 4 warning signs (2 are a bit concerning!) that you should be aware of before investing here.

While Mannai Corporation Q.P.S.C isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:MCCS

Mannai Corporation Q.P.S.C

Offers information technology services in Qatar, other GCC countries, and internationally.

Good value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026