- Qatar

- /

- Industrials

- /

- DSM:AHCS

Would Shareholders Who Purchased Aamal Company Q.P.S.C's (DSM:AHCS) Stock Five Years Be Happy With The Share price Today?

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. So we wouldn't blame long term Aamal Company Q.P.S.C. (DSM:AHCS) shareholders for doubting their decision to hold, with the stock down 36% over a half decade.

View our latest analysis for Aamal Company Q.P.S.C

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

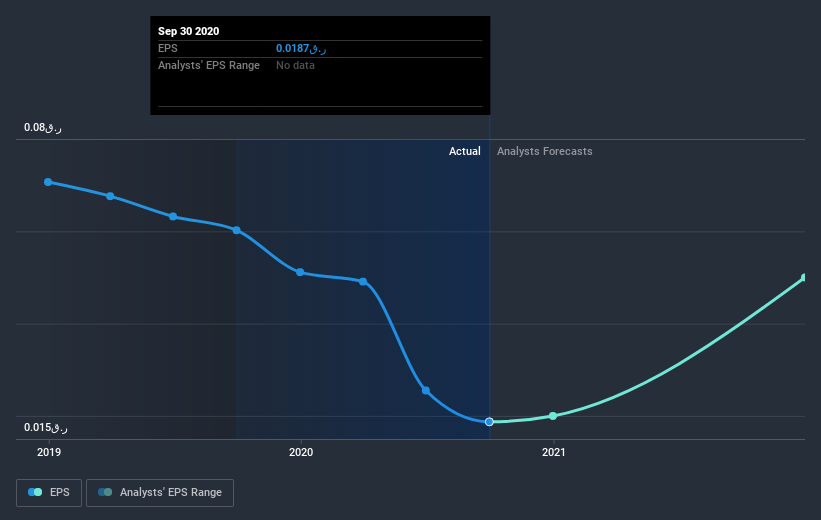

Looking back five years, both Aamal Company Q.P.S.C's share price and EPS declined; the latter at a rate of 28% per year. This fall in the EPS is worse than the 8% compound annual share price fall. So the market may previously have expected a drop, or else it expects the situation will improve. With a P/E ratio of 45.77, it's fair to say the market sees a brighter future for the business.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Aamal Company Q.P.S.C's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Aamal Company Q.P.S.C's TSR for the last 5 years was -19%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Aamal Company Q.P.S.C shareholders have received a total shareholder return of 13% over one year. And that does include the dividend. That certainly beats the loss of about 4% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Aamal Company Q.P.S.C (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

Of course Aamal Company Q.P.S.C may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on QA exchanges.

If you’re looking to trade Aamal Company Q.P.S.C, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:AHCS

Aamal Company Q.P.S.C

Engages in the industrial manufacturing, trading and distribution, managed services, and property management and development businesses in Qatar and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives